Answered step by step

Verified Expert Solution

Question

1 Approved Answer

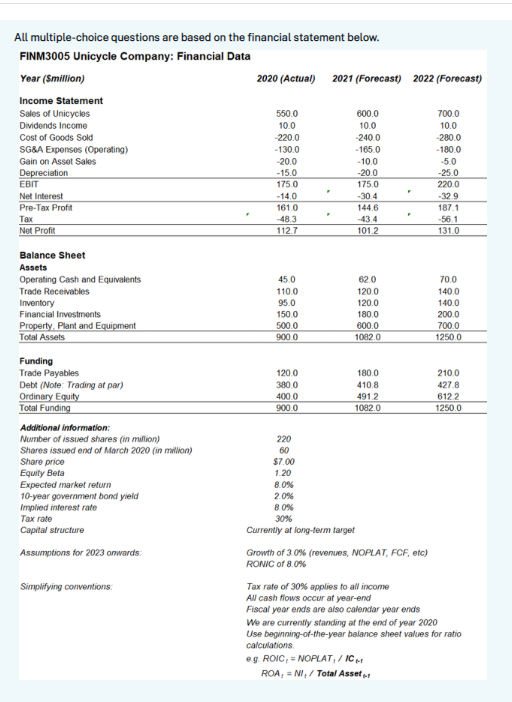

Finance Corporate Valuation Need Answers Thx. All multiple-choice questions are based on the financial statement below. FINM3005 Unicycle Company: Financial Data Year (Smillion) 2020 (Actual)

Finance Corporate Valuation Need Answers Thx.

