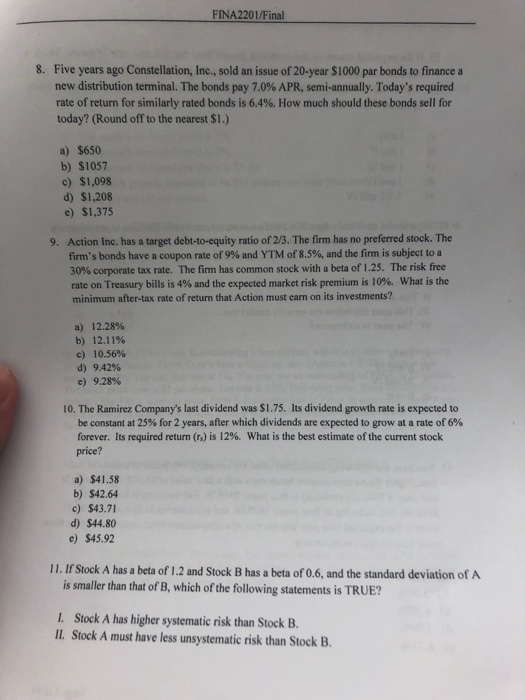

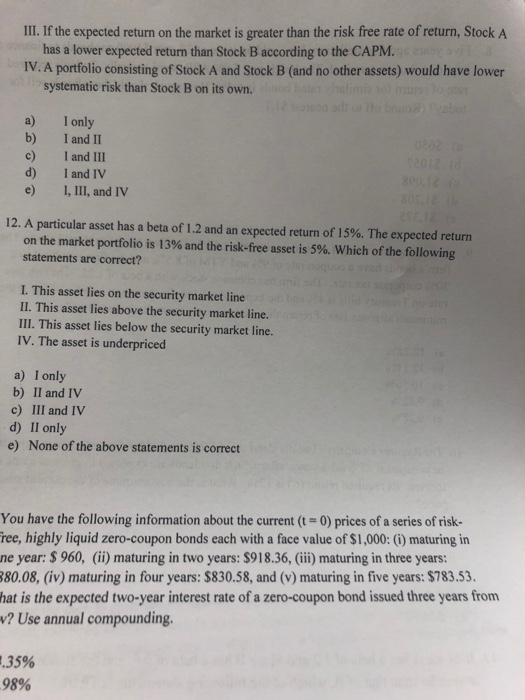

FINA2201/Final 8. Five years ago Constellation, Inc, sold an issue of 20-year $1000 par bonds to finance a new distribution terminal. The bonds pay 7.0% APR, semi-annually. Today's required rate of return for similarly rated bonds is 6.4%. How much should these bonds sell for today? (Round off to the nearest $1.) a) $650 b) $1057 c) $1,098 d) $1,208 e) $1,375 Action Inc. has a target debt-to-equity ratio of 2/3. The firm has no preferred stock. The firm's bonds have a coupon rate of 9% and YTM of 8.5%, and the firm is subject to a 9. 30% corporate tax rate. The firm has common stock with a beta of 1.25. The risk free rate on Treasury bills is 4% and the expected market risk premium is 10%, what is the minimum after-tax rate of return that Action must carn on its investments? a) 12.28% b) 12.11% c) 10.56% d) 9.42% e) 928% 10. The Ramirez Company's last dividend was $1.75. Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever. Its required return (r) is 12%, what is the best estimate of the current stock price? a) $41.58 b) $42.64 c) $43.71 d) $44.80 e) $45.92 11. If Stock A has a beta of 1.2 and Stock B has a beta of 0.6, and the standard deviation of A is smaller than that of B, which of the following statements is TRUE? L. Stock A has higher systematic risk than Stock B. L. Stock A must have less unsystematic risk than Stock B III.If the expected return on the market is greater than the risk free rate of return, Stock A has a lower expected return than Stock B according to the CAPM. IV. A portfolio consisting of Stock A and Stock B (and no other assets) would have lower systematic risk than Stock B on its own. a) Ionly b) I and II c) I and III d) l and IV e) I, III, and IV 12. A particular asset has a beta of 1.2 and an expected return of 15%. The expected return on the market portfolio is 13% and the risk-free asset is 5%, which of the following statements are correct? I. This asset lies on the security market line II. This asset lies above the security market line. III. This asset lies below the security market line. IV. The asset is underpriced a) I only b) II and IV c) III and IV d) II only e None of the above statements is correct You have the following information about the current (t 0) prices of a series of risk- ree, highly liquid zero-coupon bonds each with a face value of $1,000: (i) maturing in ne year: $ 960, (ii) maturing in two years: $918.36, (ii) maturing in three years: 80.08, (iv) maturing in four years: $830.58, and (v) maturing in five years: $783.53 hat is the expected two-year interest rate of a zero-coupon bond issued three years from v? Use annual compounding. 1.35% 98%