Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nuri Cemerlang Corporation has 8% semi annually convertible bond and will mature in another 30 years. The RM18 million bond issue was made 10

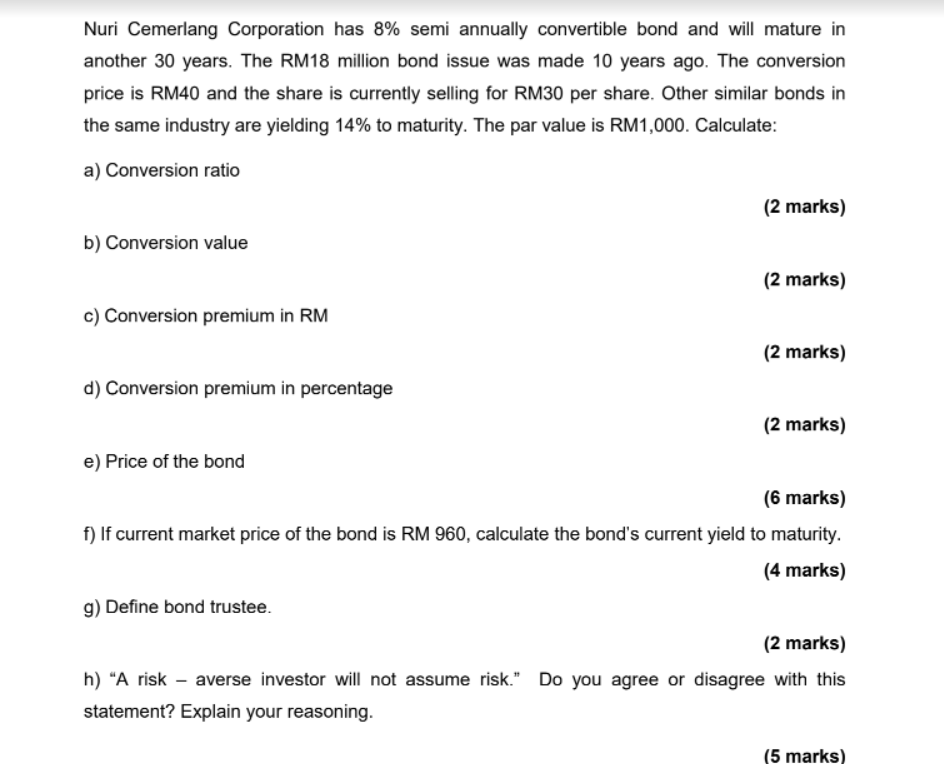

Nuri Cemerlang Corporation has 8% semi annually convertible bond and will mature in another 30 years. The RM18 million bond issue was made 10 years ago. The conversion price is RM40 and the share is currently selling for RM30 per share. Other similar bonds in the same industry are yielding 14% to maturity. The par value is RM1,000. Calculate: a) Conversion ratio b) Conversion value c) Conversion premium in RM d) Conversion premium in percentage e) Price of the bond (2 marks) g) Define bond trustee. (2 marks) (2 marks) (2 marks) (6 marks) f) If current market price of the bond is RM 960, calculate the bond's current yield to maturity. (4 marks) (2 marks) h) "A risk - averse investor will not assume risk." Do you agree or disagree with this statement? Explain your reasoning. (5 marks)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Conversion ratio The conversion ratio is calculated as the par value of the bond divided by the conversion price Conversion ratio Par value Conversi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started