Answered step by step

Verified Expert Solution

Question

1 Approved Answer

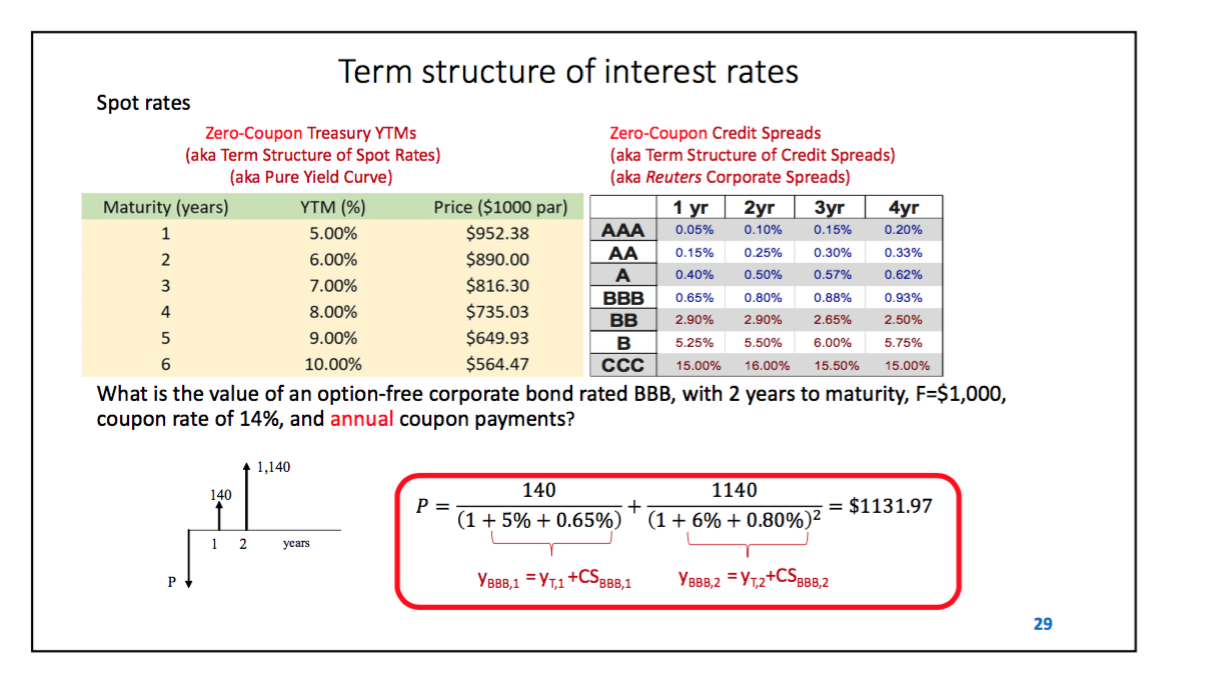

Based on the information on slide #29, compute the credit spread of an option-free corporate bond rated BB, with 3 years to maturity, F=$1,000, coupon

Based on the information on slide #29, compute the credit spread of an option-free corporate bond rated BB, with 3 years to maturity, F=$1,000, coupon rate of 8%, and annual coupon payments. Keep your answer in four decimal places as a percentage, e.g., 5.1234%

Spot rates Term structure of interest rates Zero-Coupon Treasury YTMs (aka Term Structure of Spot Rates) (aka Pure Yield Curve) Zero-Coupon Credit Spreads (aka Term Structure of Credit Spreads) (aka Reuters Corporate Spreads) Maturity (years) YTM (%) Price ($1000 par) 1 yr 2yr 3yr 4yr 1 5.00% $952.38 AAA 0.05% 0.10% 0.15% 0.20% 2 6.00% $890.00 AA 0.15% 0.25% 0.30% 0.33% A 0.40% 0.50% 0.57% 0.62% 3 7.00% $816.30 BBB 0.65% 0.80% 0.88% 0.93% 4 8.00% $735.03 BB 2.90% 2.90% 2.65% 2.50% 5 9.00% 10.00% $649.93 $564.47 6 5.25% 5.50% 6.00% 5.75% 15.00% 16.00% 15.50% 15.00% What is the value of an option-free corporate bond rated BBB, with 2 years to maturity, F=$1,000, coupon rate of 14%, and annual coupon payments? B 1,140 140 P 1 2 140 1140 P = + $1131.97 (1+5% +0.65%) (1+6% +0.80%) years Y888,1 Y+CSBBB.1 Y888.2 =Y+2+CS888.2 29

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started