Answered step by step

Verified Expert Solution

Question

1 Approved Answer

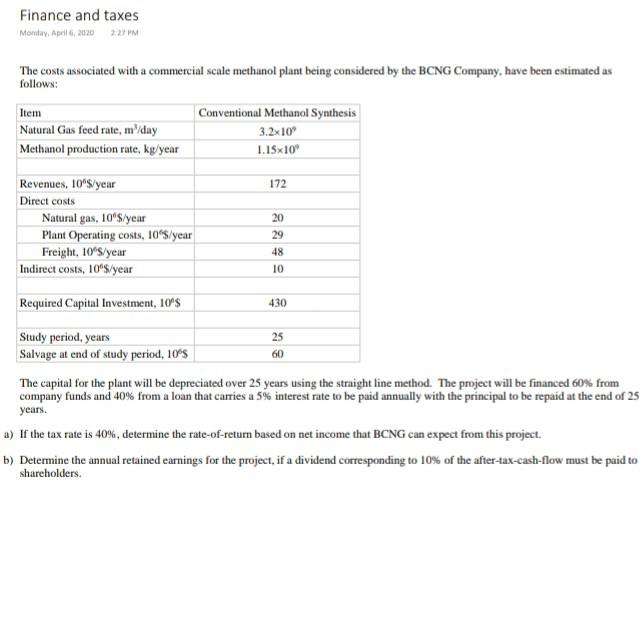

Finance and taxes Monday, April, 2020 2:27 PM The costs associated with a commercial scale methanol plant being considered by the BCNG Company, have been

Finance and taxes Monday, April, 2020 2:27 PM The costs associated with a commercial scale methanol plant being considered by the BCNG Company, have been estimated as follows: Item Conventional Methanol Synthesis Natural Gas feed rate, m/day 3.2x10 Methanol production rate, kg/year 1.15x10 172 Revenues, 10's/year Direct costs Natural gas, 10's/year Plant Operating costs, 10 s/year Freight, 10's/year Indirect costs, 10's/year 20 29 48 10 Required Capital Investment, 10^$ 430 Study period, years 25 Salvage at end of study period, 10's 60 The capital for the plant will be depreciated over 25 years using the straight line method. The project will be financed 60% from company funds and 40% from a loan that carries a 5% interest rate to be paid annually with the principal to be repaid at the end of 25 years. a) If the tax rate is 40%, determine the rate-of-return based on net income that BCNG can expect from this project. b) Determine the annual retained earnings for the project, if a dividend corresponding to 10% of the after-tax-cash-flow must be paid to shareholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started