Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Finance 300: Introduction to Finance Homework: Homework 13 (Chapter 16) Question 20, P 16-29 (similar to) Part 1 of 2 > HW Score: 55%,

.

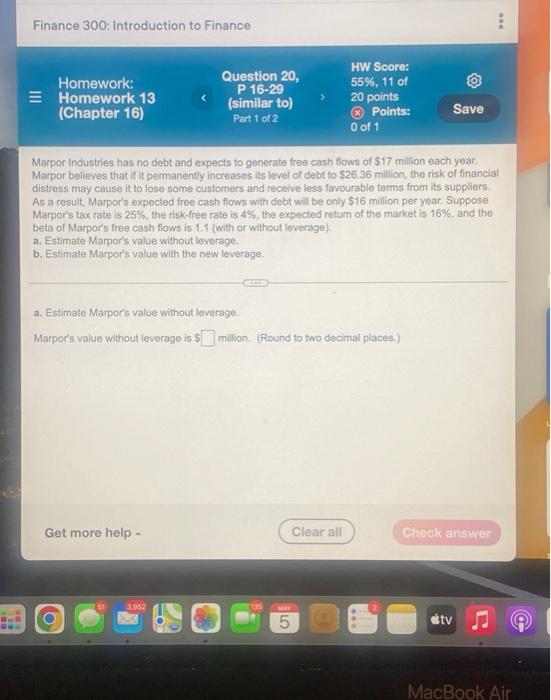

Finance 300: Introduction to Finance Homework: Homework 13 (Chapter 16) Question 20, P 16-29 (similar to) Part 1 of 2 > HW Score: 55%, 11 of 20 points Points: O of 1 Save Marpor Industries has no debt and expects to generate free cash flows of $17 million each year. Marpor believes that it it permanently increases its level of debt to $26.36 million, the risk of financial distress may cause it to lose some customers and receive less favourable terms from its suppliers As a result, Marpor's expected free cash flows with debt will be only $16 million per year. Suppose Marpor's tax rate is 25%, the risk-free rate is 4%, the expected return of the market is 16%, and the beta of Marpor's free cash flows is 1.1 (with or without leverage) a. Estimate Marpor's value without leverage. b. Eslimate Marpor's value with the new leverage: a. Estimate Marpor's value without leverage. Marpor's value without leverage is s million (Round to two decimal places.) Get more help Clear all Check answer 3:52 a 5 otv MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started