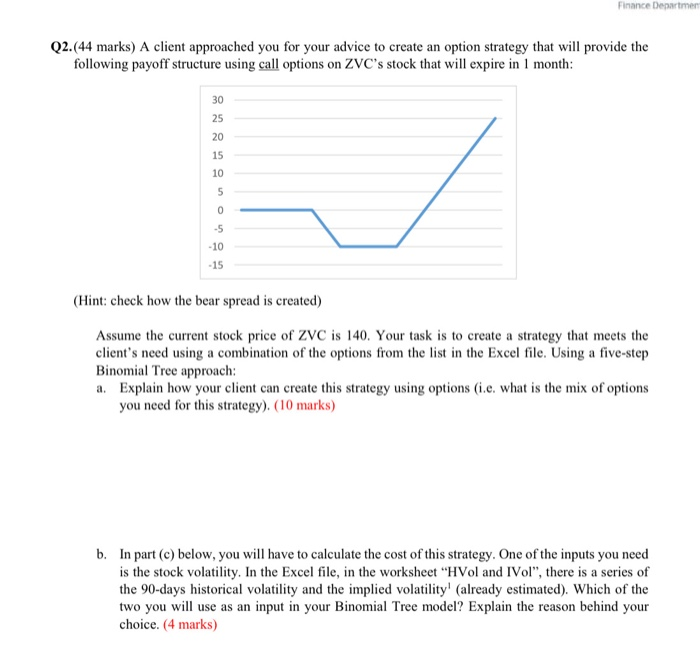

Finance Departmen Q2.(44 marks) A client approached you for your advice to create an option strategy that will provide the following payoff structure using call options on ZVC's stock that will expire in 1 month: (Hint: check how the bear spread is created) Assume the current stock price of ZVC is 140. Your task is to create a strategy that meets the client's need using a combination of the options from the list in the Excel file. Using a five-step Binomial Tree approach: a. Explain how your client can create this strategy using options (ie. what is the mix of options you need for this strategy). (10 marks) b. In part (c) below, you will have to calculate the cost of this strategy. One of the inputs you need is the stock volatility. In the Excel file, in the worksheet "HVol and IVol", there is a series of the 90-days historical volatility and the implied volatility' (already estimated). Which of the two you will use as an input in your Binomial Tree model? Explain the reason behind your choice. (4 marks) Finance Deo c. Showing the inputs you used in your calculation, and using the five-step Binomial Tree model, calculate the cost of the strategy you created for your client. (10 marks) d. Compare the prices you calculated with the prices in the Excel file. What do you notice? Explain why there might be a difference. (5 marks) e. Draw the payoff and profit (loss) diagrams of the strategy you created for your client. (5 marks) f. At what price (or prices) of the underlying stock the strategy will breakeven? (5 marks) g. What assumptions did the client make that motives the creation of this strategy? (5 marks) Finance Departmen Q2.(44 marks) A client approached you for your advice to create an option strategy that will provide the following payoff structure using call options on ZVC's stock that will expire in 1 month: (Hint: check how the bear spread is created) Assume the current stock price of ZVC is 140. Your task is to create a strategy that meets the client's need using a combination of the options from the list in the Excel file. Using a five-step Binomial Tree approach: a. Explain how your client can create this strategy using options (ie. what is the mix of options you need for this strategy). (10 marks) b. In part (c) below, you will have to calculate the cost of this strategy. One of the inputs you need is the stock volatility. In the Excel file, in the worksheet "HVol and IVol", there is a series of the 90-days historical volatility and the implied volatility' (already estimated). Which of the two you will use as an input in your Binomial Tree model? Explain the reason behind your choice. (4 marks) Finance Deo c. Showing the inputs you used in your calculation, and using the five-step Binomial Tree model, calculate the cost of the strategy you created for your client. (10 marks) d. Compare the prices you calculated with the prices in the Excel file. What do you notice? Explain why there might be a difference. (5 marks) e. Draw the payoff and profit (loss) diagrams of the strategy you created for your client. (5 marks) f. At what price (or prices) of the underlying stock the strategy will breakeven? (5 marks) g. What assumptions did the client make that motives the creation of this strategy