Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FINANCE can you please solve for Ban Company? (3rd and 4th questions) J. The Palm Company bond, which currently sells for $1,100, has a 8%

FINANCE

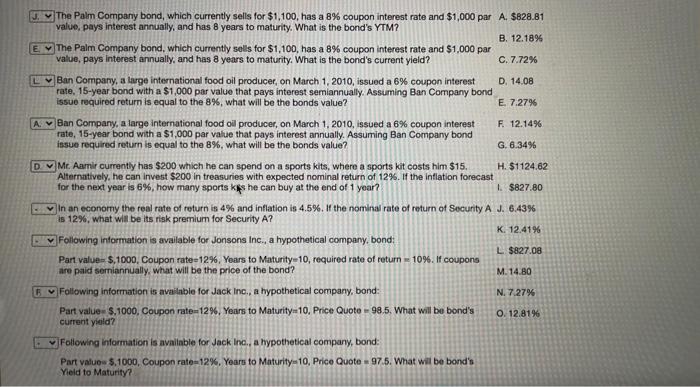

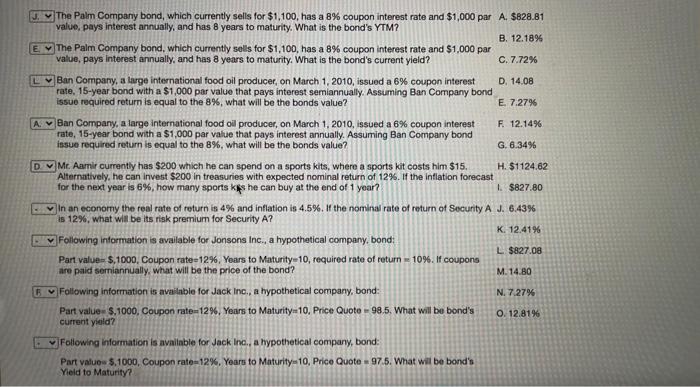

J. The Palm Company bond, which currently sells for $1,100, has a 8% coupon interest rate and $1,000 par A. $828.81 value, pays interest annually, and has 8 years to maturity. What is the bond's YTM? B. 12.18% E The Palm Company bond, which currently sells for $1,100, has a 8% coupon interest rate and $1,000 par value, pays Interest annually, and has 8 years to maturity. What is the band's current yield? C. 7.72% L v Ban Company, a large international food oil producer, on March 1, 2010, issued a 6% coupon interest D. 14.08 rate, 15-year bond with a $1,000 par value that pays interest semiannually. Assuming Ban Company bond issue required return is equal to the 8%, what will be the bonds value? E. 7.27% A. V Ban Company, a large international food oil producer, on March 1, 2010, issued a 6% coupon interest F. 12.1496 rate, 15-year bond with a $1,000 par value that pays interest annually. Assuming Ban Company bond issue required return is equal to the 8%, what will be the bonds value? G. 6.34% D Mr. Aamir currently has $200 which he can spend on a sports kits, where a sports kit costs him $15. H. $1124.62 Alternatively, he can invest $200 in treasures with expected nominal return of 12%. If the inflation forecast for the next year is 6%, how many sports she can buy at the end of 1 year? $827.80 - In an economy the real rate of return is 4% and inflation is 4.5%. If the nominal rate of return of Security A J. 6.43% is 12%, what will be its risk premium for Security A? K. 12.41% Following information is available for Jonsons Inc., a hypothetical company, bond: L $827.08 Part value- $,1000, Coupon rate=12%, Years to Maturity-10, required rate of return -10%. If coupons are paid semiannually, what will be the price of the bond? M. 14.80 Following information is available for Jack Inc., a hypothetical company, bond: N. 727% Part value - 5.1000, Coupon rate=12%. Years to Maturity=10. Price Quote - 98.5. What will be bond's 0. 12.8196 current yield? Following information is available for Jack Inc., a hypothetical company, bond: Part Value $.1000, Coupon rate=12%. Years to Maturity=10, Price Quote - 97.5. What wil be bond's Yield to Maturity can you please solve for Ban Company? (3rd and 4th questions)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started