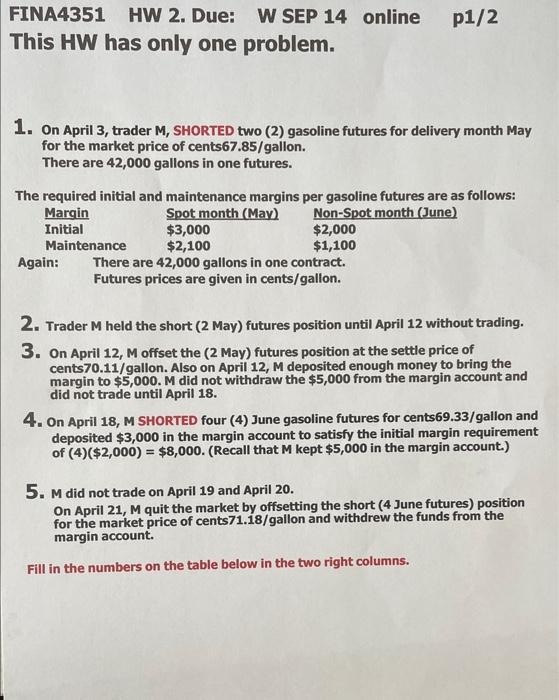

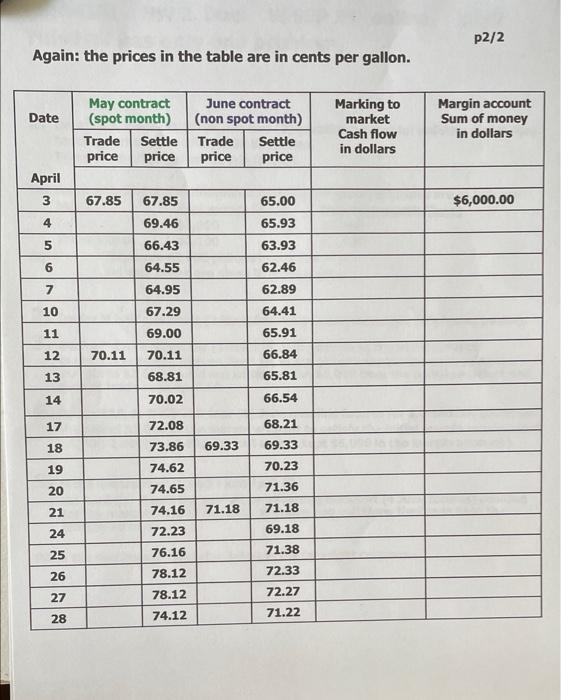

FINA4351 HW 2. Due: W SEP 14 online p1/2 This HW has only one problem. 1. On April 3, trader M, SHORTED two (2) gasoline futures for delivery month May for the market price of cents67.85/gallon. There are 42,000 gallons in one futures. The required initial and maintenance margins per gasoline futures are as follows: Again: There are 42,000 gallons in one contract. Futures prices are given in cents/gallon. 2. Trader M held the short (2 May) futures position until April 12 without trading. 3. On April 12, M offset the (2 May) futures position at the settle price of cents70.11/gallon. Also on April 12, M deposited enough money to bring the margin to $5,000. M did not withdraw the $5,000 from the margin account and did not trade until April 18. 4. On April 18, M SHORTED four (4) June gasoline futures for cents69.33/gallon and deposited $3,000 in the margin account to satisfy the initial margin requirement of (4)($2,000)=$8,000. (Recall that M kept $5,000 in the margin account) 5. M did not trade on April 19 and April 20. On April 21, M quit the market by offsetting the short ( 4 June futures) position for the market price of cents71.18/gallon and withdrew the funds from the margin account. Again: the prices in the table are in cents per gallon. FINA4351 HW 2. Due: W SEP 14 online p1/2 This HW has only one problem. 1. On April 3, trader M, SHORTED two (2) gasoline futures for delivery month May for the market price of cents67.85/gallon. There are 42,000 gallons in one futures. The required initial and maintenance margins per gasoline futures are as follows: Again: There are 42,000 gallons in one contract. Futures prices are given in cents/gallon. 2. Trader M held the short (2 May) futures position until April 12 without trading. 3. On April 12, M offset the (2 May) futures position at the settle price of cents70.11/gallon. Also on April 12, M deposited enough money to bring the margin to $5,000. M did not withdraw the $5,000 from the margin account and did not trade until April 18. 4. On April 18, M SHORTED four (4) June gasoline futures for cents69.33/gallon and deposited $3,000 in the margin account to satisfy the initial margin requirement of (4)($2,000)=$8,000. (Recall that M kept $5,000 in the margin account) 5. M did not trade on April 19 and April 20. On April 21, M quit the market by offsetting the short ( 4 June futures) position for the market price of cents71.18/gallon and withdrew the funds from the margin account. Again: the prices in the table are in cents per gallon