Question

FIN503 Fall 2023 Integrated Mini-Case Valuing Walmart Inc. Walmart Inc. (WMT) participates in retail and wholesale operations worldwide. Specifically, it operates supercenters, supermarkets, warehouse clubs,

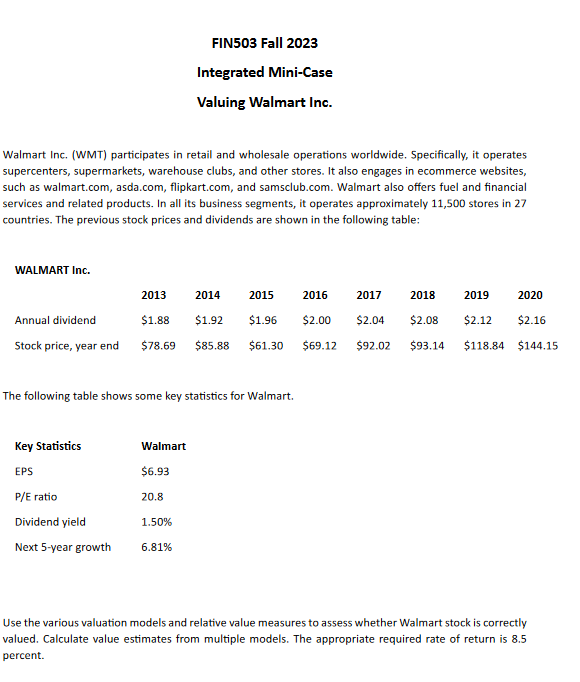

FIN503 Fall 2023 Integrated Mini-Case Valuing Walmart Inc. Walmart Inc. (WMT) participates in retail and wholesale operations worldwide. Specifically, it operates supercenters, supermarkets, warehouse clubs, and other stores. It also engages in ecommerce websites, such as walmart.com, asda.com, flipkart.com, and samsclub.com. Walmart also offers fuel and financial services and related products. In all its business segments, it operates approximately 11,500 stores in 27 countries. The previous stock prices and dividends are shown in the following table: WALMART Inc. 2013 2014 2015 2016 2017 2018 2019 2020 Annual dividend $1.88 $1.92 $1.96 $2.00 $2.04 $2.08 $2.12 $2.16 Stock price, year end $78.69 $85.88 $61.30 $69.12 $92.02 $93.14 $118.84 $144.15 The following table shows some key statistics for Walmart. Key Statistics Walmart EPS $6.93 P/E ratio 20.8 Dividend yield 1.50% Next 5-year growth 6.81% Use the various valuation models and relative value measures to assess whether Walmart stock is correctly valued. Calculate value estimates from multiple models. The appropriate required rate of return is 8.5 percent.

Walmart Inc. (WMT) participates in retail and wholesale operations worldwide. Specifically, it operates supercenters, supermarkets, warehouse clubs, and other stores. It also engages in ecommerce websites, such as walmart.com, asda.com, flipkart.com, and samsclub.com. Walmart also offers fuel and financial services and related products. In all its business segments, it operates approximately 11,500 stores in 27 countries. The previous stock prices and dividends are shown in the following table: LAIAI MA ART Inn The following table shows some key statistics for Walmart. Use the various valuation models and relative value measures to assess whether Walmart stock is correctly valued. Calculate value estimates from multiple models. The appropriate required rate of return is 8.5 percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started