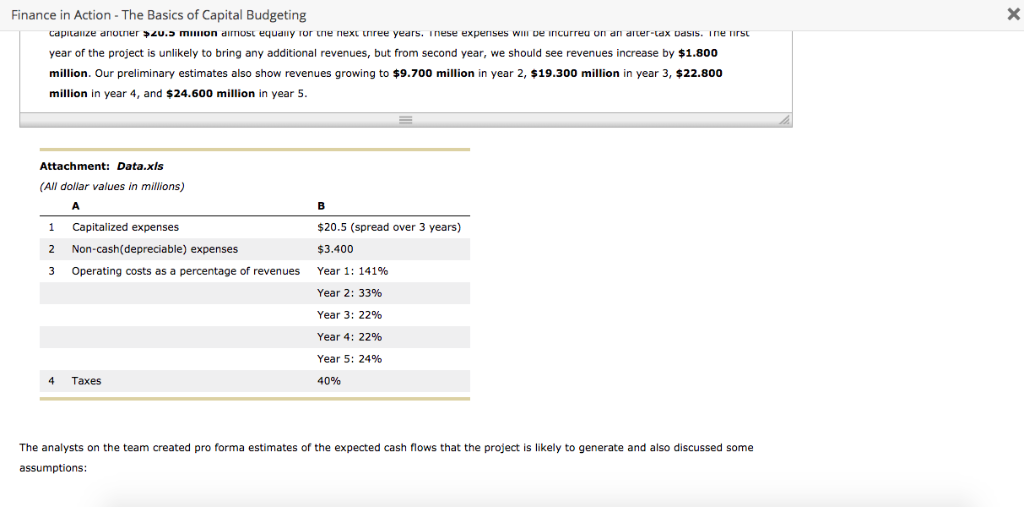

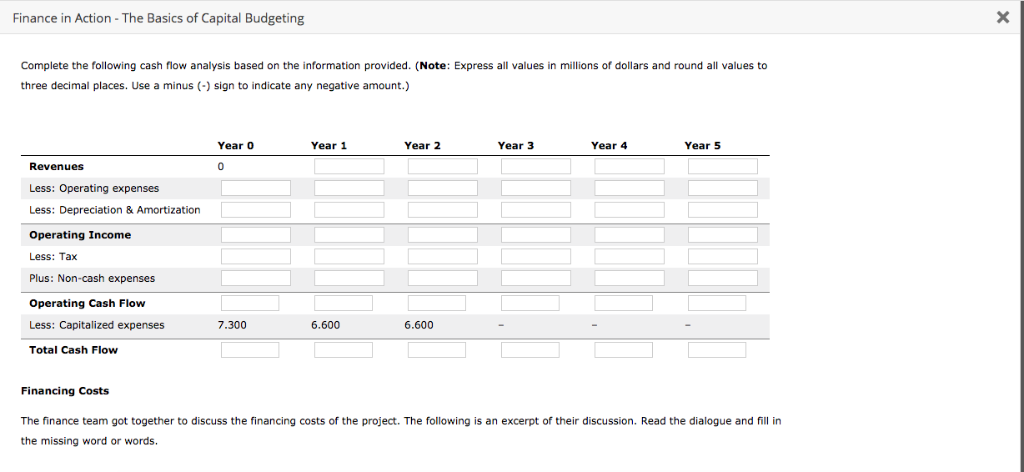

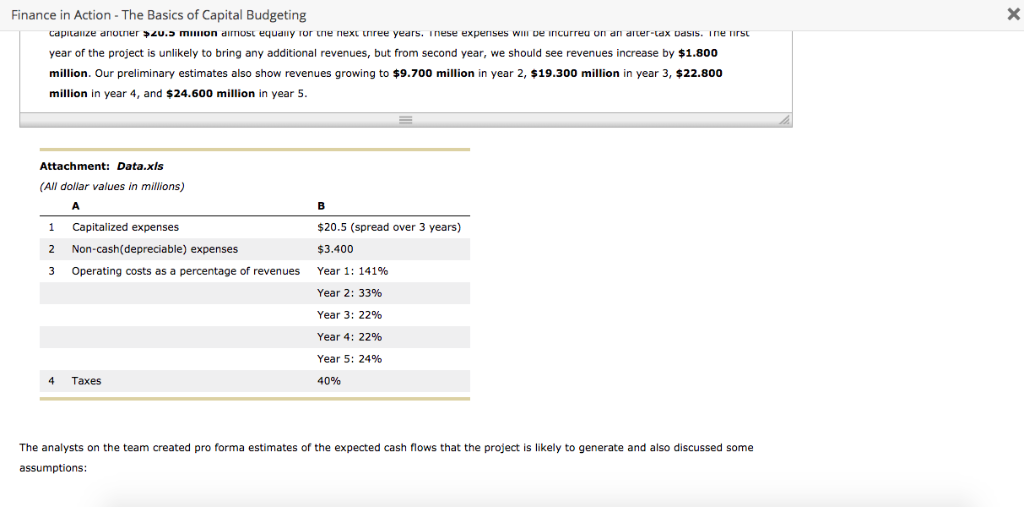

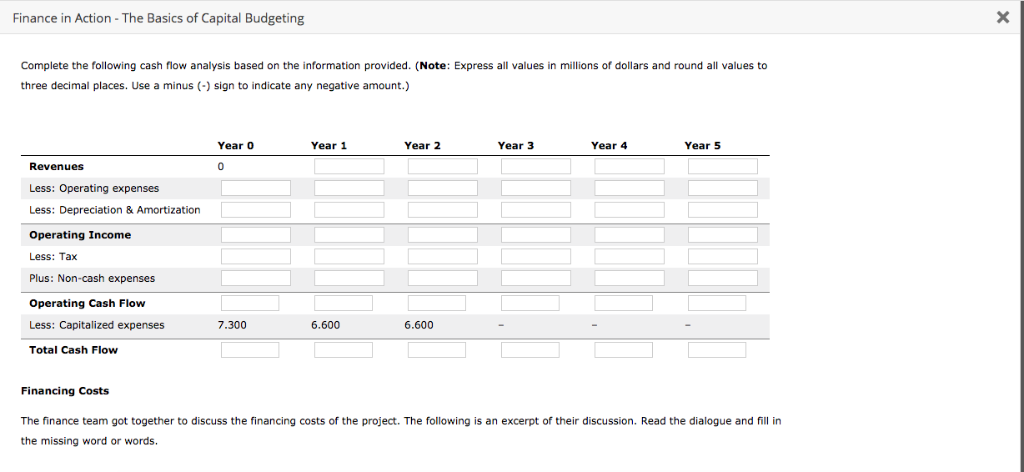

Finance in Action-The Basics of Capital Budgeting year of the project is unlikely to bring any additional revenues, but from second year, we should see revenues increase by $1.800 million. Our preliminary estimates also show revenues growing to $9.700 million in year 2, $19.300 million in year 3, $22.800 million in year 4, and $24.600 million in year 5 Attachment: Data.xls (All dollar values in millions) 1 Capitalized expenses 2 Non-cash(depreciable) expenses 3 Operating costs as a percentage of revenues $20.5 (spread over 3 years) $3.400 Year 1: 141% Year 2: 33% Year 3: 22% Year 4: 22% Year 5: 24% 40% 4 Taxes The analysts on the team created pro forma estimates of the expected cash flows that the project is likely to generate and also discussed some assumptions: Finance in Action-The Basics of Capital Budgeting Complete the following cash flow analysis based on the information provided. (Note: Express all values in millions of dollars and round all values to three decimal places. Use a minus (sign to indicate any negative amount.) Year o Year 1 Year 2 Year 3 Year 4 Year 5 53 Less: Operating expenses Less: Depreciation & Amortization Operating Income Less: Tax Plus: Non-cash expenses Operating Cash Flow Less: Capitalized expenses Total Cash Flow 6.600 6.600 Financing Costs The finance team got together to discuss the financing costs of the project. The following is an