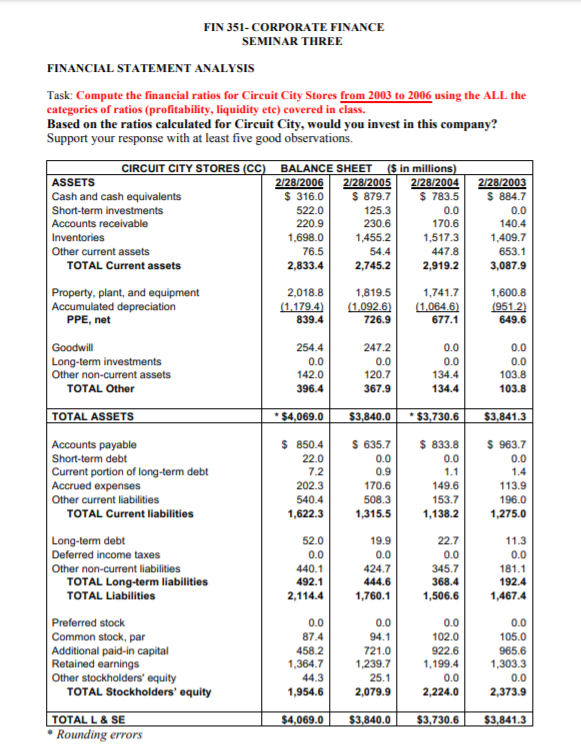

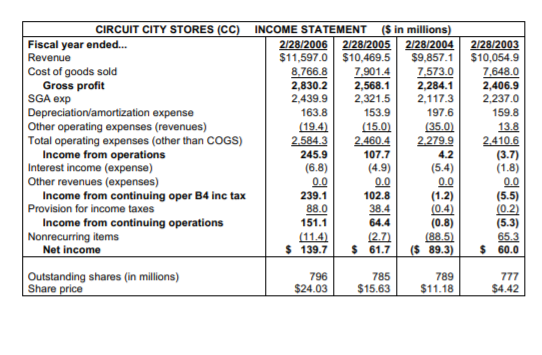

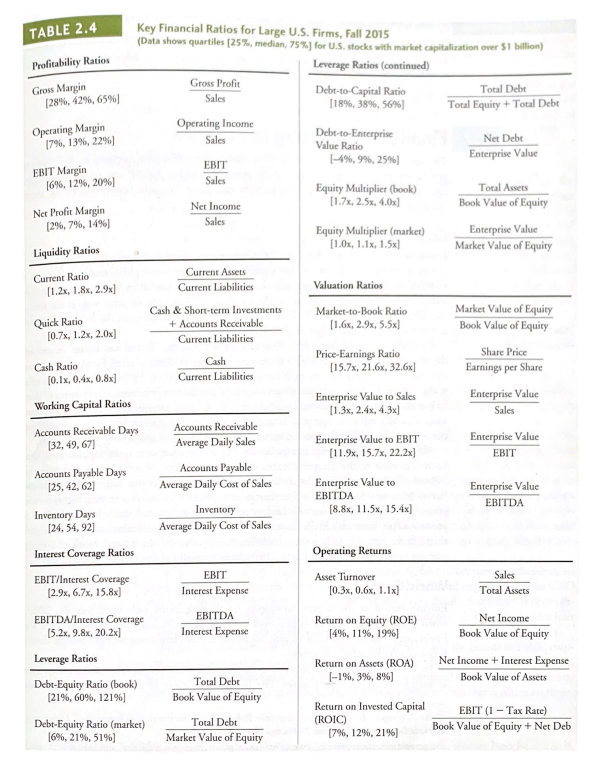

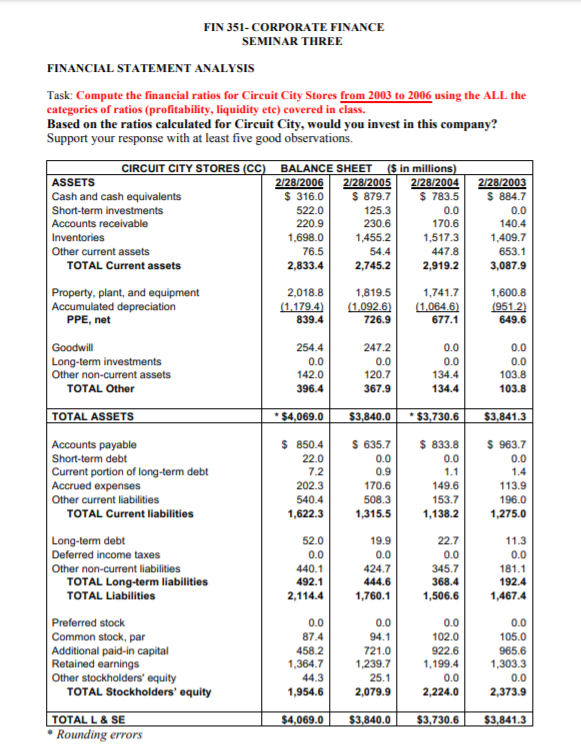

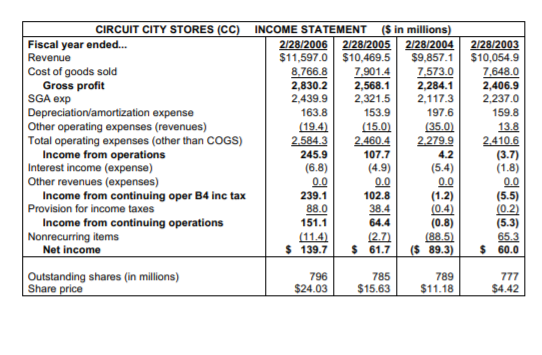

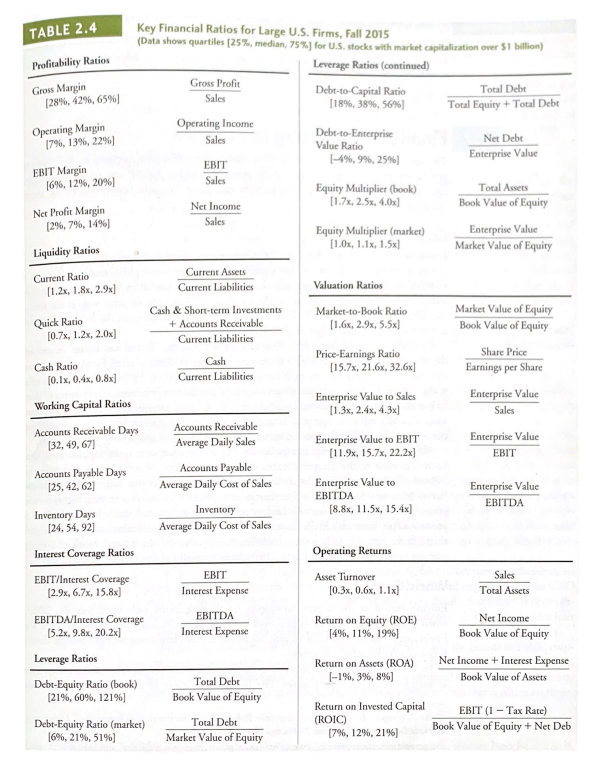

FIN 351-CORPORATE FINANCE SEMINAR THREE FINANCIAL STATEMENT ANALYSIS Task: Compute the financial ratios for Circuit City Stores from 2003 to 2006 using the ALL the categories of ratios (profitability, liquidity etc) covered in class. Based on the ratios calculated for Circuit City, would you invest in this company? Support your response with at least five good observations. 0.0 CIRCUIT CITY STORES (CC) BALANCE SHEET ($ in millions) ASSETS 2/28/2006 2/28/2005 2/28/2004 Cash and cash equivalents $ 316.0 S879.7 $ 783.5 Short-term investments 522.0 125.3 Accounts receivable 220.9 230.6 170.6 Inventories 1,698.0 1,455.2 1,517.3 Other current assets 76.5 54.4 447.8 TOTAL Current assets 2,833.4 2,745.2 2,919.2 2/28/2003 $ 884.7 0.0 140.4 1,409.7 653.1 3,087.9 Property, plant, and equipment Accumulated depreciation PPE, net 2,018.8 (1.179.4) 839.4 1.819.5 (1.092.6) 726.9 1,741.7 (1.064.6) 677.1 1,600.8 1951.2 649.6 0.0 Goodwill Long-term investments Other non-current assets TOTAL Other 254.4 0.0 142.0 396.4 247.2 0.0 120.7 367.9 0.0 134.4 134.4 0.0 0.0 103.8 103.8 TOTAL ASSETS * $4,069.0 $3,840.0 $3,730.6 $3,841.3 $ 635.7 $ 833.8 $ 850.4 22.0 $ 963.7 0.0 72 0.0 0.9 0.0 1.1 Accounts payable Short-term debt Current portion of long-term debt Accrued expenses Other current liabilities TOTAL Current liabilities 202.3 540.4 1,622.3 170.6 