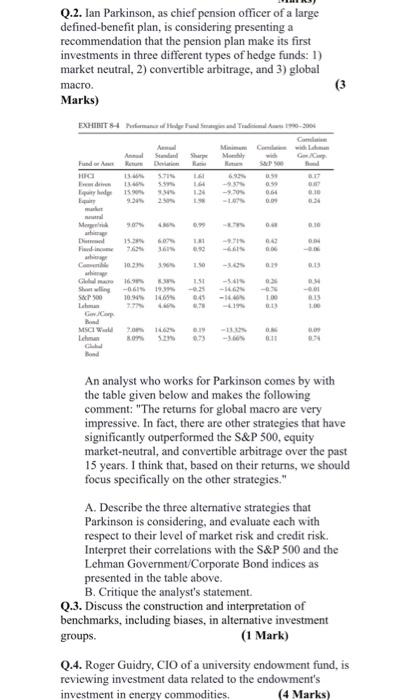

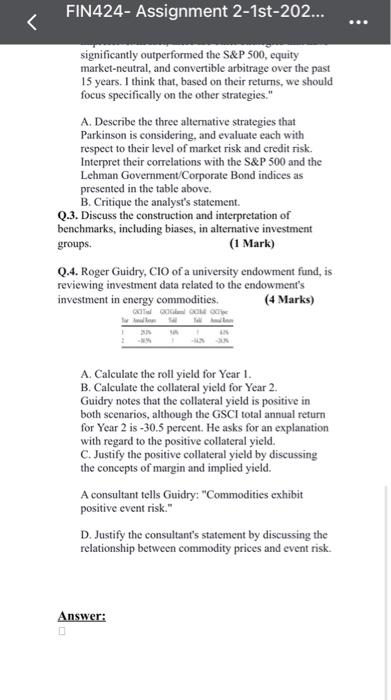

FIN424- Assignment 2-1st-202... For Instructor's Use only \begin{tabular}{l} Instructor's Name: \\ \hline Stodeats' Girade; 00 / 10 Level of Marks: Hizh/Middle'Low \\ \hline \end{tabular} - The Assignment must be submitted on Blackboard (WORD format only) via allocated folder. - Assignments submitted through email will not be accepted. - Students are advised to make their work clear and well presented, marks may be reduced for poor presentation. This includes filling your information on the cover page. - Students must mention question number clearly in their answer. - Late submission will NOT be accepted. - Avoid plagiarism, the work should be in your own words, copying from students or other resources without proper referencing will result in ZERO marks. No exceptions. - All answered must be typed using Times New Roman (size 12, double-spaced) font. No pictures containing text will be accepted and will be considered plagiarism). - Submissions without this cover page will NOT be accepted. Learning Outcomes: CLO:1.1 Reeognise the characteristies and risks of stocks, bonds, money murket, and property imvestments. CLO:1.2 Describe hedging activities, stock opticas, and currency dervatives. Assignment 2 Questions: Week 8 (10 Marks) Q.1. Compare the relative liquidity characteristics of direct versus indirect investment in real estate. Discuss three factors that affect the liquidity of both forms of investment. Q.2. Ian Parkinson, as chief pension officer of a large defined-benefit plan, is considering presenting a recommendation that the pension plan make its first investments in three different types of hedge funds: 1) market neutral, 2) convertible arbitrage, and 3) global macro. (3 Marks) An analyst who works for Parkinson comes by with the table given below and makes the following comment: "The returns for global macro are very impressive. In fact, there are other strategies that have significantly outperformed the S\&P 500, equity market-neutral, and convertible arbitrage over the past 15 years. 1 think that, based on their returns, we should focus specifically on the other strategies." A. Describe the three altemative strategies that Parkinson is considering, and evaluate each with respect to their level of market risk and credit risk. Interpret their correlations with the S\&P 500 and the Lehman Government/Corporate Bond indices as presented in the table above. B. Critique the analyst's statement. Q.3. Discuss the construction and interpretation of benchmarks, including biases, in alternative investment groups. (1 Mark) Q.4. Roger Guidry, ClO of a university endowment fund, is reviewing investment data related to the endowment's investment in energy commodities. (4 Marks) significantly outperformed the S\&P 500, equity market-neutral, and convertible arbitrage over the past 15 years. I think that, based on their returns, we should focus specifically on the other strategies." A. Describe the three alternative strategies that Parkinson is considering, and evaluate each with respect to their level of market risk and credit risk. Interpret their correlations with the S\&P 500 and the Lehman Government/Corporate Bond indices as presented in the table above. B. Critique the analyst's statement. Q.3. Discuss the construction and interpretation of benchmarks, including biases, in alternative investment groups. (1 Mark) Q.4. Roger Guidry, ClO of a university endowment fund, is reviewing investment data related to the endowment's investment in energy commodities. (4 Marks) A. Calculate the roll yield for Year 1 . B. Calculate the collateral yield for Year 2 . Guidry notes that the collateral yield is positive in both scenarios, although the GSCI total annual return for Year 2 is 30.5 percent. He asks for an explanation with regard to the positive collateral yield. C. Justify the positive collateral yield by discussing the concepts of margin and implied yield. A consultant tells Guidry: "Commodities exhibit positive event risk." D. Justify the consultant's statement by discussing the relationship between commodity prices and event risk