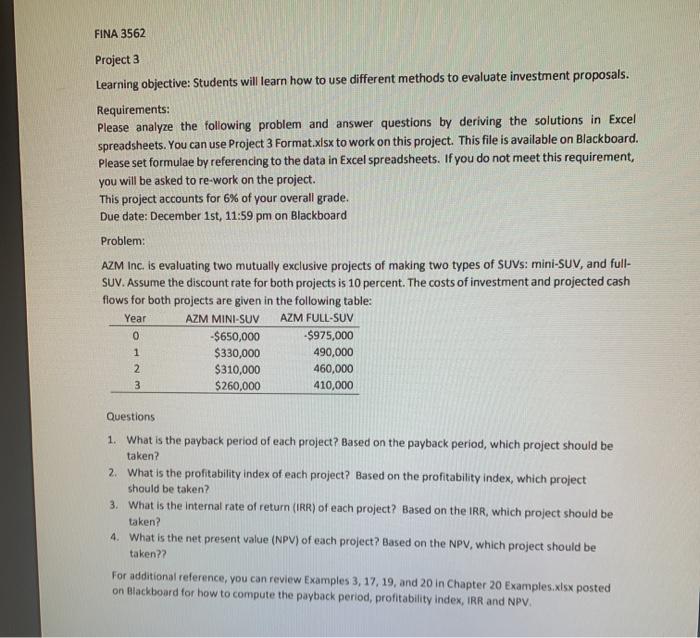

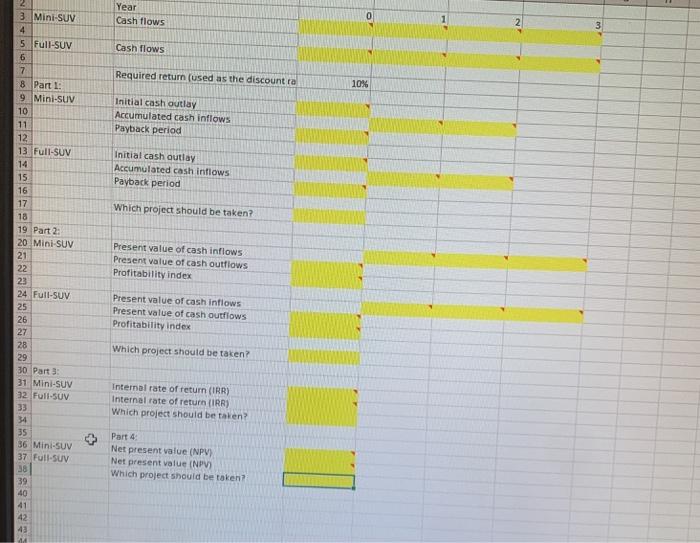

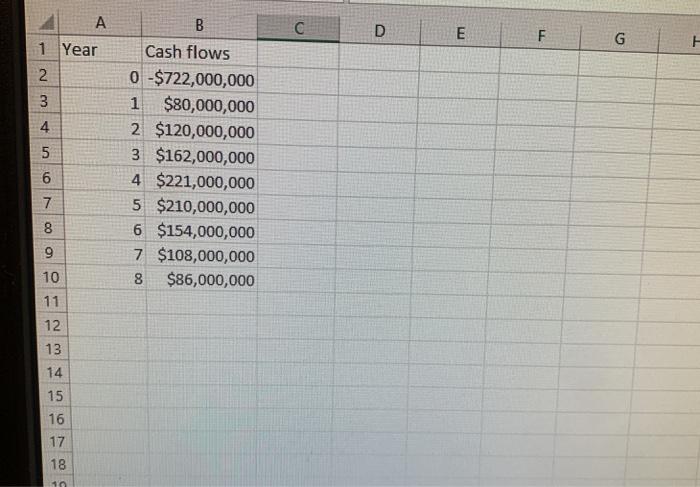

FINA 3562 Project 3 Learning objective: Students will learn how to use different methods to evaluate investment proposals. Requirements: Please analyze the following problem and answer questions by deriving the solutions in Excel spreadsheets. You can use Project 3 Format.xlsx to work on this project. This file is available on Blackboard. Please set formulae by referencing to the data in Excel spreadsheets. If you do not meet this requirement, you will be asked to re-work on the project. This project accounts for 6% of your overall grade. Due date: December 1st, 11:59 pm on Blackboard Problem: AZM Inc. is evaluating two mutually exclusive projects of making two types of SUVs: mini-SUV, and full- SUV. Assume the discount rate for both projects is 10 percent. The costs of investment and projected cash flows for both projects are given in the following table: Year AZM MINI-SUV AZM FULL-SUV 0 -$650,000 $975,000 $330,000 490,000 $310,000 460,000 $260,000 410,000 1 2 3 Questions 1. What is the payback period of each project? Based on the payback period, which project should be taken? 2. What is the profitability index of each project? Based on the profitability index, which project should be taken? 3. What is the internal rate of return (IRR) of each project? Based on the IRR, which project should be taken? 4. What is the net present value (NPV) of each project? Based on the NPV, which project should be taken?? For additional reference, you can review Examples 3, 17, 19, and 20 in Chapter 20 Examples.xlsx posted on Blackboard for how to compute the payback period, profitability index, IRR and NPV. Year Cash flows 0 2 3 Cash flows Required return (used as the discount ra 10% Initial cash outlay Accumulated cash inflows Payback period Initial cash outlay Accumulated cash inflows Payback period 3 Mini-SUV 4 5 Full-SUV 6 7 8 Part 1 9 Mini-SUV 10 11 12 13 Full SUV 14 15 16 17 18 19 Part 2 20 Mini-SUV 21 22 23 24 Full SUV 25 26 27 28 29 30 Part 3 31 Mini-SUV 32 Full SUV 33 Which project should be taken? Present value of cash inflows Present value of cash outflows Profitability index Present value of cash inflows Present value of cash outflows Profitability Index Which project should be taken? Internal rate of return (IRR) Internal rate of return (IRR) Which project should be taken? 35 36 Mini-SUV 37 Full-SUV Part Net present value (NPV) Net present value (NPV) Which project should be taken? 39 40 41 42 43 A D E F G F 1 Year 2 3 4 5 B Cash flows 0 $722,000,000 1 $80,000,000 2 $120,000,000 3 $162,000,000 4 $221,000,000 5 $210,000,000 6 $154,000,000 7 $108,000,000 8 $86,000,000 LO 7 9 8 8 9 10 11 12 13 14 15 16 17 18 10