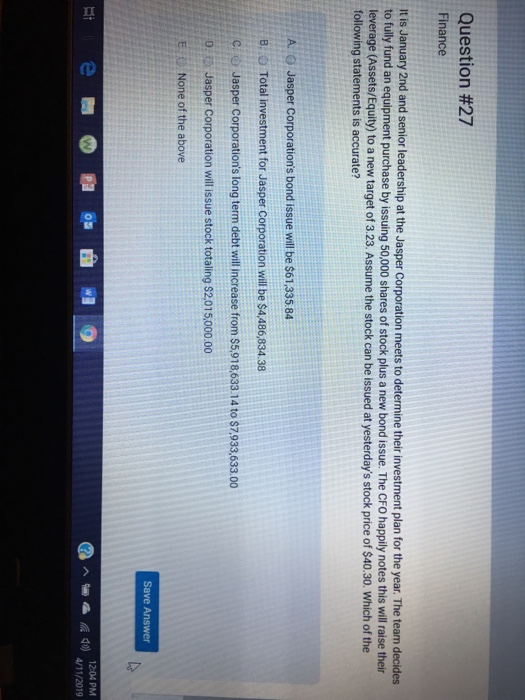

Finance f the J asper Company purchases all of its outstanding shares at the current price, how much would it cost? A. $87,335.58 B O $102,711,040.00 C. o $89,208,080.00 D$100,851,616.00 E. $13,502,960.00 Previous Finance Last year, Jasper's Juice product charged $1,361,069.03 for depreciation on the income statement of Jasper Inc. If earlier this year, a new depreciable asset was purchased for Juice, which of the following effects would occur on Jasper's financial statements (all other items remaining equal)? A. O Net cash from operations would remain the same B. O The fixed asset of plant and equipment would decrease C. O Net cash from operations would increase D. O Net cash from operations would decrease E. O Variable Costs would increase ^dd) 4/11/201 How can someone tell the difference in the quality of different bonds? A. O the investment firms that the bond is purchased through B. O bond rating C. O number of bonds issued by the company D. O price of the bond E. O dollar amount of the bond Previous Question #27 Finance It is January 2nd and senior leadership at the Jasper Corporation meets to determine their investment plan for the year. The team decides to fully fund an equipment purchase by issuing 50,000 shares of stock plus a new bond issue. The CFo happily notes this will raise their leverage (Assets/Equity) to a new target of 3.23. Assume the stock can be issued at yesterday's stock price of $40.30. Which of the following statements is accurate? A. O Jasper Corporation's bond issue will be $61,335.84 B. O Total investment for Jasper Corporation will be $4,486,834.38 C Jasper Corporation's long term debt will increase from $5.918633 14 to $7.933,633.00 D Jasper Corporation will issue stock totaling $2,015,000.00 E None of the above Save Answer 12:04 PM A al4/11/2019 Finance f the J asper Company purchases all of its outstanding shares at the current price, how much would it cost? A. $87,335.58 B O $102,711,040.00 C. o $89,208,080.00 D$100,851,616.00 E. $13,502,960.00 Previous Finance Last year, Jasper's Juice product charged $1,361,069.03 for depreciation on the income statement of Jasper Inc. If earlier this year, a new depreciable asset was purchased for Juice, which of the following effects would occur on Jasper's financial statements (all other items remaining equal)? A. O Net cash from operations would remain the same B. O The fixed asset of plant and equipment would decrease C. O Net cash from operations would increase D. O Net cash from operations would decrease E. O Variable Costs would increase ^dd) 4/11/201 How can someone tell the difference in the quality of different bonds? A. O the investment firms that the bond is purchased through B. O bond rating C. O number of bonds issued by the company D. O price of the bond E. O dollar amount of the bond Previous Question #27 Finance It is January 2nd and senior leadership at the Jasper Corporation meets to determine their investment plan for the year. The team decides to fully fund an equipment purchase by issuing 50,000 shares of stock plus a new bond issue. The CFo happily notes this will raise their leverage (Assets/Equity) to a new target of 3.23. Assume the stock can be issued at yesterday's stock price of $40.30. Which of the following statements is accurate? A. O Jasper Corporation's bond issue will be $61,335.84 B. O Total investment for Jasper Corporation will be $4,486,834.38 C Jasper Corporation's long term debt will increase from $5.918633 14 to $7.933,633.00 D Jasper Corporation will issue stock totaling $2,015,000.00 E None of the above Save Answer 12:04 PM A al4/11/2019