Answered step by step

Verified Expert Solution

Question

1 Approved Answer

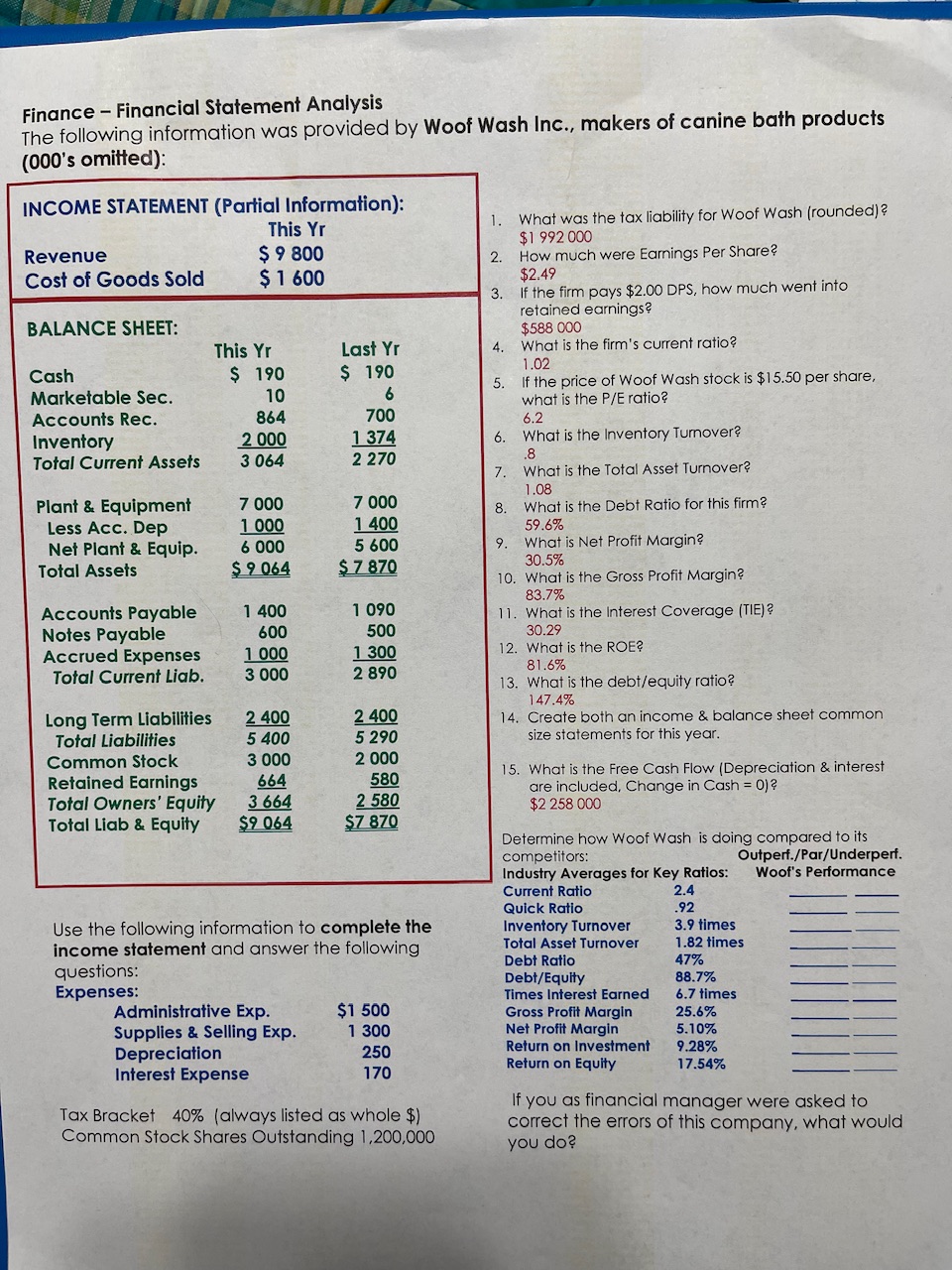

Finance - Financial Statement Analysis The following information was provided by Woof Wash Inc., makers of canine bath products (000's omitted): 1. What was the

Finance - Financial Statement Analysis The following information was provided by Woof Wash Inc., makers of canine bath products (000's omitted): 1. What was the tax liability for Woof Wash (rounded)? $1992000 2. How much were Earnings Per Share? $2.49 3. If the firm pays $2.00DPS, how much went into retained earnings? $588000 4. What is the firm's current ratio? 1.02 5. If the price of Woof Wash stock is $15.50 per share, what is the P/E ratio? 6.2 6. What is the Inventory Turnover? 8 7. What is the Total Asset Turnover? 1.08 8. What is the Debt Ratio for this firm? 59.6% 9. What is Net Profit Margin? 30.5% 10. What is the Gross Profit Margin? 83.7% 11. What is the Interest Coverage (TIE)? 30.29 12. What is the ROE? 81.6% 13. What is the debt/equity ratio? 147.4% 14. Create both an income \& balance sheet common size statements for this year. 15. What is the Free Cash Flow (Depreciation \& interest are included, Change in Cash =0 )? $2258000 Determine how Woof Wash is doing compared to its competitors: Outperf./Par/Underperf. Use the following information to complete the income statement and answer the following questions: Expereac. Tax Bracket 40\% (always listed as whole \$) Common Stock Shares Outstanding 1,200,000 If you as financial manager were asked to correct the errors of this company, what would you do

Finance - Financial Statement Analysis The following information was provided by Woof Wash Inc., makers of canine bath products (000's omitted): 1. What was the tax liability for Woof Wash (rounded)? $1992000 2. How much were Earnings Per Share? $2.49 3. If the firm pays $2.00DPS, how much went into retained earnings? $588000 4. What is the firm's current ratio? 1.02 5. If the price of Woof Wash stock is $15.50 per share, what is the P/E ratio? 6.2 6. What is the Inventory Turnover? 8 7. What is the Total Asset Turnover? 1.08 8. What is the Debt Ratio for this firm? 59.6% 9. What is Net Profit Margin? 30.5% 10. What is the Gross Profit Margin? 83.7% 11. What is the Interest Coverage (TIE)? 30.29 12. What is the ROE? 81.6% 13. What is the debt/equity ratio? 147.4% 14. Create both an income \& balance sheet common size statements for this year. 15. What is the Free Cash Flow (Depreciation \& interest are included, Change in Cash =0 )? $2258000 Determine how Woof Wash is doing compared to its competitors: Outperf./Par/Underperf. Use the following information to complete the income statement and answer the following questions: Expereac. Tax Bracket 40\% (always listed as whole \$) Common Stock Shares Outstanding 1,200,000 If you as financial manager were asked to correct the errors of this company, what would you do Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started