excerpt of their discussion. Read the dialogue and fill in the missing word or words. Finance in Action-The Basics of Capital Budgeting year of the project is unlikely to bring any additional revenues, but from second year, we should see revenues increase by $1.800 million. Our preliminary estimates also show revenues growing to $9.700 million in year 2, $19.300 million in year 3, $22.800 million in year 4, and $24.600 million in year 5 Attachment: Data.xls (All dollar values in millions) 1 Capitalized expenses 2 Non-cash(depreciable) expenses 3 Operating costs as a percentage of revenues $20.5 (spread over 3 years) $3.400 Year 1: 141% Year 2: 33% Year 3: 22% Year 4: 22% Year 5: 24% 40% 4 Taxes The analysts on the team created pro forma estimates of the expected cash flows that the project is likely to generate and also discussed some assumptions: Finance in Action-The Basics of Capital Budgeting Complete the following cash flow analysis based on the information provided. (Note: Express all values in millions of dollars and round all values to three decimal places. Use a minus (sign to indicate any negative amount.) Year o Year 1 Year 2 Year 3 Year 4 Year 5 53 Less: Operating expenses Less: Depreciation & Amortization Operating Income Less: Tax Plus: Non-cash expenses Operating Cash Flow Less: Capitalized expenses Total Cash Flow 6.600 6.600 Financing Costs The finance team got together to discuss the financing costs of the project. The following is an excerpt of their discussion. Read the dialogue and fill in the missing word or words