Answered step by step

Verified Expert Solution

Question

1 Approved Answer

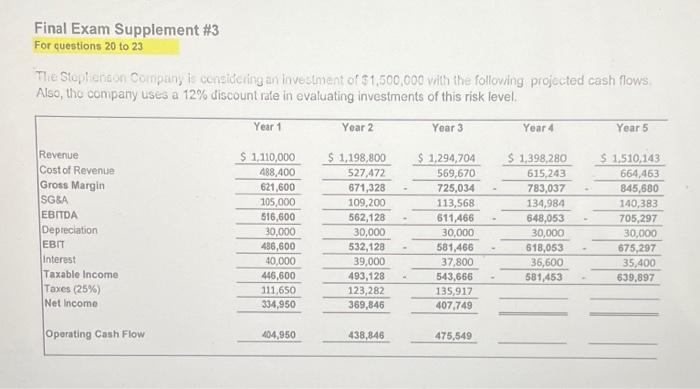

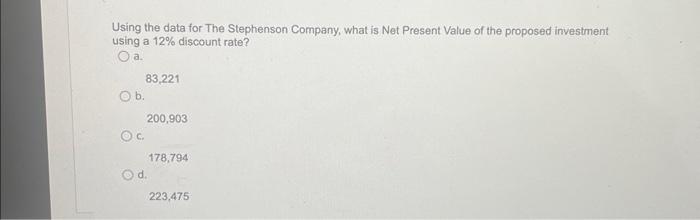

Final Exam Supplement #3 For questions 20 to 23 The Stephenson Company is considering an investment of $1,500,000 with the following projected cash flows. Also,

Final Exam Supplement #3 For questions 20 to 23 The Stephenson Company is considering an investment of $1,500,000 with the following projected cash flows. Also, the company uses a 12% discount rate in evaluating investments of this risk level. Revenue Cost of Revenue Gross Margin SG&A EBITDA Depreciation EBIT Interest Taxable Income Taxes (25%) Net Income Operating Cash Flow Year 1 $ 1,110,000 488,400 621,600 105,000 516,600 30,000 486,600 40,000 446,600 111,650 334,950 404,950 Year 2 $ 1,198,800 527,472 671,328 109,200 562,128 30,000 532,128 39,000 493,128 123,282 369,846 438,846 Year 3 $ 1,294,704 569,670 725,034 113,568 611,466 30,000 581,466 37,800 543,666 135,917 407,749 475,549 Year 4 $ 1,398,280 615,243 783,037 134,984 648,053 30,000 618,053 36,600 581,453 Year 5 $ 1,510,143 664,463 845,680 140,383 705,297 30,000 675,297 35,400 639,897

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started