Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finally, in addition to its normal operations, DTS also has launched a division that builds physical therapy centers. At the end of 2018, there was

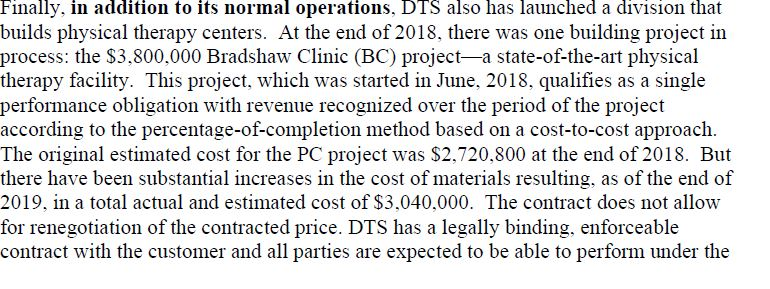

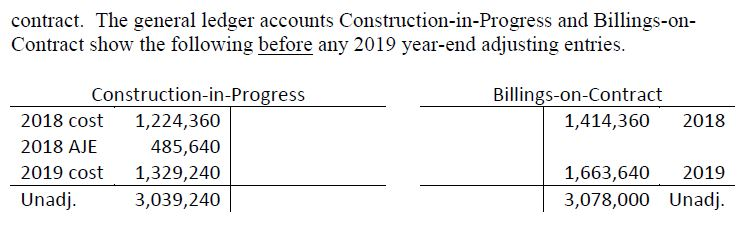

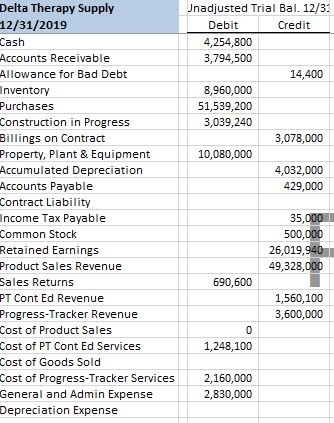

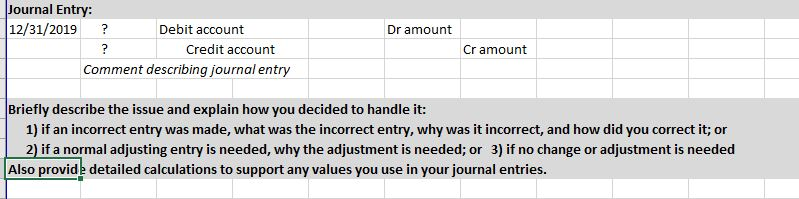

Finally, in addition to its normal operations, DTS also has launched a division that builds physical therapy centers. At the end of 2018, there was one building project in process: the $3,800,000 Bradshaw Clinic (BC) projecta state-of-the-art physical therapy facility. This project, which was started in June, 2018, qualifies as a single performance obligation with revenue recognized over the period of the project according to the percentage-of-completion method based on a cost-to-cost approach. The original estimated cost for the PC project was $2,720,800 at the end of 2018. But there have been substantial increases in the cost of materials resulting, as of the end of 2019, in a total actual and estimated cost of $3,040,000. The contract does not allow for renegotiation of the contracted price. DTS has a legally binding, enforceable contract with the customer and all parties are expected to be able to perform under the contract. The general ledger accounts Construction-in-Progress and Billings-on- Contract show the following before any 2019 year-end adjusting entries. Billings-on-Contract 1,414,360 2018 Construction-in-Progress 2018 cost 1,224,360 2018 AJE 485,640 2019 cost 1,329,240 Unadj. 3,039,240 1,663,640 2019 3,078,000 Unadj. Unadjusted Trial Bal. 12/3: Debit Credit 4,254,800 3,794,500 14,400 8,960,000 51,539,200 3,039,240 3,078,000 10,080,000 4,032,000 429,000 Delta Therapy Supply 12/31/2019 Cash Accounts Receivable Allowance for Bad Debt Inventory Purchases Construction in Progress Billings on Contract Property, Plant & Equipment Accumulated Depreciation Accounts Payable Contract Liability Income Tax Payable Common Stock Retained Earnings Product Sales Revenue Sales Returns PT Cont Ed Revenue Progress-Tracker Revenue Cost of Product Sales Cost of PT Cont Ed Services Cost of Goods Sold Cost of Progress-Tracker Services General and Admin Expense Depreciation Expense 35,000 500,000 26,019,940 49,328,000 690,600 1,560,100 3,600,000 0 1,248,100 2,160,000 2,830,000 Dr amount Journal Entry: 12/31/2019 Debit account Credit account Comment describing journal entry ? ? Cramount Briefly describe the issue and explain how you decided to handle it: 1) if an incorrect entry was made, what was the incorrect entry, why was it incorrect, and how did you correct it; or 2) if a normal adjusting entry is needed, why the adjustment is needed; or 3) if no change or adjustment is needed Also provide detailed calculations to support any values you use in your journal entries. Finally, in addition to its normal operations, DTS also has launched a division that builds physical therapy centers. At the end of 2018, there was one building project in process: the $3,800,000 Bradshaw Clinic (BC) projecta state-of-the-art physical therapy facility. This project, which was started in June, 2018, qualifies as a single performance obligation with revenue recognized over the period of the project according to the percentage-of-completion method based on a cost-to-cost approach. The original estimated cost for the PC project was $2,720,800 at the end of 2018. But there have been substantial increases in the cost of materials resulting, as of the end of 2019, in a total actual and estimated cost of $3,040,000. The contract does not allow for renegotiation of the contracted price. DTS has a legally binding, enforceable contract with the customer and all parties are expected to be able to perform under the contract. The general ledger accounts Construction-in-Progress and Billings-on- Contract show the following before any 2019 year-end adjusting entries. Billings-on-Contract 1,414,360 2018 Construction-in-Progress 2018 cost 1,224,360 2018 AJE 485,640 2019 cost 1,329,240 Unadj. 3,039,240 1,663,640 2019 3,078,000 Unadj. Unadjusted Trial Bal. 12/3: Debit Credit 4,254,800 3,794,500 14,400 8,960,000 51,539,200 3,039,240 3,078,000 10,080,000 4,032,000 429,000 Delta Therapy Supply 12/31/2019 Cash Accounts Receivable Allowance for Bad Debt Inventory Purchases Construction in Progress Billings on Contract Property, Plant & Equipment Accumulated Depreciation Accounts Payable Contract Liability Income Tax Payable Common Stock Retained Earnings Product Sales Revenue Sales Returns PT Cont Ed Revenue Progress-Tracker Revenue Cost of Product Sales Cost of PT Cont Ed Services Cost of Goods Sold Cost of Progress-Tracker Services General and Admin Expense Depreciation Expense 35,000 500,000 26,019,940 49,328,000 690,600 1,560,100 3,600,000 0 1,248,100 2,160,000 2,830,000 Dr amount Journal Entry: 12/31/2019 Debit account Credit account Comment describing journal entry ? ? Cramount Briefly describe the issue and explain how you decided to handle it: 1) if an incorrect entry was made, what was the incorrect entry, why was it incorrect, and how did you correct it; or 2) if a normal adjusting entry is needed, why the adjustment is needed; or 3) if no change or adjustment is needed Also provide detailed calculations to support any values you use in your journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started