508.3 1,315.5 149.6 153.7 1,138.2 1.4 113.9 196.0 1,275.0 Long-term debt Deferred income taxes Other non-current liabilities TOTAL Long-term liabilities TOTAL Liabilities 52.0 0.0 440.1 492.1 2,114.4 19.9 0.0 424.7 444.6 1,760.1 22.7 0.0 345.7 368.4 1,506.6 11.3 0.0 181.1 192.4 1,467.4 0.0 0.0 Preferred stock Common stock, par Additional paid-in capital Retained earnings Other stockholders' equity TOTAL Stockholders' equity 0.0 87.4 458.2 1,364.7 44.3 1,954.6 94.1 721.0 1,239.7 25.1 2,079.9 0.0 102.0 922.6 1,199.4 0.0 2,224.0 105.0 965.6 1,303.3 0.0 2,373.9 $4,069.0 $3,840.0 $3,730.6 $3,841.3 TOTAL L & SE Rounding errors CIRCUIT CITY STORES (CC) INCOME STATEMENT (S in millions) Fiscal year ended... 2/28/2006 2/28/2005 2/28/2004 Revenue $11,597.0 $10,469.5 $9.857.1 Cost of goods sold 8,766.8 7.901.4 1 7.573.0 Gross profit 2,830.2 2,568.1 2.284.1 SGA exp 2,439.9 2.321.5 2.117.3 Depreciation/amortization expense 163.8 153.9 197.6 Other operating expenses (revenues) (19.4) (15.0) (35.0) Total operating expenses (other than COGS) 2.584.3 2.460.4 2.279.9 Income from operations 245.9 107.7 Interest income (expense) (6.8) (4.9) (5.4) Other revenues (expenses) 0.0 0.0 Income from continuing oper B4 inc tax 239.1 102.8 (1.2) Provision for income taxes 88.0 38.4 (0.4) Income from continuing operations 151.1 64.4 (0.8) Nonrecurring items (11.4) (2.7) (88.5) Net Income $ 139.7 $ 61.7 | ($ 89.3) 2/28/2003 $10.054.9 7,648.0 2,406.9 2.237.0 159.8 13.8 2.410.6 (3.7) (1.8) 4.2 00 0.0 (0.2) (5.3) 65.3 60.0 $ 777 Outstanding shares in millions) Share price 796 $24.03 785 $15.63 789 $11.18 $4.42