Answered step by step

Verified Expert Solution

Question

1 Approved Answer

final If we anticipate a decrease of the interest rate in the next 6 months, we should purchase bonds of which: The coupon rate is

final

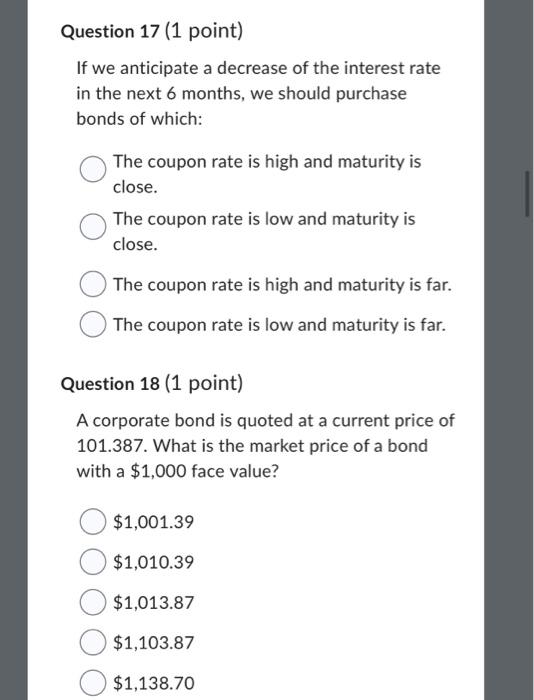

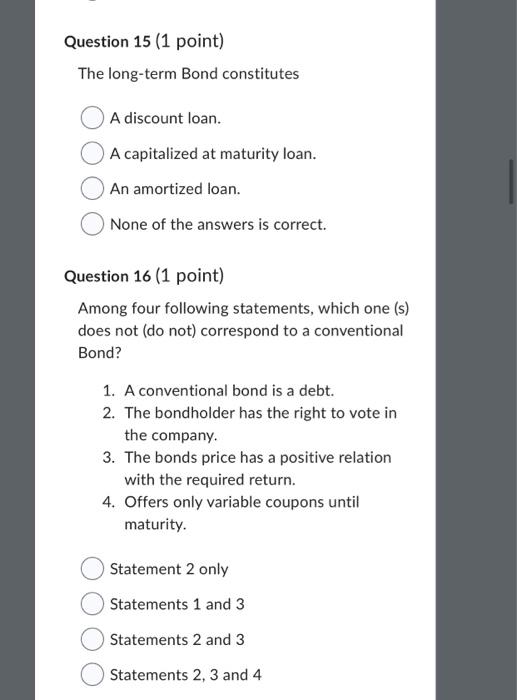

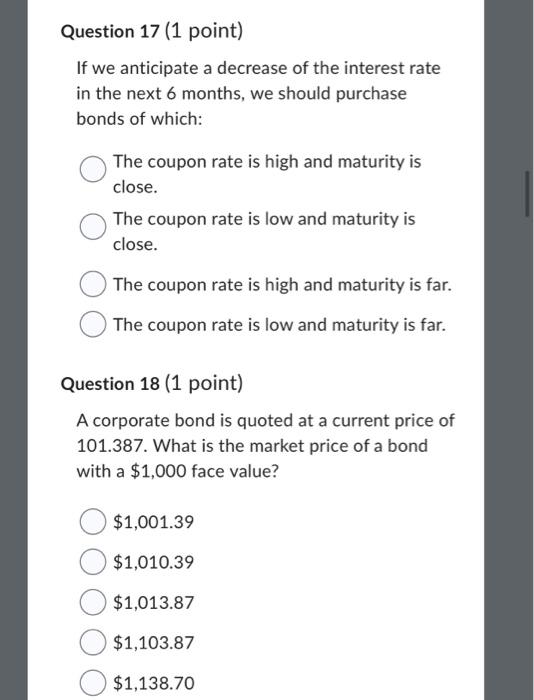

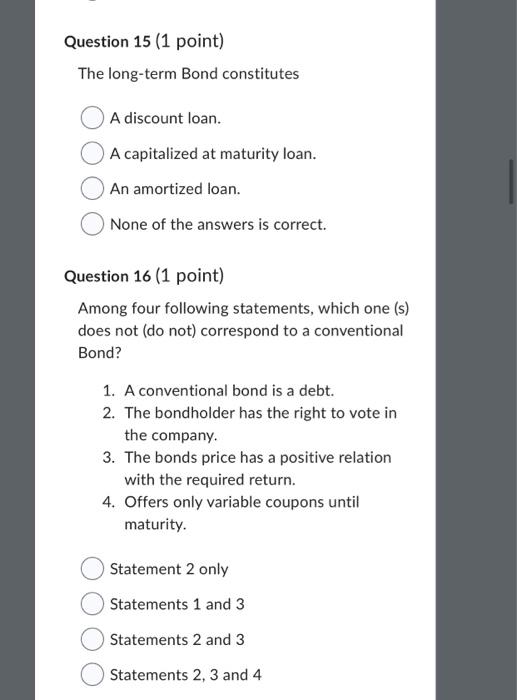

If we anticipate a decrease of the interest rate in the next 6 months, we should purchase bonds of which: The coupon rate is high and maturity is close. The coupon rate is low and maturity is close. The coupon rate is high and maturity is far. The coupon rate is low and maturity is far. Question 18 (1 point) A corporate bond is quoted at a current price of 101.387. What is the market price of a bond with a $1,000 face value? $1,001.39 $1,010.39 $1,013.87 $1,103.87 $1,138.70 The long-term Bond constitutes A discount loan. A capitalized at maturity loan. An amortized loan. None of the answers is correct. Question 16 (1 point) Among four following statements, which one (s) does not (do not) correspond to a conventional Bond? 1. A conventional bond is a debt. 2. The bondholder has the right to vote in the company. 3. The bonds price has a positive relation with the required return. 4. Offers only variable coupons until maturity. Statement 2 only Statements 1 and 3 Statements 2 and 3 Statements 2, 3 and 4 If we anticipate a decrease of the interest rate in the next 6 months, we should purchase bonds of which: The coupon rate is high and maturity is close. The coupon rate is low and maturity is close. The coupon rate is high and maturity is far. The coupon rate is low and maturity is far. Question 18 (1 point) A corporate bond is quoted at a current price of 101.387. What is the market price of a bond with a $1,000 face value? $1,001.39 $1,010.39 $1,013.87 $1,103.87 $1,138.70 The long-term Bond constitutes A discount loan. A capitalized at maturity loan. An amortized loan. None of the answers is correct. Question 16 (1 point) Among four following statements, which one (s) does not (do not) correspond to a conventional Bond? 1. A conventional bond is a debt. 2. The bondholder has the right to vote in the company. 3. The bonds price has a positive relation with the required return. 4. Offers only variable coupons until maturity. Statement 2 only Statements 1 and 3 Statements 2 and 3 Statements 2, 3 and 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started