Question

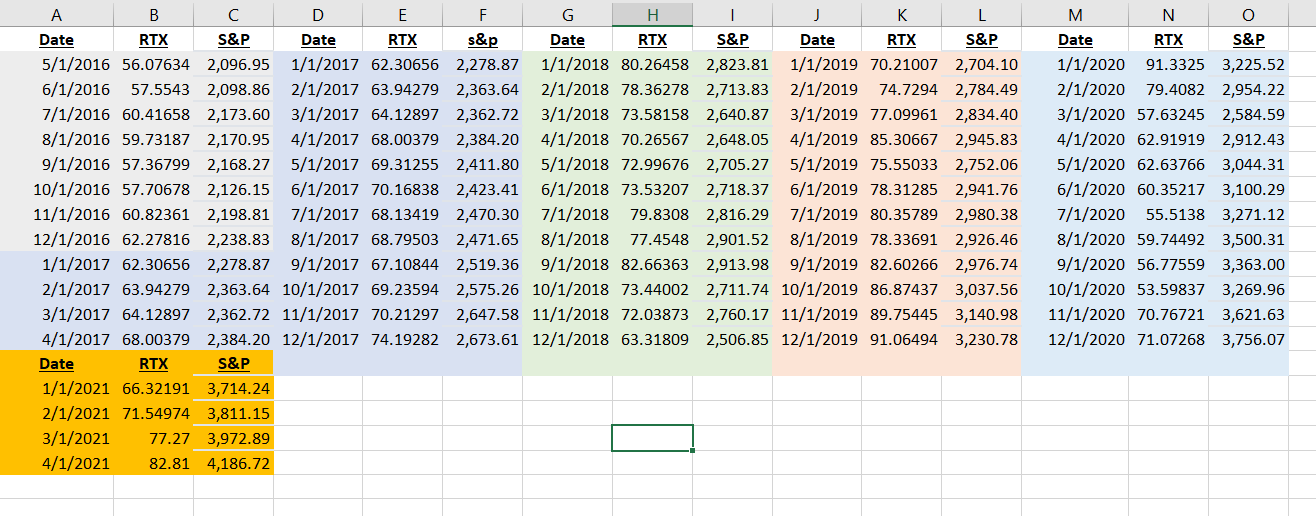

FIN 6406 Excel HW 3 You need the excel spreadsheet provided that has raw data for Raytheon Company and the Standard & Poors 500 Index.

FIN 6406 Excel HW 3 You need the excel spreadsheet provided that has raw data for Raytheon Company and the Standard & Poors 500 Index. Suppose you have been hired as a financial consultant to Raytheon Company (RTX), a large, publicly traded firm that is the market share leader in radar detection systems (RDSs). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSs. This will be a five-year project. You need to advise them whether to take the project or not. Calculate the Payback Period, NPV, and IRR for the project and determine whether they should take the project or not.

1. The company bought some land three years ago for $6 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. The land was appraised last week for $4.5 million.

2. In five years, the value of the land will be $4.9 million.

3. The plant and equipment will cost $25 million to build.

4. The manufacturing plant has a 30-year tax life, and RTX uses straight-line depreciation. At the end of the project, the plant and equipment can be scrapped for $10 million.

5. The project requires $4,000,000 in initial net working capital investment to get operational.

6. The plan is to manufacture 15,000 RDSs in the first year and sell them at $10,400 per machine. The following 4 years, the number to be produced grows by 15%, 20%, 25%, and 25% annually, i.e. year over year. The price of the RDS will rise by 4.5% per year.

7. The company will incur $7,900,000 in annual fixed costs, and the variable production costs are $9,000 per RDS in the first year. The following 4 years, variable production costs will grow at a rate of 4.5%, 2.75%, 2%, and 1.75% annually, i.e. year over year.

8. RTXs tax rate is 21 percent.

9. The following market data on RTXs securities is current: Debt: 222,000, 6.5% percent coupon bonds are outstanding, 10 years to maturity, selling for 101.36 percent of par; the bonds have a $1,000 par value each and make semiannual payments. Common: 6,000,000 shares outstanding, selling for $82.81 per share; you have stock prices and S&P 500 index value for the past five years. Preferred: 442,000 shares of 4 percent preferred stock outstanding, selling for $95.76 per share and having a par value of $100. Market: 6.5 percent expected market risk premium; 3 percent risk-free rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started