Question

Finance homework help: Perform a financial analysis for a project using the format provided in Figure 4-5 in chapter 4. Assume that the projected costs

Finance homework help:

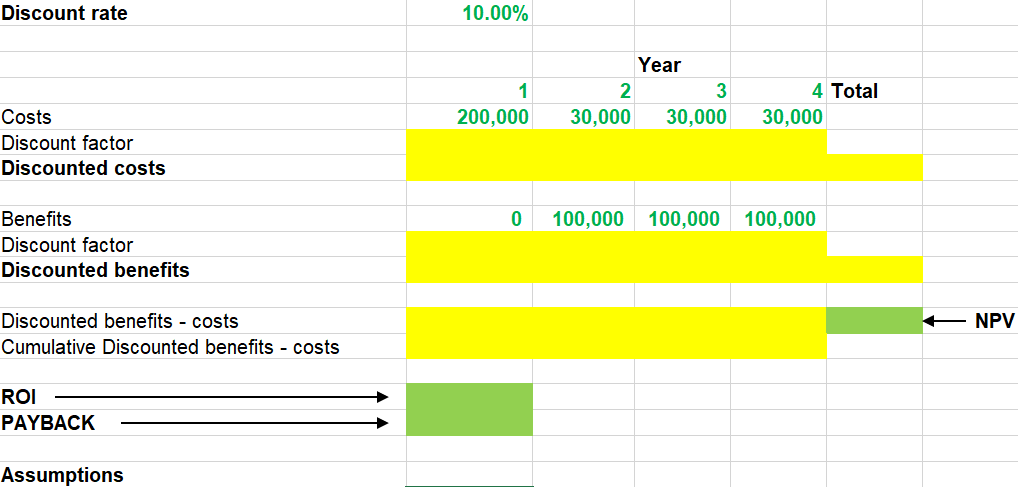

Perform a financial analysis for a project using the format provided in Figure 4-5 in chapter 4. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $250,000 in Year 1 and $35,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $150,000 each year in Years 2, 3, and 4. Use a 10 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the companion website to calculate and clearly display the NPV, ROI, and year in which payback occurs. In addition, write a paragraph explaining whether you would recommend investing in this project

Discount rate 10.00% 1 200,000 Year 2 3 30,000 30,000 4 Total 30,000 Costs Discount factor Discounted costs 0 100,000 100,000 100,000 Benefits Discount factor Discounted benefits NPV Discounted benefits - costs Cumulative Discounted benefits - costs ROI PAYBACK Assumptions Discount rate 10.00% 1 200,000 Year 2 3 30,000 30,000 4 Total 30,000 Costs Discount factor Discounted costs 0 100,000 100,000 100,000 Benefits Discount factor Discounted benefits NPV Discounted benefits - costs Cumulative Discounted benefits - costs ROI PAYBACK AssumptionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started