FINAL PROJECT CASE STUDY Part 1 Table 2 Balanced Scorecard Branston Soda Company manufactures soda. In 20x0, Branston earned $12.0 million in operating income

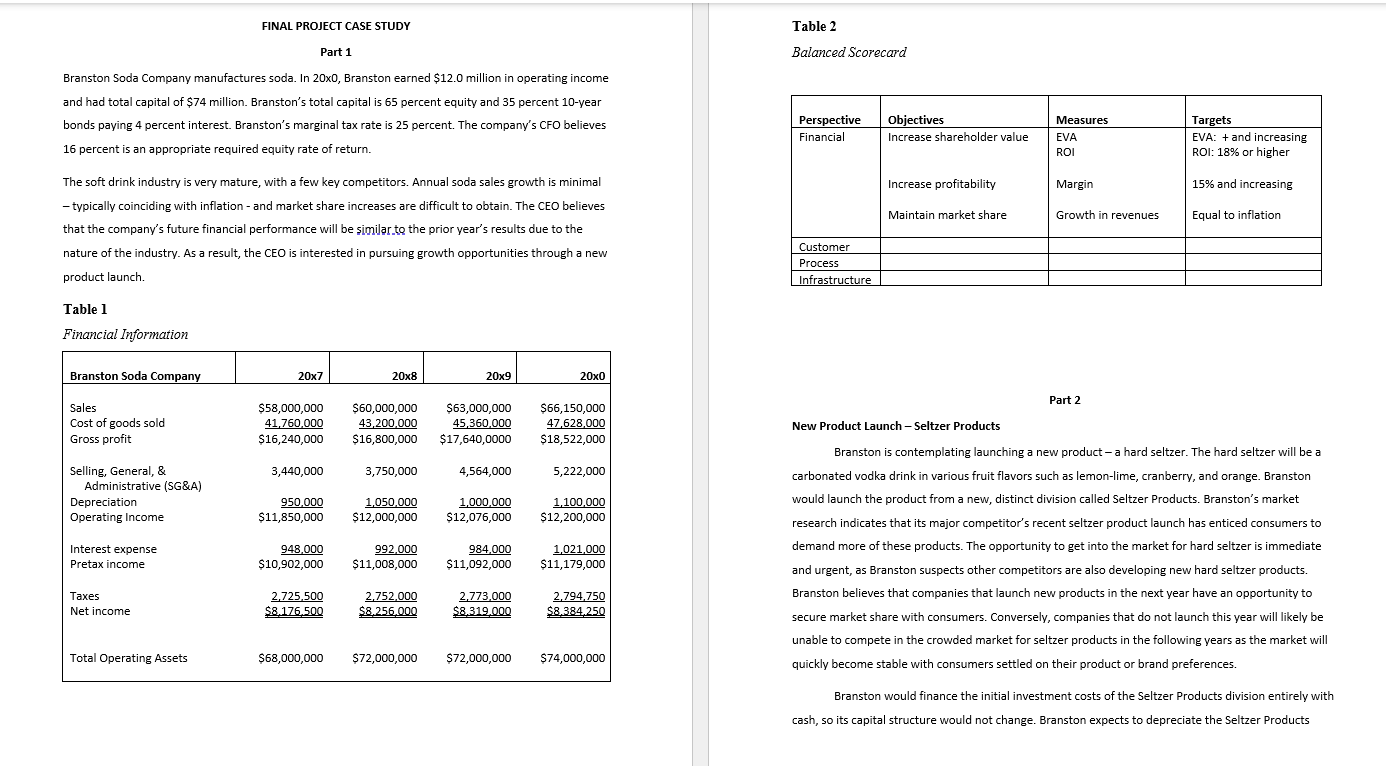

FINAL PROJECT CASE STUDY Part 1 Table 2 Balanced Scorecard Branston Soda Company manufactures soda. In 20x0, Branston earned $12.0 million in operating income and had total capital of $74 million. Branston's total capital is 65 percent equity and 35 percent 10-year bonds paying 4 percent interest. Branston's marginal tax rate is 25 percent. The company's CFO believes 16 percent is an appropriate required equity rate of return. The soft drink industry is very mature, with a few key competitors. Annual soda sales growth is minimal - typically coinciding with inflation - and market share increases are difficult to obtain. The CEO believes that the company's future financial performance will be similar to the prior year's results due to the nature of the industry. As a result, the CEO is interested in pursuing growth opportunities through a new product launch. Process Infrastructure Table 1 Financial Information Branston Soda Company 20x7 20x8 20x9 20x0 Sales $58,000,000 Cost of goods sold 41,760,000 Gross profit $16,240,000 $60,000,000 $63,000,000 43,200,000 45,360,000 $16,800,000 $17,640,0000 $66,150,000 47,628,000 $18,522,000 Selling, General, & 3,440,000 3,750,000 4,564,000 5,222,000 Administrative (SG&A) Depreciation Operating Income 950,000 $11,850,000 1,050,000 $12,000,000 1,000,000 $12,076,000 1,100,000 $12,200,000 Interest expense Pretax income Taxes 948,000 $10,902,000 992,000 $11,008,000 984,000 $11,092,000 1,021,000 $11,179,000 Net income 2,725,500 $8,176,500 2,752,000 $8,256,000 2,773,000 $8,319,000 2,794,750 $8,384,250 Total Operating Assets $68,000,000 $72,000,000 $72,000,000 $74,000,000 Perspective Financial Objectives Increase shareholder value Measures Targets EVA ROI EVA: + and increasing ROI: 18% or higher Increase profitability Margin Maintain market share Growth in revenues 15% and increasing Equal to inflation Customer Part 2 New Product Launch - Seltzer Products Branston is contemplating launching a new product - a hard seltzer. The hard seltzer will be a carbonated vodka drink in various fruit flavors such as lemon-lime, cranberry, and orange. Branston would launch the product from a new, distinct division called Seltzer Products. Branston's market research indicates that its major competitor's recent seltzer product launch has enticed consumers to demand more of these products. The opportunity to get into the market for hard seltzer is immediate and urgent, as Branston suspects other competitors are also developing new hard seltzer products. Branston believes that companies that launch new products in the next year have an opportunity to secure market share with consumers. Conversely, companies that do not launch this year will likely be unable to compete in the crowded market for seltzer products in the following years as the market will quickly become stable with consumers settled on their product or brand preferences. Branston would finance the initial investment costs of the Seltzer Products division entirely with cash, so its capital structure would not change. Branston expects to depreciate the Seltzer Products

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The case study for Branston Soda Company involves analyzing their financial performance and considering a new product launch Heres a stepbystep breakd...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started