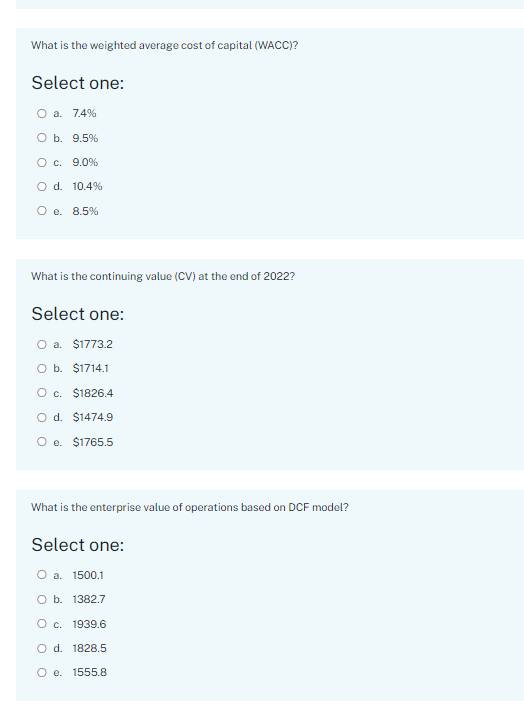

All multiple-choice questions are based on the financial statement below. FINM3005 Unicycle Company: Financial Data Year (Smillion) 2020 (Actual) 2021 (Forecast) 2022 (Forecast) Income Statement Sales of Unicycles 550.0 600.0 700.0 Dividends Income 10.0 10.0 10.0 Cost of Goods Sold 220.0 -240.0 -280.0 SG&A Expenses (Operating) -130.0 - 1650 -180.0 Gain on Asset Sales 20.0 - 10.0 -5.0 Depreciation -15.0 -20.0 -250 EBIT 1750 175.0 220.0 Net Interest -140 -30.4 -329 Pre-Tax Profit 161.0 144.6 1871 Tax -483 -43.4 -56.1 Net Profit 112.7 101.2 131.0 F Balance Sheet Assets Operating Cash and Equivalents Trade Receivables Inventory Financial Investments Property. Plant and Equipment Total Assets 450 1100 95.0 1500 5000 9000 620 120.0 120.0 180.0 600.0 10820 70.0 140.0 140.0 200.0 700.0 1250 0 1200 3800 4000 900.0 180 0 410.8 491.2 10820 2100 427 8 6122 12500 Funding Trade Payables Debt (Note: Trading at par) Ordinary Equity Total Funding Additional Information: Number of issued shares (in million) Shares issued end of March 2020 (in Million) Share price Equity Beta Expected market return 10-year government bond yield Implied interest rate Tax rate Capital structure Assumptions for 2023 onwards 220 60 $7.00 1.20 8.0% 20% 8.0% 30% Currently at long-term target Growth of 3.0% (revenues, NOPLAT, FCF, etc.) RONIC of 8.0% Simplifying conventions Tax rate of 30% applies to all income All cash flows occur at year-end Fiscal year ends are also calendar year ends We are currently standing at the end of year 2020 Use beginning-of-the-year balance sheet values for ratio calculations eg. ROIC, NOPLAT/IC ROA, NI,/ Total Assef What is the weighted average cost of capital (WACC)? Select one: O a. 7.4% O b. 9.5% O c. 9.0% O d. 10.4% O e. 8.5% What is the continuing value (CV) at the end of 2022? Select one: O a. $1773.2 O b. $1714.1 O c. $1826.4 O d. $1474.9 O e. $1765.5 What is the enterprise value of operations based on DCF model? Select one: O a. 1500.1 O b. 1382.7 O c. 1939.6 O d. 1828.5 O e. 1555.8 All multiple-choice questions are based on the financial statement below. FINM3005 Unicycle Company: Financial Data Year (Smillion) 2020 (Actual) 2021 (Forecast) 2022 (Forecast) Income Statement Sales of Unicycles 550.0 600.0 700.0 Dividends Income 10.0 10.0 10.0 Cost of Goods Sold 220.0 -240.0 -280.0 SG&A Expenses (Operating) -130.0 - 1650 -180.0 Gain on Asset Sales 20.0 - 10.0 -5.0 Depreciation -15.0 -20.0 -250 EBIT 1750 175.0 220.0 Net Interest -140 -30.4 -329 Pre-Tax Profit 161.0 144.6 1871 Tax -483 -43.4 -56.1 Net Profit 112.7 101.2 131.0 F Balance Sheet Assets Operating Cash and Equivalents Trade Receivables Inventory Financial Investments Property. Plant and Equipment Total Assets 450 1100 95.0 1500 5000 9000 620 120.0 120.0 180.0 600.0 10820 70.0 140.0 140.0 200.0 700.0 1250 0 1200 3800 4000 900.0 180 0 410.8 491.2 10820 2100 427 8 6122 12500 Funding Trade Payables Debt (Note: Trading at par) Ordinary Equity Total Funding Additional Information: Number of issued shares (in million) Shares issued end of March 2020 (in Million) Share price Equity Beta Expected market return 10-year government bond yield Implied interest rate Tax rate Capital structure Assumptions for 2023 onwards 220 60 $7.00 1.20 8.0% 20% 8.0% 30% Currently at long-term target Growth of 3.0% (revenues, NOPLAT, FCF, etc.) RONIC of 8.0% Simplifying conventions Tax rate of 30% applies to all income All cash flows occur at year-end Fiscal year ends are also calendar year ends We are currently standing at the end of year 2020 Use beginning-of-the-year balance sheet values for ratio calculations eg. ROIC, NOPLAT/IC ROA, NI,/ Total Assef What is the weighted average cost of capital (WACC)? Select one: O a. 7.4% O b. 9.5% O c. 9.0% O d. 10.4% O e. 8.5% What is the continuing value (CV) at the end of 2022? Select one: O a. $1773.2 O b. $1714.1 O c. $1826.4 O d. $1474.9 O e. $1765.5 What is the enterprise value of operations based on DCF model? Select one: O a. 1500.1 O b. 1382.7 O c. 1939.6 O d. 1828.5 O e. 1555.8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started