Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance homework. This was all the info given and i dont know where to start! please help me solve An oil-drilling company must choose between

Finance homework. This was all the info given and i dont know where to start! please help me solve

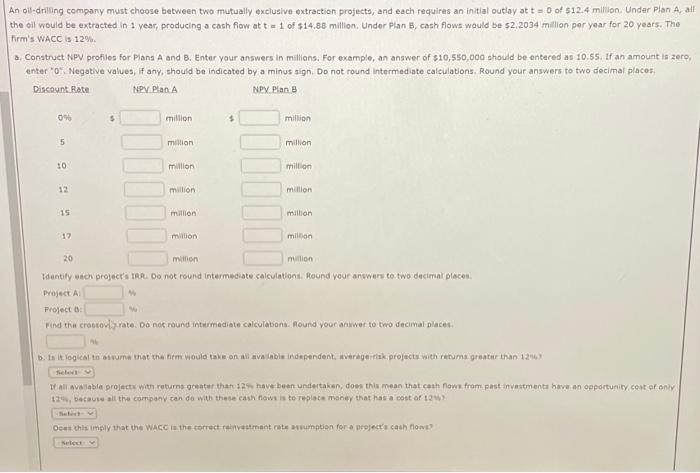

An oil-drilling company must choose between two mutually exclusive extraction projects, and each requires an initial outiay at t=0 of $12.4 million. Under Plan A, alf the oil wiould be extracted in 1 year, producing a cash fiow at t=1 of $14,88 million. Under Plan B, cash flows would be $2,2034 million per year for 20 years. The firm's WACC is 120 . a. Construct NPV profiles for Plans A and 8. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. If an amount is 2ero, enter "0-, Negatlve values, If any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to two decimal places. Uentify eech project's thr. Do not round intermediate calculations. Round your anwers te two decimal places. Frolect B : Find tha crostorly rate. Do not round intermediate calculabana. Gound your anwwer to two decimal placel. the, becaule all the company can do with these cash fow is to rwpiace maney that has a cost af 12 wi Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started