Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6.1 Calculate the return and the return relative for the following assets: (a) A preferred stock bought for $70 per share, held one year

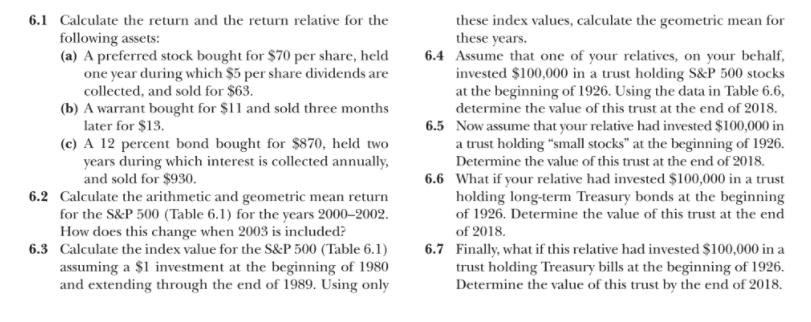

6.1 Calculate the return and the return relative for the following assets: (a) A preferred stock bought for $70 per share, held one year during which $5 per share dividends are collected, and sold for $63. (b) A warrant bought for $11 and sold three months later for $13. (c) A 12 percent bond bought for $870, held two years during which interest is collected annually, and sold for $930. 6.2 Calculate the arithmetic and geometric mean return for the S&P 500 (Table 6.1) for the years 2000-2002. How does this change when 2003 is included? 6.3 Calculate the index value for the S&P 500 (Table 6.1) assuming a $1 investment at the beginning of 1980 and extending through the end of 1989. Using only these index values, calculate the geometric mean for these years. 6.4 Assume that one of your relatives, on your behalf, invested $100,000 in a trust holding S&P 500 stocks at the beginning of 1926. Using the data in Table 6.6, determine the value of this trust at the end of 2018. 6.5 Now assume that your relative had invested $100,000 in a trust holding "small stocks" at the beginning of 1926. Determine the value of this trust at the end of 2018. 6.6 What if your relative had invested $100,000 in a trust holding long-term Treasury bonds at the beginning of 1926. Determine the value of this trust at the end of 2018. 6.7 Finally, what if this relative had invested $100,000 in a trust holding Treasury bills at the beginning of 1926. Determine the value of this trust by the end of 2018.

Step by Step Solution

★★★★★

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

61 a Return 6370570 01 or 10 Return relative 0101 1 b R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started