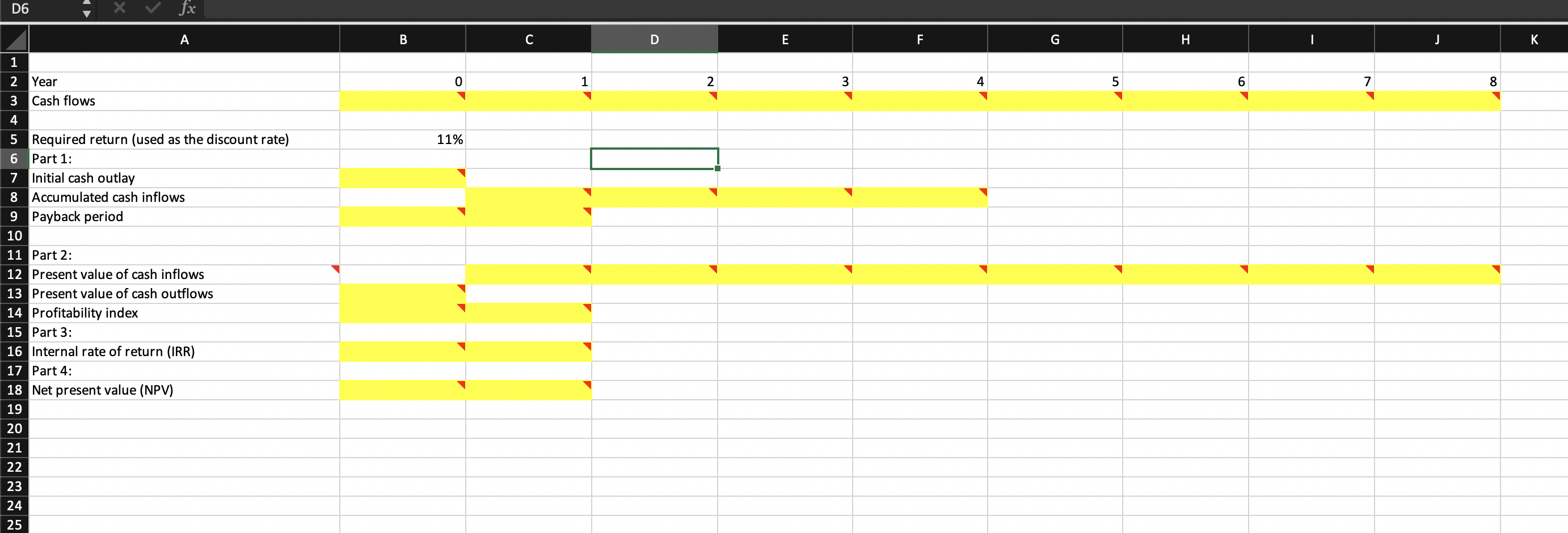

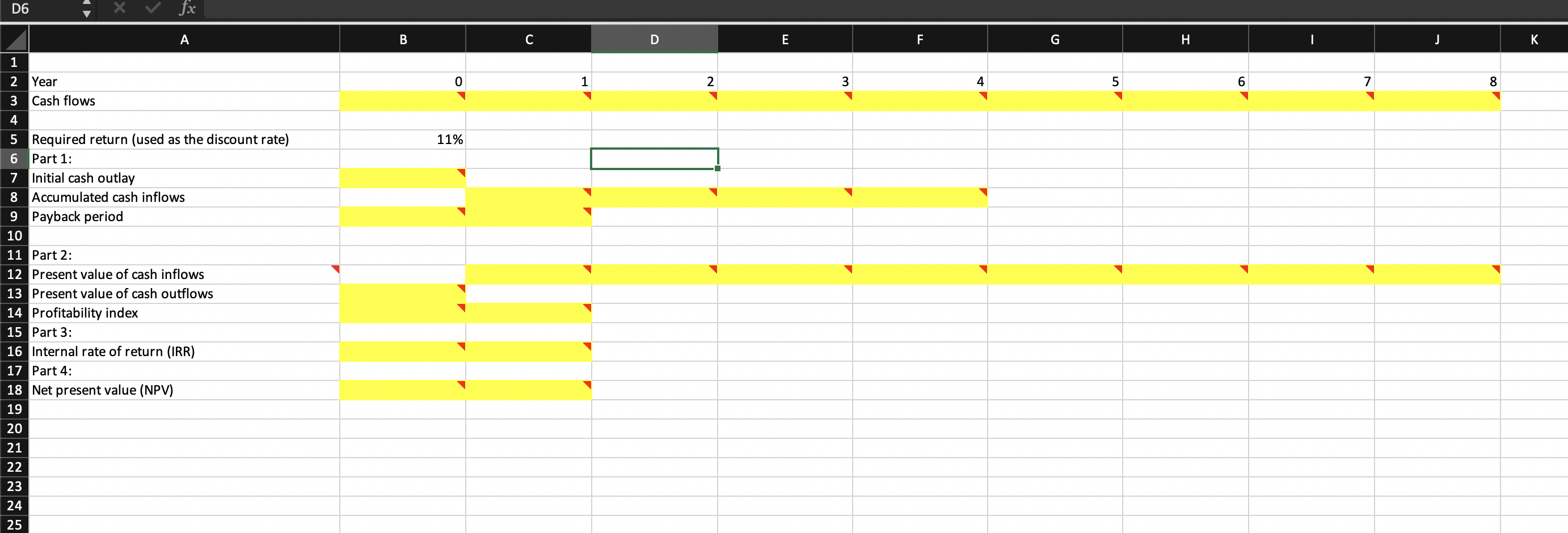

FINA 3562 Project 4 Learning objective: Students will learn how to use different methods to evaluate an investment project. Requirements: Please analyze the following minicase and answer questions by deriving the solutions in Excel spreadsheets. You can use Project 4 Format.xlsx to work on this project. This file is available on Blackboard. Please set formulae by referencing to the data in Excel spreadsheets. If you do not meet this requirement, you will be asked to re-work on the project. Two students can work together for this project. Remember to put your partner's name in the Excel worksheet. This project accounts for 6% of your overall grade. Due date: April 24, 11:59 pm on Blackboard Minicase: Kenney Gold Mining is evaluating a new gold mine in Montana. The company has estimated that the mine would be productive for eight years. Jim Cochran, the company's financial officer, has been asked to perform an analysis of the new mine and present his recommendation on whether the company should open the new mine. Jim has used the estimates provided by the company's geologist to determine the revenues that could be expected from the mine. He has also projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $722 million today. The expected cash flows each year from the mine are shown in the following table. Kenney Gold Mining has a 11 percent required return on all of its gold mines. Year Cash flows $722,000,000 $80,000,000 $120,000,000 $162,000,000 $221,000,000 $210,000,000 $154,000,000 $108,000,000 $86,000,000 DOWNPO Questions 1. What is the payback period of the project? If the cut-off payback period is 4 years, should we accept or reject the project? Why? 2. What is the profitability index of the project? Should the project be accepted? Why? 3. What is the internal rate of return (IRR) of the project? Should the project be accepted? Why? 4. What is the net present value (NPV) of the project? Should the project be accepted? Why? For additional reference, you can review Examples 3, 17, 19, and 20 in Chapter 20 Examples.xlsx posted on Blackboard for how to compute the payback period, profitability index, IRR and NPV. D6 1 2 11% 2 Year 3 Cash flows 4 5 Required return (used as the discount rate) 6 Part 1: 7 Initial cash outlay 8 Accumulated cash inflows 9 Payback period 10 11 Part 2: 12 Present value of cash inflows 13 Present value of cash outflows 14 Profitability index 15 Part 3: 16 Internal rate of return (IRR) 17 Part 4: 18 Net present value (NPV) 19 20 21 22 23 24 25