Answered step by step

Verified Expert Solution

Question

1 Approved Answer

finace math *good pocutes* please clearly state answer with corresponding question. page 1 page 2 page 3 A design studio received a loan of $6,850

finace math *good pocutes*

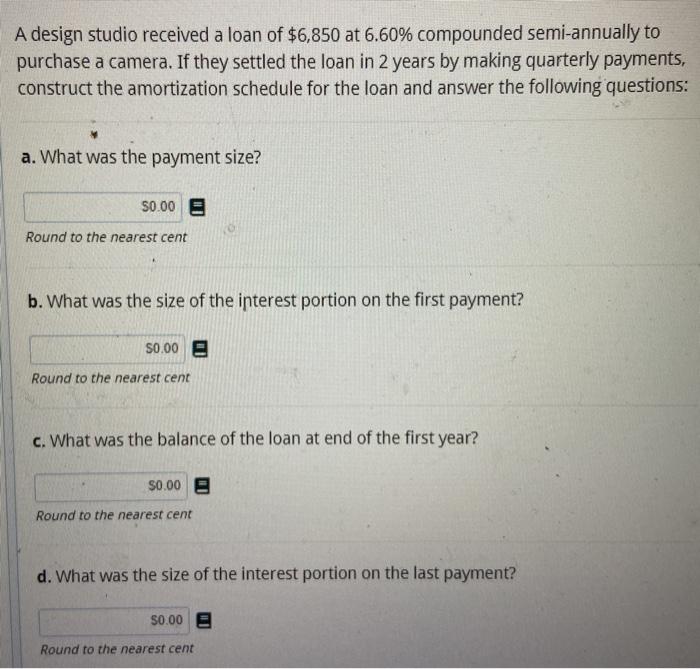

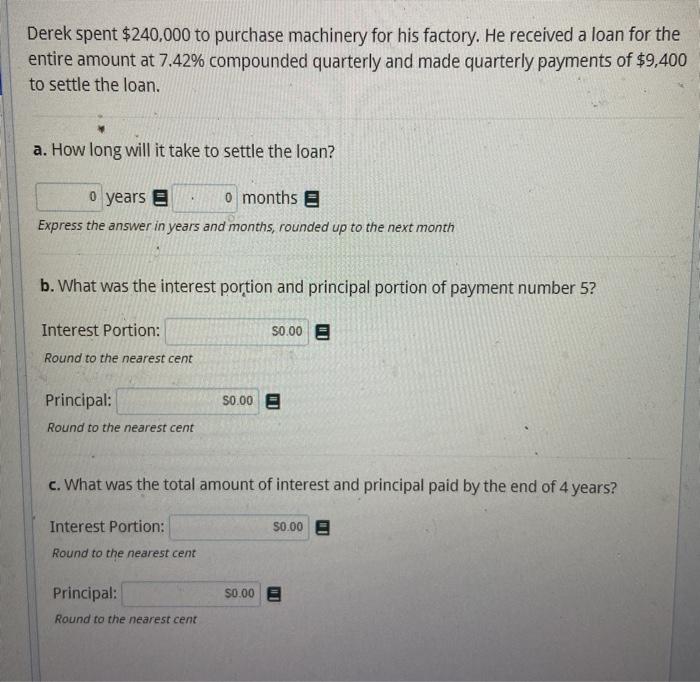

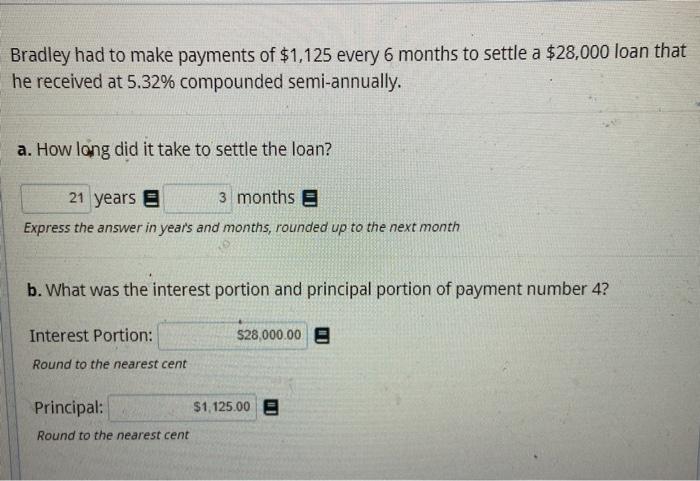

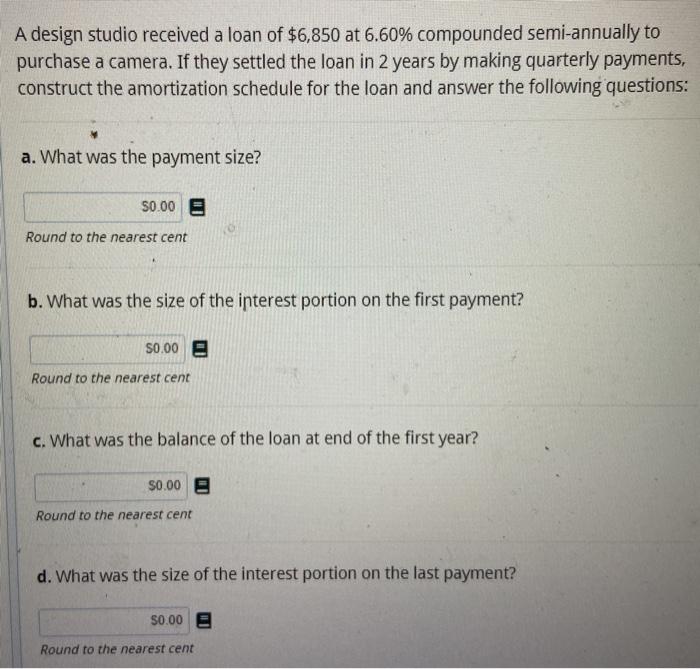

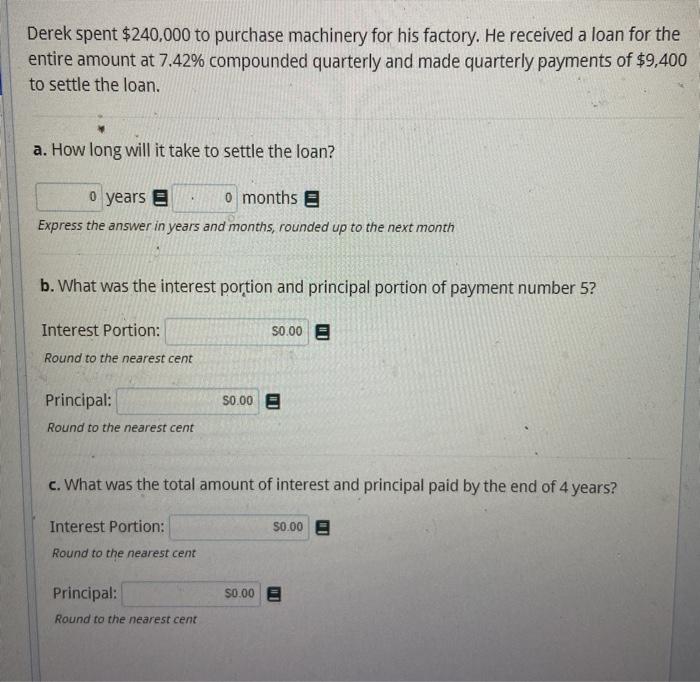

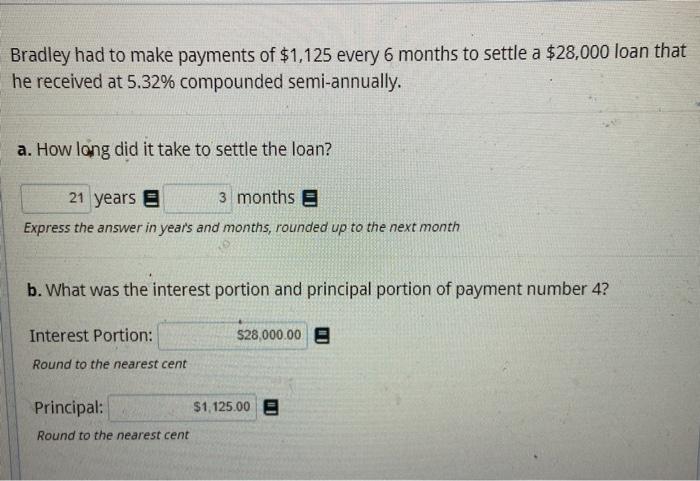

A design studio received a loan of $6,850 at 6.60% compounded semi-annually to purchase a camera. If they settled the loan in 2 years by making quarterly payments, construct the amortization schedule for the loan and answer the following questions: a. What was the payment size? $0.00 E Round to the nearest cent b. What was the size of the interest portion on the first payment? 50.00 Round to the nearest cent c. What was the balance of the loan at end of the first year? $0.00 e Round to the nearest cent d. What was the size of the interest portion on the last payment? 50.00 Round to the nearest cent Derek spent $240,000 to purchase machinery for his factory. He received a loan for the entire amount at 7.42% compounded quarterly and made quarterly payments of $9,400 to settle the loan. a. How long will it take to settle the loan? 0 years o months E Express the answer in years and months, rounded up to the next month b. What was the interest portion and principal portion of payment number 5? Interest Portion: 50.00 Round to the nearest cent Principal: 50.00 Round to the nearest cent c. What was the total amount of interest and principal paid by the end of 4 years? Interest Portion: 50.00 E Round to the nearest cent Principal: 50.00 Round to the nearest cent Bradley had to make payments of $1,125 every 6 months to settle a $28,000 loan that he received at 5.32% compounded semi-annually. a. How long did it take to settle the loan? 21 years 3 months E Express the answer in years and months, rounded up to the next month b. What was the interest portion and principal portion of payment number 4? Interest Portion: $28,000.00 Round to the nearest cent Principal: $1,125.00 Round to the nearest cent please clearly state answer with corresponding question.

page 1

page 2

page 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started