Question

Final Examination (Optional) MASTERING ADJUSTING ENTRIES Instructions: Detach the Final Examination Answer Sheet on page 147 before beginning your final examination. Select the correct letter

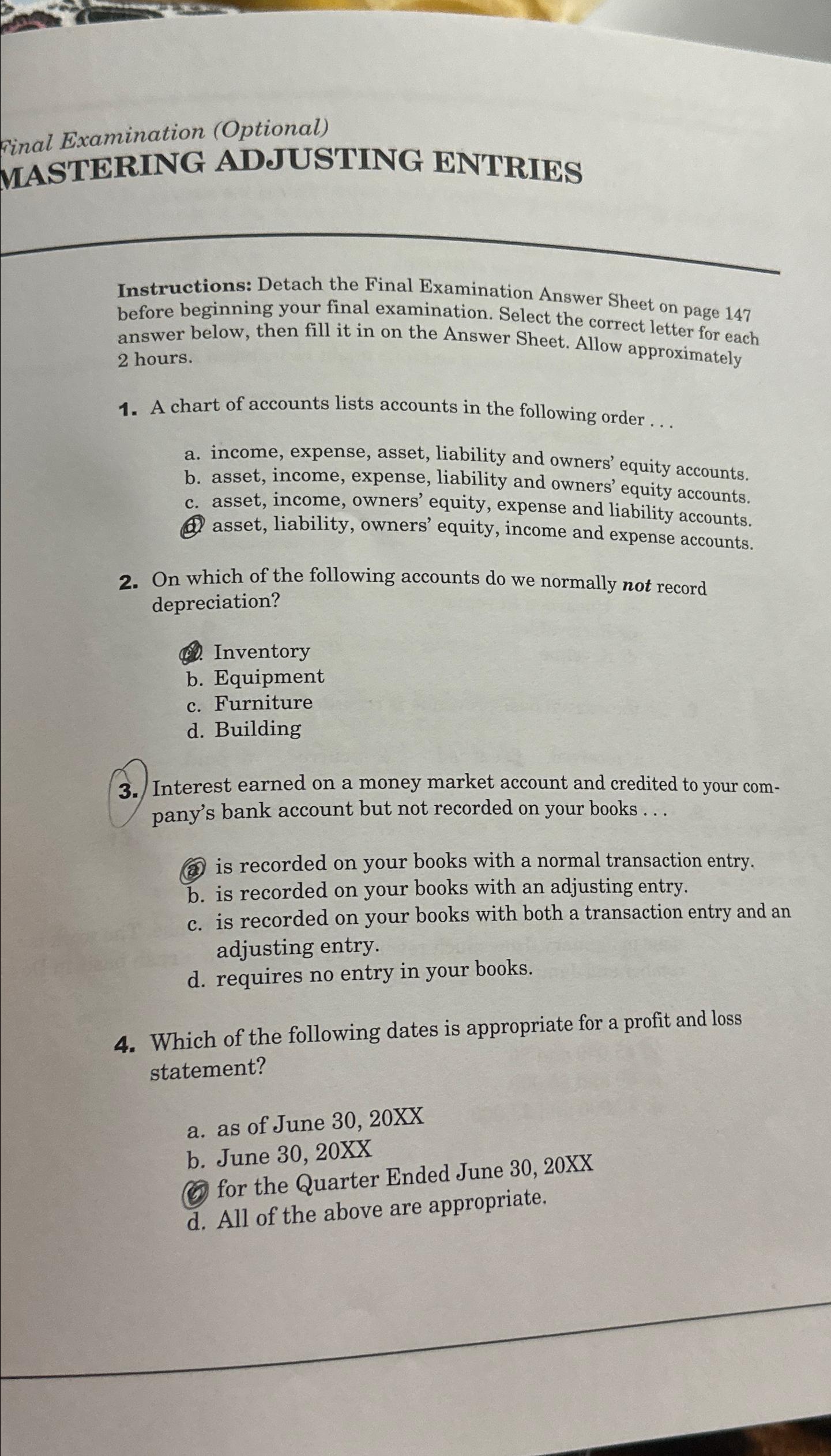

Final Examination (Optional)\ MASTERING ADJUSTING ENTRIES\ Instructions: Detach the Final Examination Answer Sheet on page 147 before beginning your final examination. Select the correct letter for each answer below, then fill it in on the Answer Sheet. Allow approximately 2 hours.\ A chart of accounts lists accounts in the following order...\ a. income, expense, asset, liability and owners' equity accounts.\ b. asset, income, expense, liability and owners' equity accounts.\ c. asset, income, owners' equity, expense and liability accounts.\ @. asset, liability, owners' equity, income and expense accounts.\ On which of the following accounts do we normally not record depreciation?\ Inventory\ b. Equipment\ c. Furniture\ d. Building\ Interest earned on a money market account and credited to your company's bank account but not recorded on your books ...\ (62) is recorded on your books with a normal transaction entry.\ b. is recorded on your books with an adjusting entry.\ c. is recorded on your books with both a transaction entry and an adjusting entry.\ d. requires no entry in your books.\ Which of the following dates is appropriate for a profit and loss statement?\ a. as of June

30,20xx\ b. June 30 , 20XX\ (C.) for the Quarter Ended June 30, 20XX\ d. All of the above are appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started