Answered step by step

Verified Expert Solution

Question

1 Approved Answer

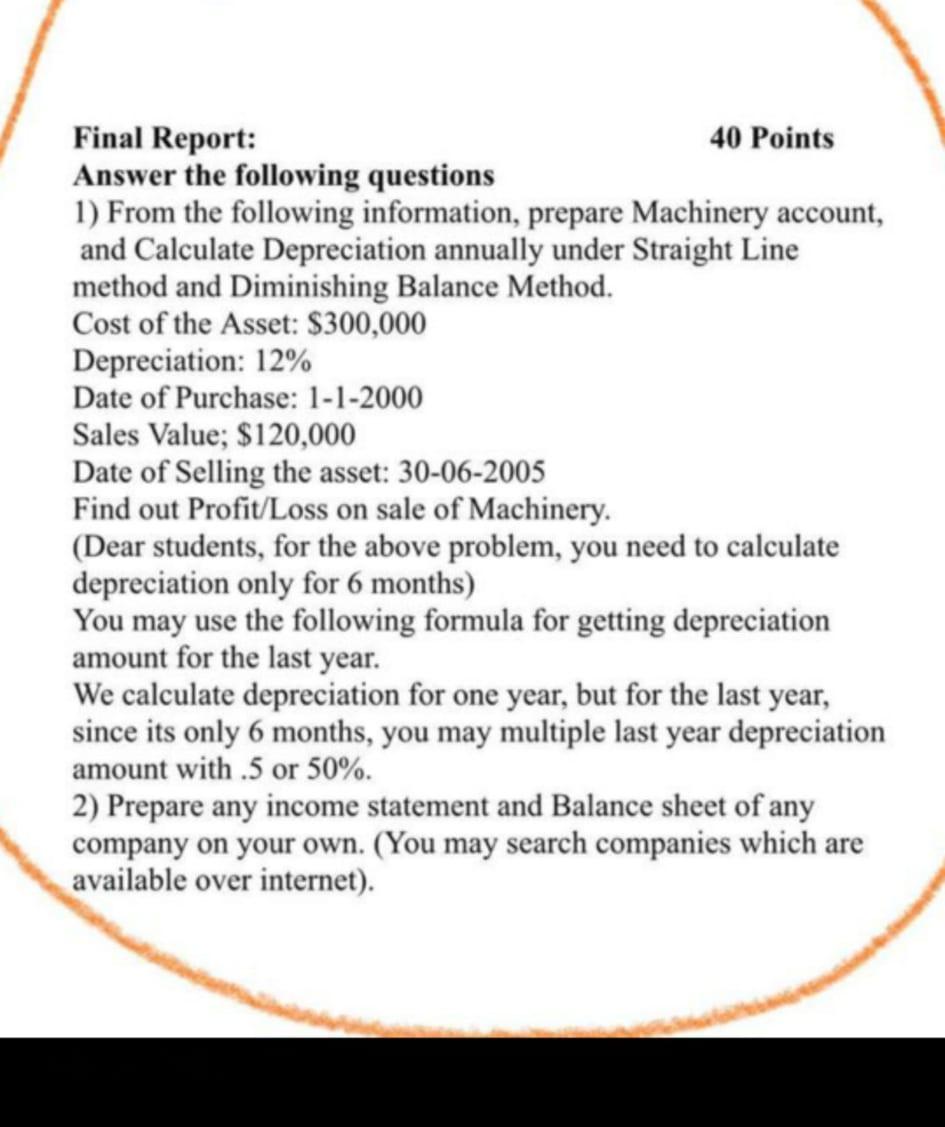

Final Report: Answer the following questions 1) From the following information, prepare Machinery account, and Calculate Depreciation annually under Straight Line method and Diminishing

Final Report: Answer the following questions 1) From the following information, prepare Machinery account, and Calculate Depreciation annually under Straight Line method and Diminishing Balance Method. Cost of the Asset: $300,000 Depreciation: 12% Date of Purchase: 1-1-2000 40 Points Sales Value; $120,000 Date of Selling the asset: 30-06-2005 Find out Profit/Loss on sale of Machinery. (Dear students, for the above problem, you need to calculate depreciation only for 6 months) You may use the following formula for getting depreciation amount for the last year. We calculate depreciation for one year, but for the last year, since its only 6 months, you may multiple last year depreciation amount with .5 or 50%. 2) Prepare any income statement and Balance sheet of any company on your own. (You may search companies which are available over internet).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started