FIN 382

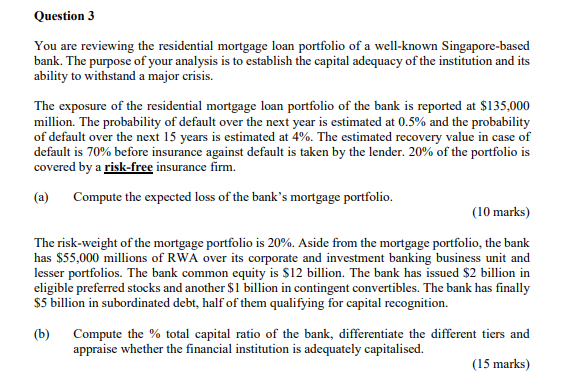

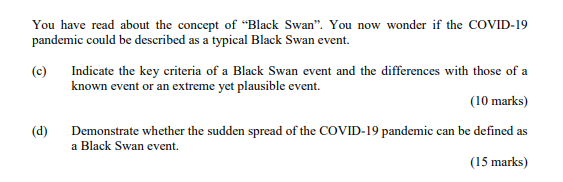

Question 3 You are reviewing the residential mortgage loan portfolio of a well-known Singapore-based bank. The purpose of your analysis is to establish the capital adequacy of the institution and its ability to withstand a major crisis. The exposure of the residential mortgage loan portfolio of the bank is reported at $135,000 million. The probability of default over the next year is estimated at 0.5% and the probability of default over the next 15 years is estimated at 4%. The estimated recovery value in case of default is 70% before insurance against default is taken by the lender. 20% of the portfolio is covered by a risk-free insurance firm. (a) Compute the expected loss of the bank's mortgage portfolio. (10 marks) The risk-weight of the mortgage portfolio is 20%. Aside from the mortgage portfolio, the bank has $55,000 millions of RWA over its corporate and investment banking business unit and lesser portfolios. The bank common equity is $12 billion. The bank has issued $2 billion in eligible preferred stocks and another $1 billion in contingent convertibles. The bank has finally $5 billion in subordinated debt, half of them qualifying for capital recognition. (b) Compute the % total capital ratio of the bank, differentiate the different tiers and appraise whether the financial institution is adequately capitalised. (15 marks) You have read about the concept of "Black Swan. You now wonder if the COVID-19 pandemic could be described as a typical Black Swan event. (c) Indicate the key criteria of a Black Swan event and the differences with those of a known event or an extreme yet plausible event. (10 marks) (d) Demonstrate whether the sudden spread of the COVID-19 pandemic can be defined as a Black Swan event. (15 marks) Question 3 You are reviewing the residential mortgage loan portfolio of a well-known Singapore-based bank. The purpose of your analysis is to establish the capital adequacy of the institution and its ability to withstand a major crisis. The exposure of the residential mortgage loan portfolio of the bank is reported at $135,000 million. The probability of default over the next year is estimated at 0.5% and the probability of default over the next 15 years is estimated at 4%. The estimated recovery value in case of default is 70% before insurance against default is taken by the lender. 20% of the portfolio is covered by a risk-free insurance firm. (a) Compute the expected loss of the bank's mortgage portfolio. (10 marks) The risk-weight of the mortgage portfolio is 20%. Aside from the mortgage portfolio, the bank has $55,000 millions of RWA over its corporate and investment banking business unit and lesser portfolios. The bank common equity is $12 billion. The bank has issued $2 billion in eligible preferred stocks and another $1 billion in contingent convertibles. The bank has finally $5 billion in subordinated debt, half of them qualifying for capital recognition. (b) Compute the % total capital ratio of the bank, differentiate the different tiers and appraise whether the financial institution is adequately capitalised. (15 marks) You have read about the concept of "Black Swan. You now wonder if the COVID-19 pandemic could be described as a typical Black Swan event. (c) Indicate the key criteria of a Black Swan event and the differences with those of a known event or an extreme yet plausible event. (10 marks) (d) Demonstrate whether the sudden spread of the COVID-19 pandemic can be defined as a Black Swan event. (15 marks)