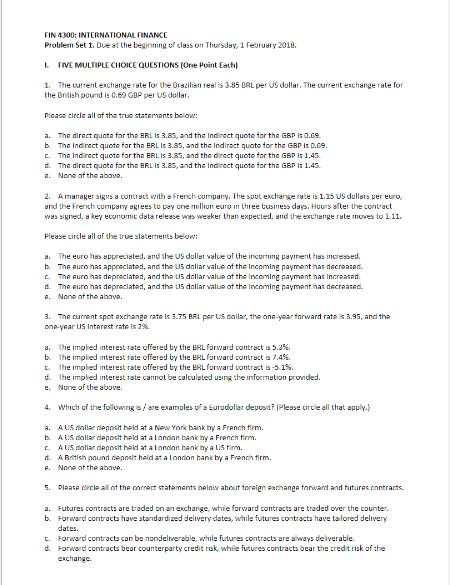

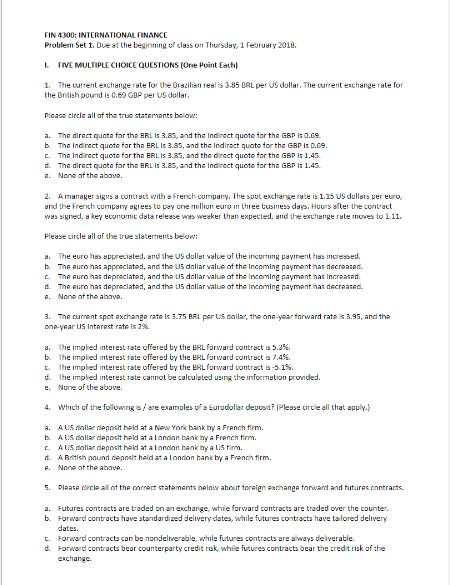

FIN 4300: INTERNATIONAL FINANCE Problern Set1. Due al the beginning of class on Tusday, 1 Feoruary 2010. L FIVE MULTIPLE CHOICE QUESTIONS (One Point Eathl 1. The ourrent exchange rate Tor the Drszilian resl is 3.85 DRL per US dollar. The ourrent echange rate for the Brtish pound is C.69 GDP per US doller Picaso circie all af tha true statenents baloww a. b. C- d. a. Te direct quote for the BRL ls 3.as, snd the Indirect quote for the GBp ls o.Ge. The Ind rect quote far tho ERL Is 3.35, and the Indiract quato for the GBP Is D.G9 The Indirect quote for tna BRL ls 3-as, and the drect quote for tha GBp Is 1.45. The diract quote for tha BRL is 3.83, and the Indirect quote for tha GEP Is 1.45 Nono of the abowe. 2. A manager 3ns d contract with' French curripany. The sput exchange rate is 1.15 US dullars per euro, and the French cumpany agrees to pay cnemillin euro in three tusiness days. Hours after the cuntract was signed, a key ecoromic dsta release was weaker than expected, and the exuhangerate moves to 1.11 Please circle all of the truestatenents beg . The euro tiss pprecisted. ,d ihe US dulla' value of the incurnlng pay'nent h831ncreased. b. The ouro has appreclatod, and the US dallarvalue ot the Incaming paymont has decreased. C. The ouro has depraclated, and tha U5 dallarvalue of the incoming payment has Increased d. Theuro has depreciated. and tho US dallar value of the incoming payment nas decreased. 0. Nono at tho abawe. 3. The current spot axchanga rato Is 3.75 BRI per LS callar, the one-year farward rate s 3.95, and tha one-year us Interest rate is 2%. a. The implied interest rate offered by the HL forward contract s 5.3%. b. The rnpled interest rate offered by the BRL forward contract is /.4%. c. The impled interest rate offered by the RL forward contract is .5 1%. d The implied interest rate cannot be calculated using the information pronded. e. None of the above 4, which cf the following/are examples of a burudollar deposit? Please urce all that apply. a. A US allar deposit held at a Noww York bank by a French fim. b A Sallar depoait hald at a Landan bank hy a French firm AUS dallar deposit held at a Landan hank by a im. d. A Bntish pound deandt held at a london bank by a F ncn tirm. e. None ot the abue. S. lease lo al ot the correct statements helow ahouut toreign exchange tarwand and tutures contracts a. Futures contracts are traded on an excharge, whie forward contracts are traded over the counter b Forward centracts have standardized delivery dates, while futures contracts have talored delivery dates. t. Forward contracts can be nondeliverable, while futures contracts are aways deiverable d. Forward centracts bear counterparty credit ruk, while futures contracts bear the credt risk of the exchange