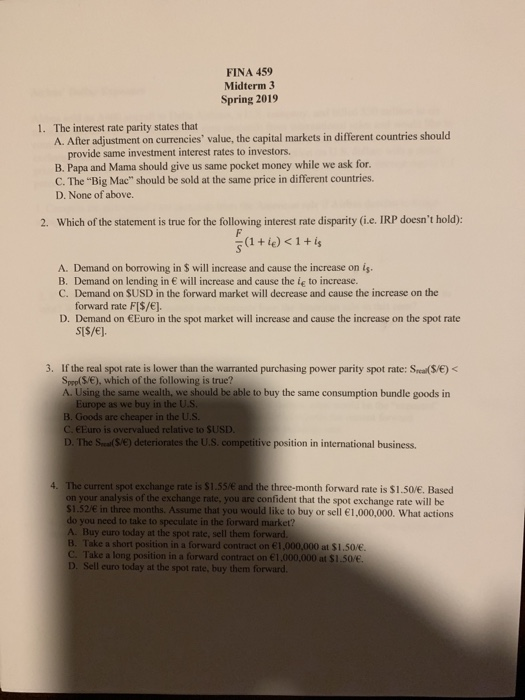

FINA 459 Midterm3 Spring 2019 The interest rate parity states that A. After adjustment on currencies' value, the capital markets in different countries should 1. provide same investment interest rates to investors. B. Papa and Mama should give us same pocket money while we ask for. C. The "Big Mac" should be sold at the same price in different countries. D. None of above. 2. Which of the statement is true for the following interest rate disparity (i.e. IRP doesn't hold): (1+ie)1+is A. Demand on borrowing in $ will increase and cause the increase on is B. Demand on lending in will increase and cause the ie to increase C. Demand on SUSD in the forward market will decrease and cause the increase on the forward rate FIS/E]. D. Demand on CEuro in the spot market will increase and cause the increase on the spot rate 3. If the real spot rate is lower than the warranted purchasing power parity spot rate: Seal(S/6) Sppp(S/E), which of the following is true? A. Using the same wealth, we should be able to buy the same consumption bundle goods in Europe as we buy in the U.S B. Goods are cheaper in the U.S C. EEuro is overvalued relative to SUSD D. The Seal S/e) deteriorates the U.S. competitive position in international business. 4 The current spot exchange rate is S1.5S/e and the three-month forward rate is $1.50/. Based on your analysis of the exchange rate, you are confident that the spot exchange rate will be $1.52/ in three months. Assume that you would like to buy or sell 1,000,000. What actions do you need to take to speculate in the forward market? A. Buy euro today at the spot rate, sell them forward B. Take a short position in a forward contract on 1,000,000 at $1.50/. C. Take a long position in a forward contract on 1000,000 at $1.50ve. D. Sell euro today at the spot rate, buy them forward. FINA 459 Midterm3 Spring 2019 The interest rate parity states that A. After adjustment on currencies' value, the capital markets in different countries should 1. provide same investment interest rates to investors. B. Papa and Mama should give us same pocket money while we ask for. C. The "Big Mac" should be sold at the same price in different countries. D. None of above. 2. Which of the statement is true for the following interest rate disparity (i.e. IRP doesn't hold): (1+ie)1+is A. Demand on borrowing in $ will increase and cause the increase on is B. Demand on lending in will increase and cause the ie to increase C. Demand on SUSD in the forward market will decrease and cause the increase on the forward rate FIS/E]. D. Demand on CEuro in the spot market will increase and cause the increase on the spot rate 3. If the real spot rate is lower than the warranted purchasing power parity spot rate: Seal(S/6) Sppp(S/E), which of the following is true? A. Using the same wealth, we should be able to buy the same consumption bundle goods in Europe as we buy in the U.S B. Goods are cheaper in the U.S C. EEuro is overvalued relative to SUSD D. The Seal S/e) deteriorates the U.S. competitive position in international business. 4 The current spot exchange rate is S1.5S/e and the three-month forward rate is $1.50/. Based on your analysis of the exchange rate, you are confident that the spot exchange rate will be $1.52/ in three months. Assume that you would like to buy or sell 1,000,000. What actions do you need to take to speculate in the forward market? A. Buy euro today at the spot rate, sell them forward B. Take a short position in a forward contract on 1,000,000 at $1.50/. C. Take a long position in a forward contract on 1000,000 at $1.50ve. D. Sell euro today at the spot rate, buy them forward