Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance 13. What is the monthly payment on a $350,000 mortgage, given a 30 year term and a 6.2% annual interest rate? a. $1,995 b.

Finance

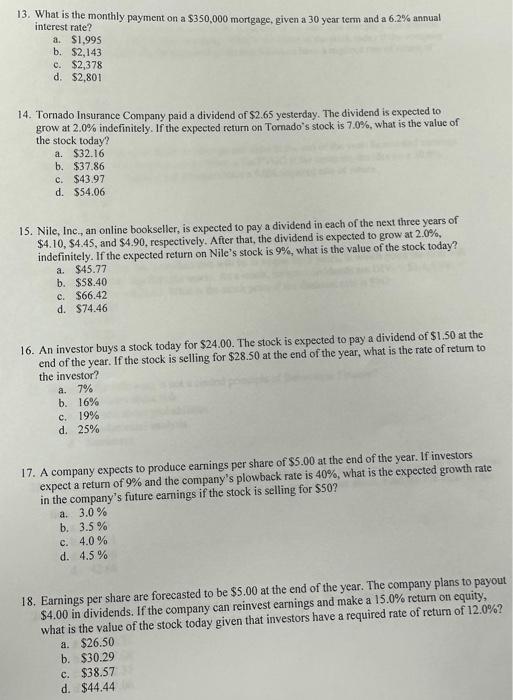

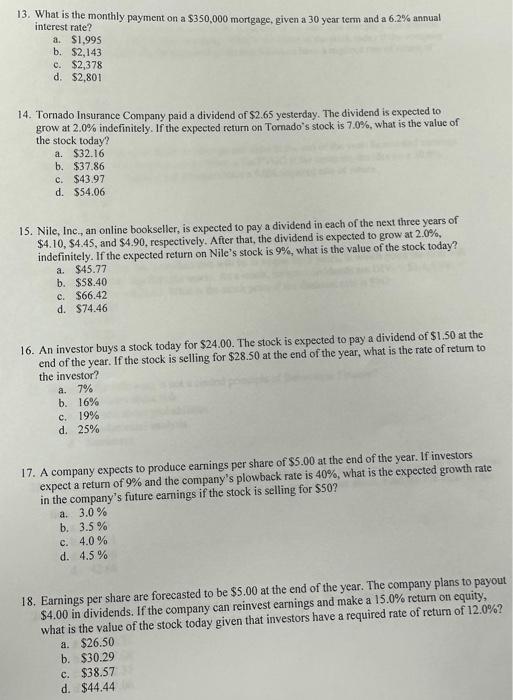

13. What is the monthly payment on a $350,000 mortgage, given a 30 year term and a 6.2% annual interest rate? a. $1,995 b. $2,143 c. $2,378 d. $2,801 14. Tornado Insurance Company paid a dividend of $2.65 yesterday. The dividend is expected to grow at 2.0% indefinitely. If the expected retum on Tomado's stock is 7.0%, what is the value of the stock today? a. $32.16 b. $37.86 c. $43.97 d. $54.06 15. Nile, Inc, an online bookseller, is expected to pay a dividend in each of the next three years of $4.10,$4.45, and $4.90, respectively. After that, the dividend is expected to grow at 2.0%, indefinitely. If the expected return on Nile's stock is 9%, what is the value of the stock today? a. $45.77 b. $58.40 c. $66.42 d. $74.46 16. An investor buys a stock today for $24.00. The stock is expected to pay a dividend of $1.50 at the end of the year. If the stock is selling for $28.50 at the end of the year, what is the rate of return to the investor? a. 7% b. 16% c. 19% d. 25% 17. A company expects to produce earnings per share of $5.00 at the end of the year. If investors expect a return of 9% and the company's plowback rate is 40%, what is the expected growth rate in the company's future earnings if the stock is selling for $50 ? a. 3.0% b. 3.5% c. 4.0% d. 4.5% 18. Earnings per share are forecasted to be $5.00 at the end of the year. The company plans to payout $4.00 in dividends. If the company can reinvest earnings and make a 15.0% return on equity, what is the value of the stock today given that investors have a required rate of return of 12.0% ? a. $26.50 b. $30.29 c. $38.57 d. $44.44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started