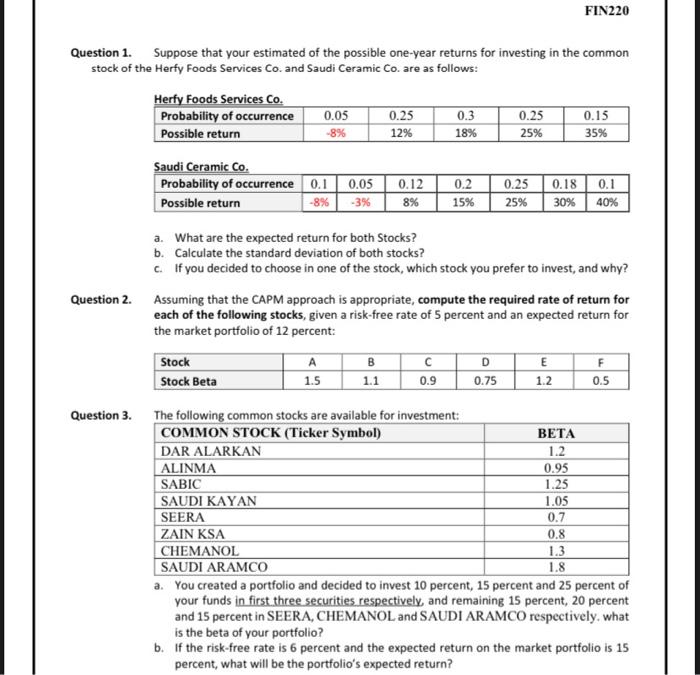

FIN220 Question 1. Suppose that your estimated of the possible one-year returns for investing in the common stock of the Herfy Foods Services Co. and Saudi Ceramic Co. are as follows: Herfy Foods Services Co. Probability of occurrence 0.05 0.25 0.3 0.25 0.15 Possible return -8% 12% 18% 25% 35% Saudi Ceramic Co. Probability of occurrence 0.1 0.05 Possible return -8% -3% 0.12 8% 0.2 15% 0.25 0.18 0.1 25% 30% 40% a. What are the expected return for both Stocks? b. Calculate the standard deviation of both stocks? c. If you decided to choose in one of the stock, which stock you prefer to invest, and why? Question 2. Assuming that the CAPM approach is appropriate, compute the required rate of return for each of the following stocks, given a risk-free rate of 5 percent and an expected return for the market portfolio of 12 percent: Stock A B D E F Stock Beta 1.5 1.1 0.9 0.75 0.5 1.2 Question 3. The following common stocks are available for investment: COMMON STOCK (Ticker Symbol) BETA DAR ALARKAN 1.2 ALINMA 0.95 SABIC 1.25 SAUDI KAYAN 1.05 SEERA 0.7 ZAIN KSA 0.8 CHEMANOL 1.3 SAUDI ARAMCO 1.8 a. You created a portfolio and decided to invest 10 percent, 15 percent and 25 percent of your funds in first three securities respectively and remaining 15 percent, 20 percent and 15 percent in SEERA, CHEMANOL and SAUDI ARAMCO respectively, what is the beta of your portfolio? b. If the risk-free rate is 6 percent and the expected return on the market portfolio is 15 percent, what will be the portfolio's expected return? Question 6. In early 2020, Saudi Fisheries Co (SIFCO) issued new common stock at a market price of $50. Dividends last year were $5.00 and are expected to grow at an annual rate of 3 percent forever. Floatation costs will be 3 percent of market price. What is SIFCO's cost of equity for the new issue? Question 7. Arabian Pipes Co. (APC) is issuing a $5,000 par value bond that pays 6 percent annual interest and matures in 12 years. Investors are willing to pay $4,800 for the bond. Floatation costs will be 3 percent of market value. The Company is in a 15 percent tax bracket. What will be the firm's after-tax cost of debt on the bond?? Question 8. The preferred stock of Arabian Pipes Co. (APC) sells for $50 and pays 5 percent dividends. The net price of the stock is $42. What is the cost of capital for the preferred stock