Answered step by step

Verified Expert Solution

Question

1 Approved Answer

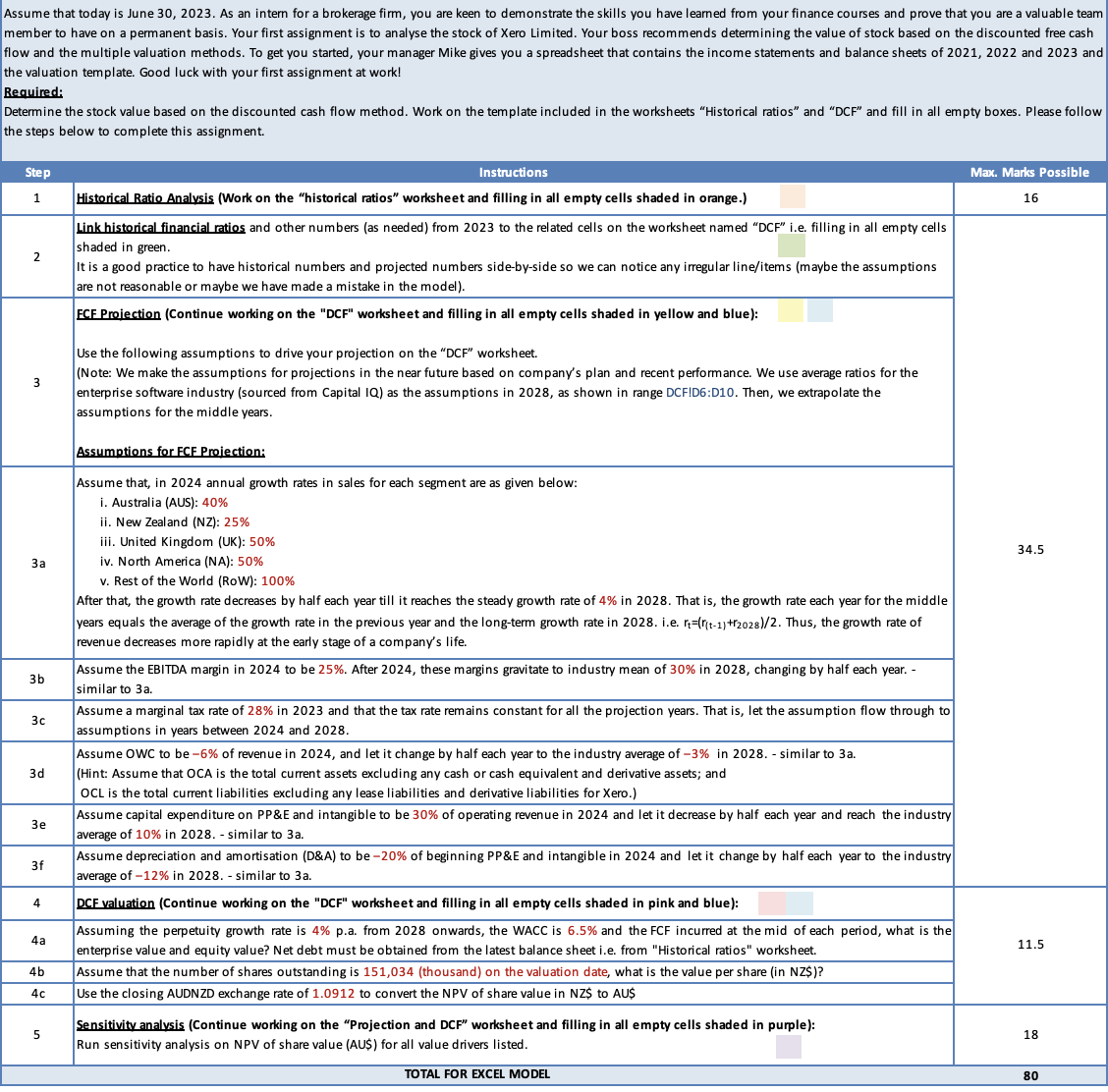

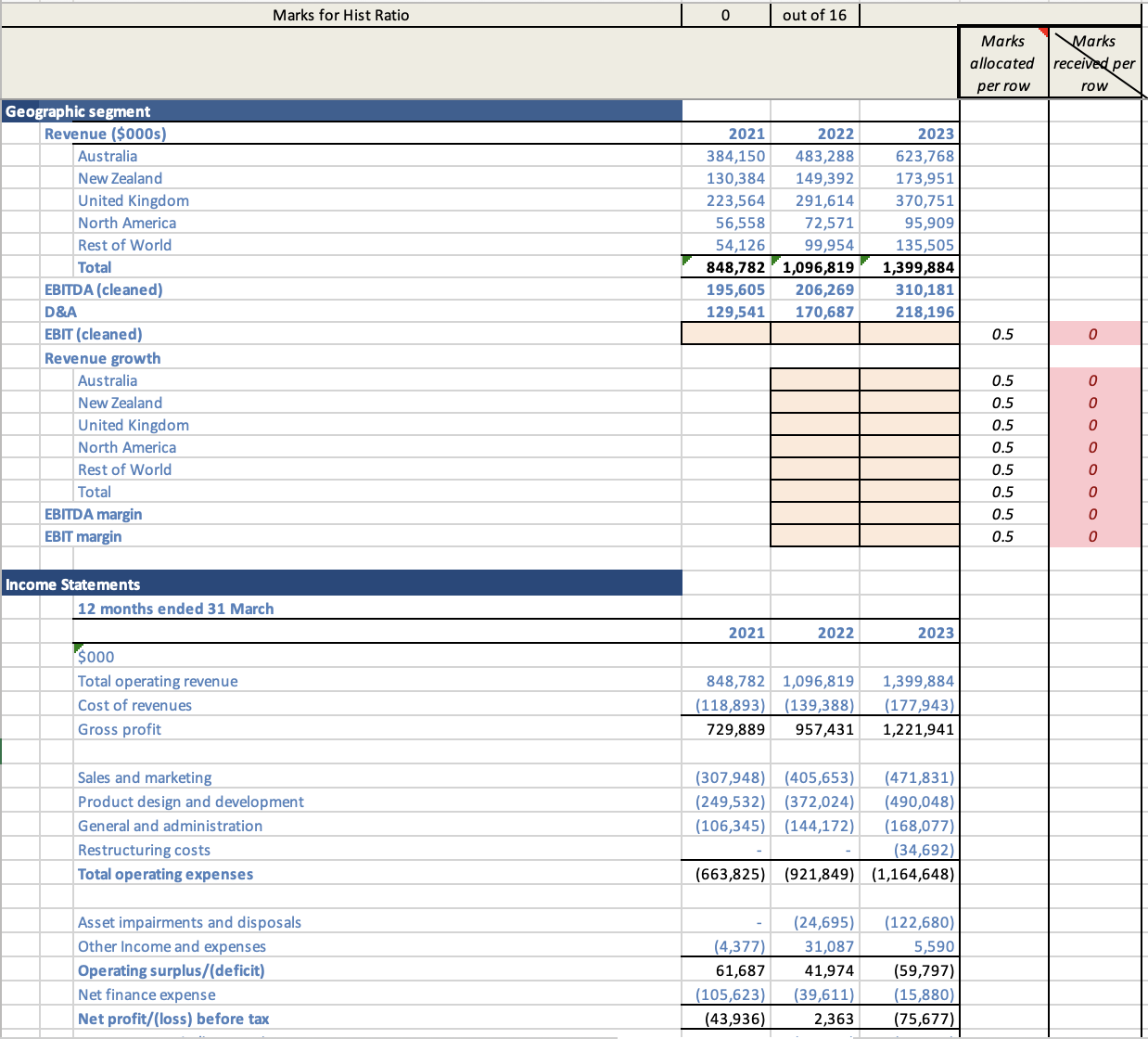

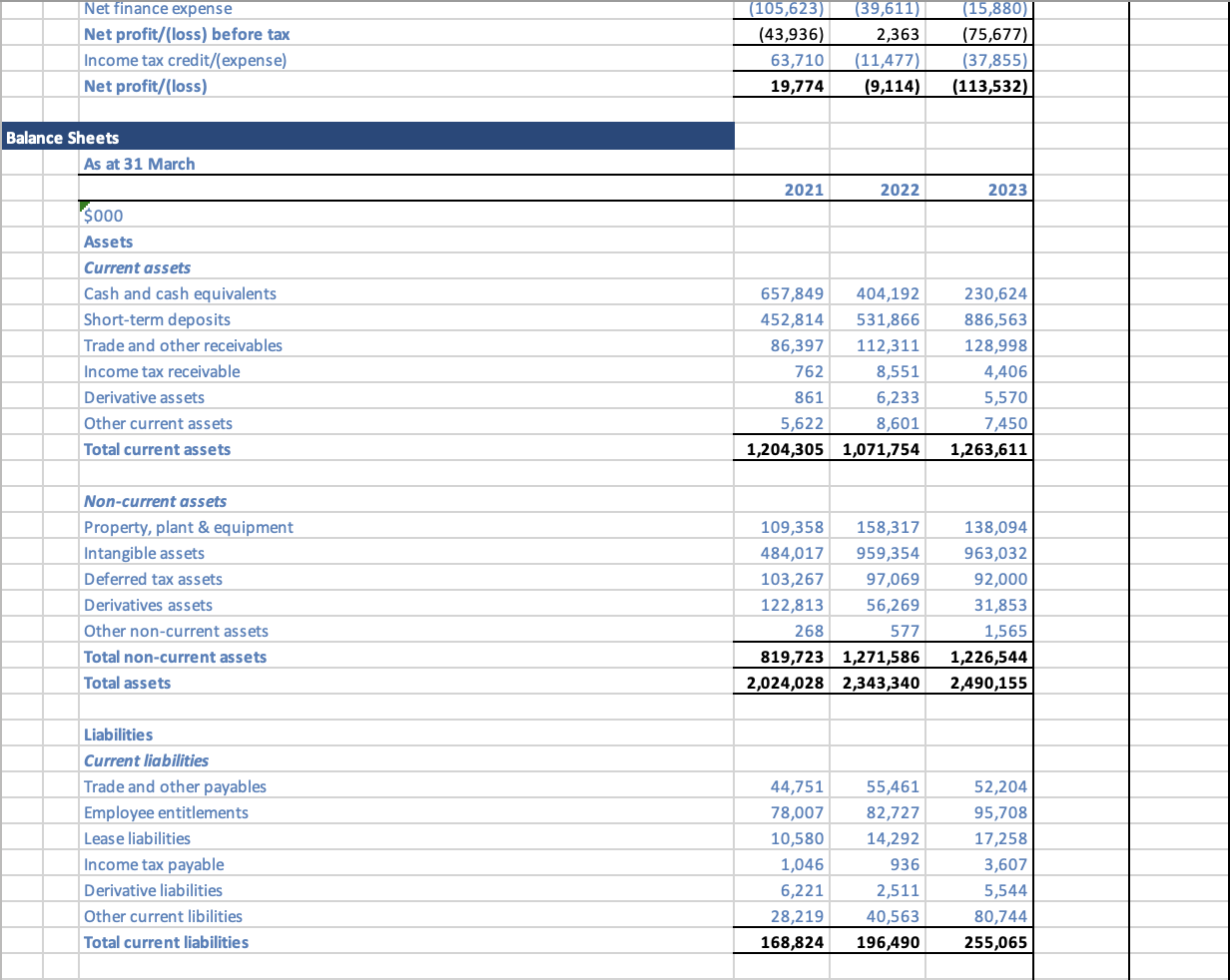

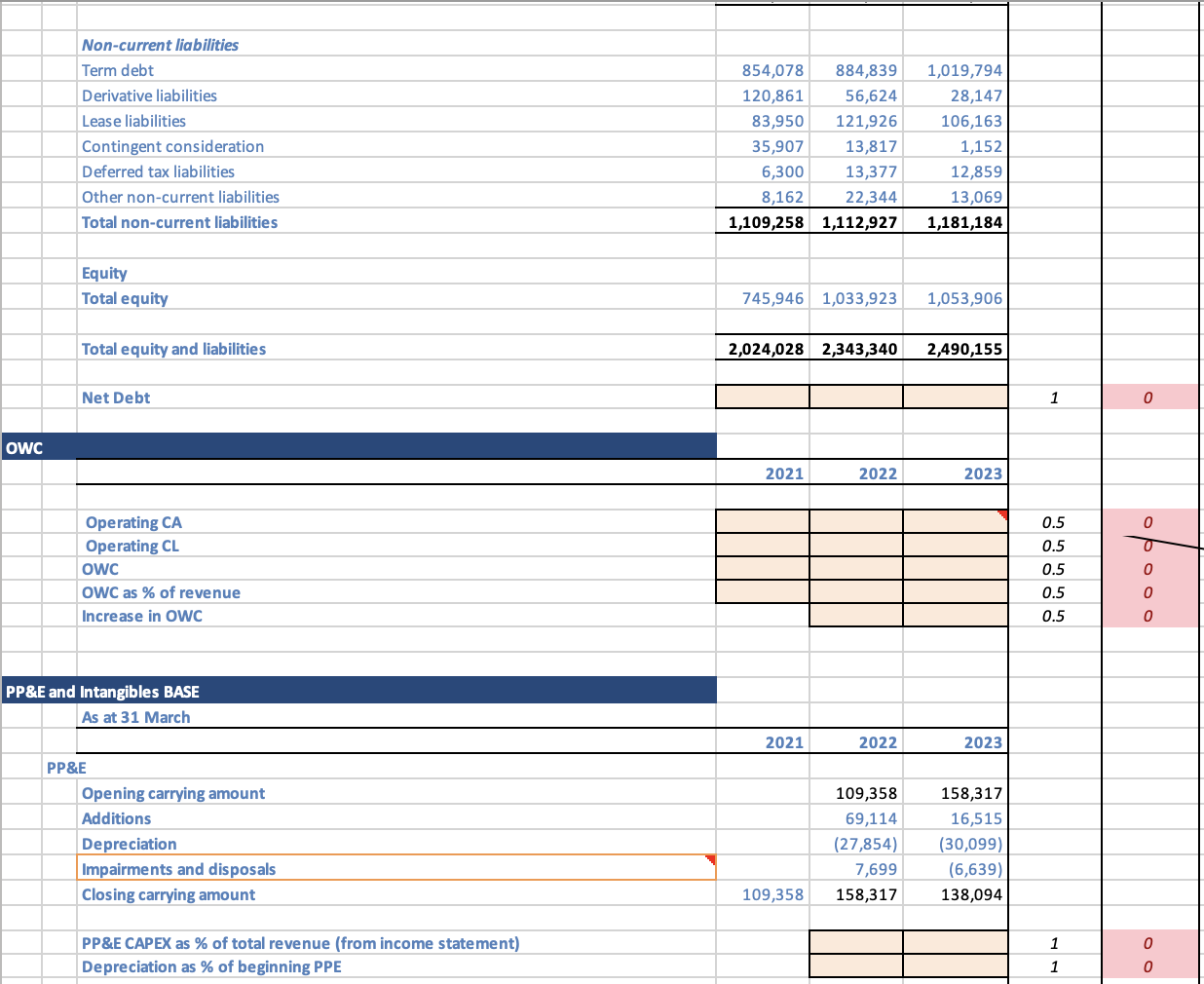

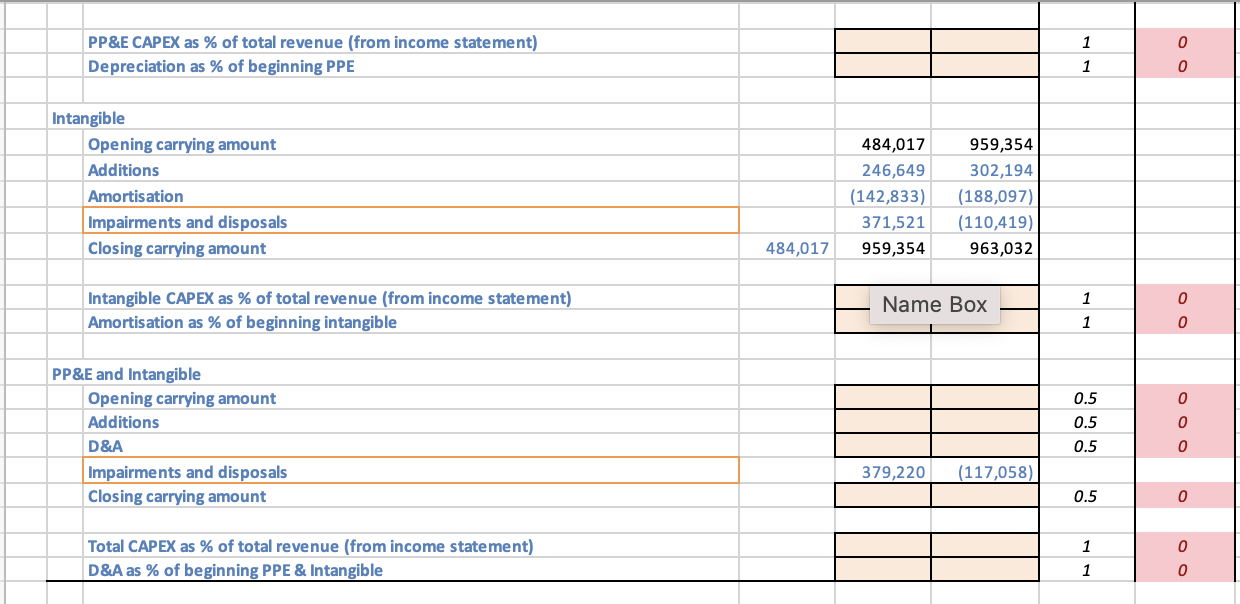

Finance 351 practice excel questions: trying to solve for EBIT (cleaned), Revenue growth for countries, Net Debt, OWC, PP&E CAPEX as % of total revenue

Finance 351 practice excel questions: trying to solve for EBIT (cleaned), Revenue growth for countries, Net Debt, OWC, PP&E CAPEX as % of total revenue (from income statement), Depreciation as % of beginning PPE, Intangible CAPEX as % of total revenue (from income statement), Amortisation as % of beginning intangible and PP&E and Intangible. All the highlighted orange parts.

Assume that today is June 30,2023 . As an intern for a brokerage firm, you are keen to demonstrate the skills you have learned from your finance courses and prove that you are a valuable team member to have on a permanent basis. Your first assignment is to analyse the stock of Xero Limited. Your boss recommends determining the value of stock based on the discounted free cash 221,2022 and 2023 and npty boxes. Please follow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started