Answered step by step

Verified Expert Solution

Question

1 Approved Answer

finance / business analytics pls answer fast thanks 2 3 4 56789012 11 12 13 14 15 456 16 A 17 18 B 10 Additionally,

finance / business analytics

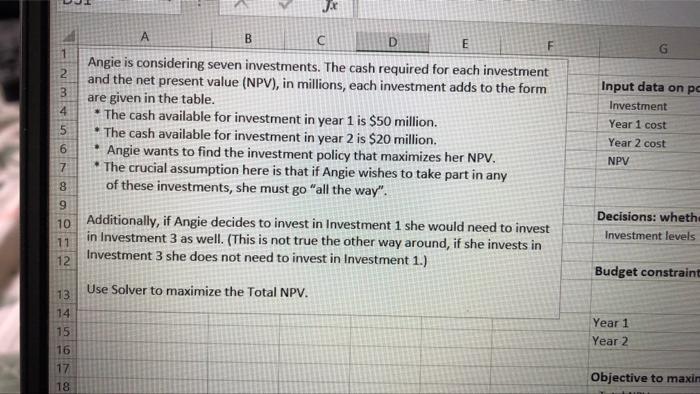

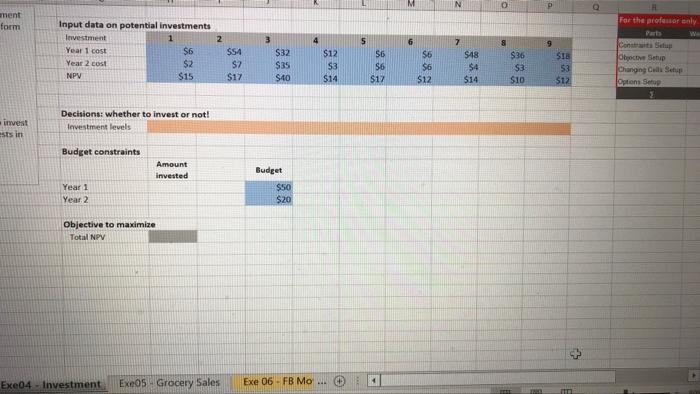

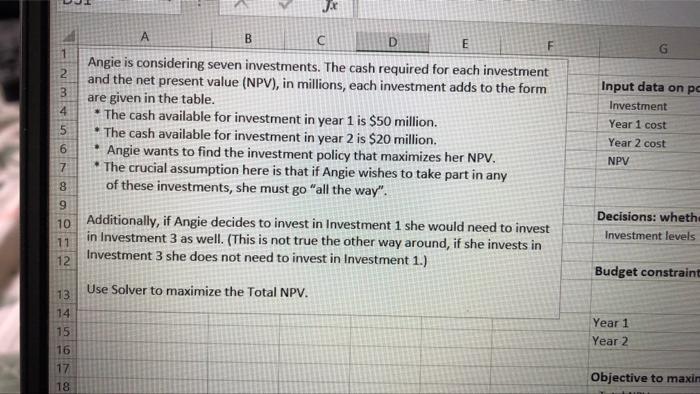

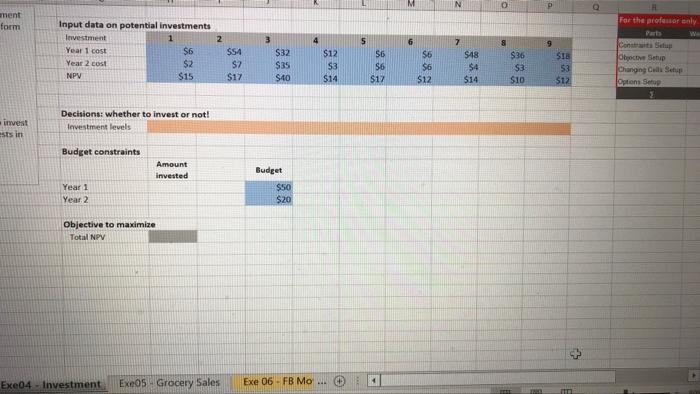

2 3 4 56789012 11 12 13 14 15 456 16 A 17 18 B 10 Additionally, if Angie decides to invest in Investment 1 she would need to invest in Investment 3 as well. (This is not true the other way around, if she invests in Investment 3 she does not need to invest in Investment 1.) Use Solver to maximize the Total NPV. Jx D E Angie is considering seven investments. The cash required for each investment and the net present value (NPV), in millions, each investment adds to the form are given in the table. *The cash available for investment in year 1 is $50 million. *The cash available for investment in year 2 is $20 million. *Angie wants to find the investment policy that maximizes her NPV. *The crucial assumption here is that if Angie wishes to take part in any of these investments, she must go "all the way". F G Input data on pc Investment Year 1 cost Year 2 cost NPV Decisions: wheth Investment levels Budget constraint Year 1 Year 2 Objective to maxin ment form invest ests in Input data on potential investments Investment Year 1 cost Year 2 cost NPV Budget constraints Decisions: whether to invest or not! Investment levels Year 1 Year 2 Objective to maximize Total NPV 1 Exe04 Investment $6 $2 $15 Amount invested 2 $54 $7 $17 $32 $35 $40 Budget $50 $20 4 $12 $3 $14 Exe05- Grocery Sales Exe 06-FB Mo... 5 56 $6 $17 E. $6 $6 $12 7 $48 $4 $14 0 8 $36 $3 $10 1900 a 9 $18 53 $12 m Q For the professor only. Parts We Constrats Setup Objective Setup Changing Cells Setup Options Setup 2 pls answer fast thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started