Answered step by step

Verified Expert Solution

Question

1 Approved Answer

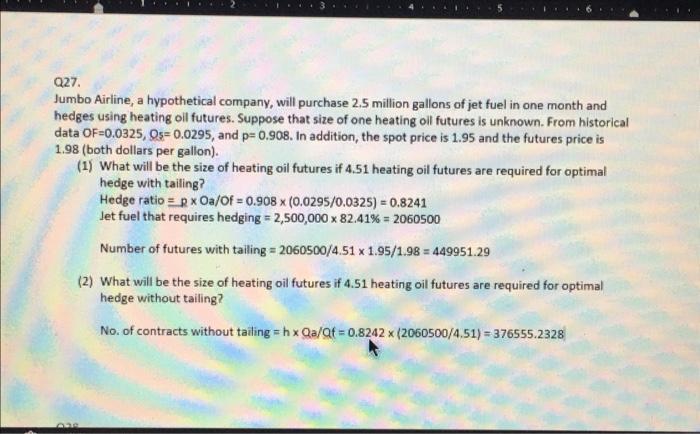

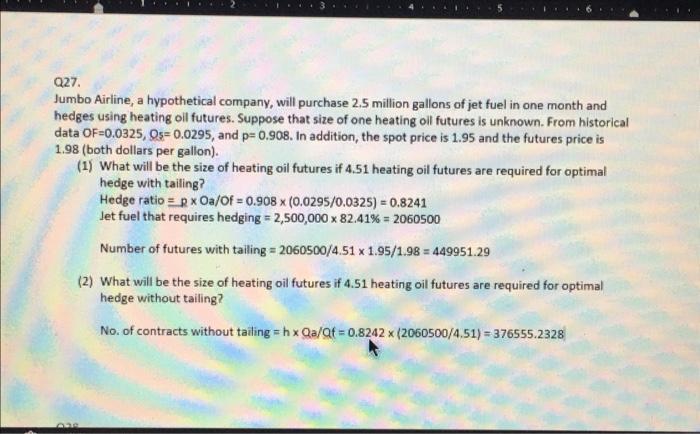

finance derivatives : Please check the answers for question 2 - 5 Q27. Jumbo Airline, a hypothetical company, will purchase 2,5 million gallons of jet

finance derivatives : Please check the answers for question 2

- 5 Q27. Jumbo Airline, a hypothetical company, will purchase 2,5 million gallons of jet fuel in one month and hedges using heating oil futures. Suppose that size of one heating oil futures is unknown. From historical data OF=0.0325, Os=0.0295, and p=0.908. In addition, the spot price is 1.95 and the futures price is 1.98 (both dollars per gallon). (1) What will be the size of heating oil futures if 4.51 heating oil futures are required for optimal hedge with tailing? Hedge ratio = Rx Oa/Of = 0.908 x (0.0295/0.0325) = 0.8241 Jet fuel that requires hedging = 2,500,000 x 82.41% = 2060500 Number of futures with tailing = 2060500/4.51 x 1.95/1.98 = 449951.29 (2) What will be the size of heating oil futures if 4.51 heating oil futures are required for optimal hedge without tailing? No. of contracts without tailing=hx Qa/at=0.8242 x (2060500/4.51) = 376555.2328 AT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started