Answered step by step

Verified Expert Solution

Question

1 Approved Answer

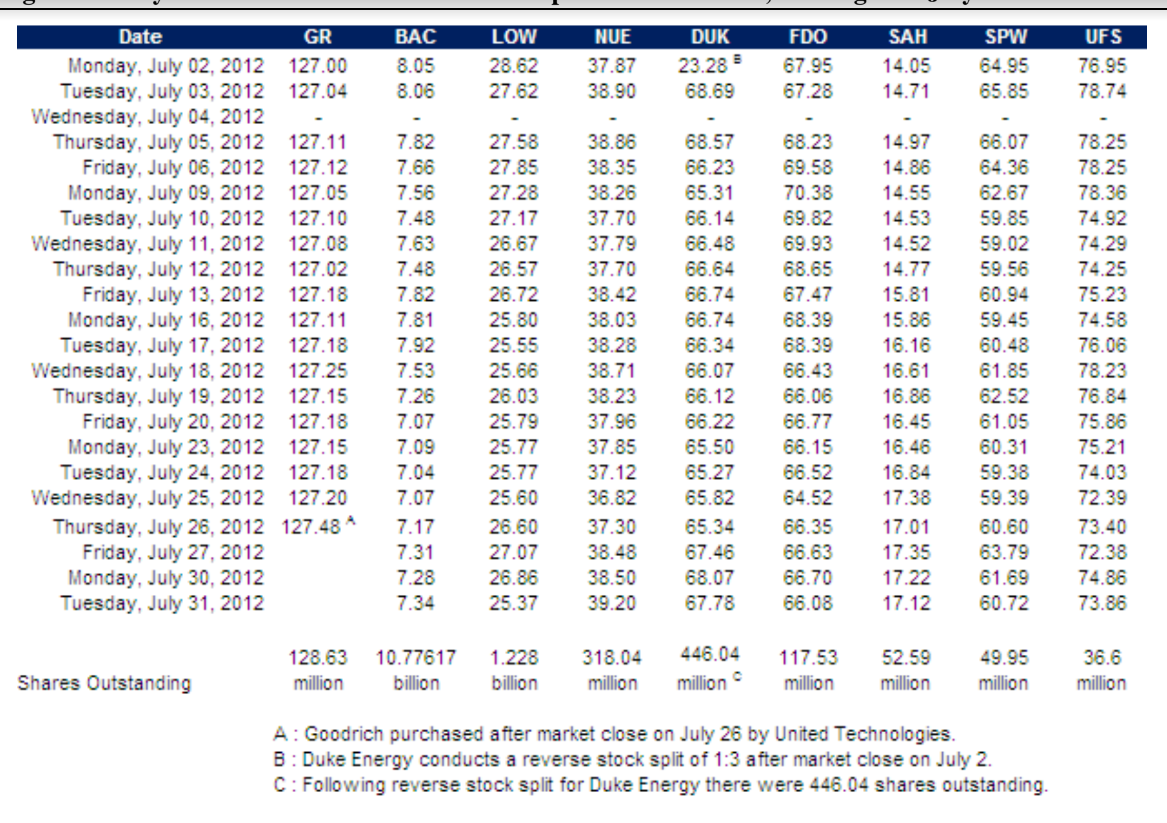

Finance Investment A: Goodrich purchased after market close on July 26 by United Technologies. B : Duke Energy conducts a reverse stock split of 1:3

Finance Investment

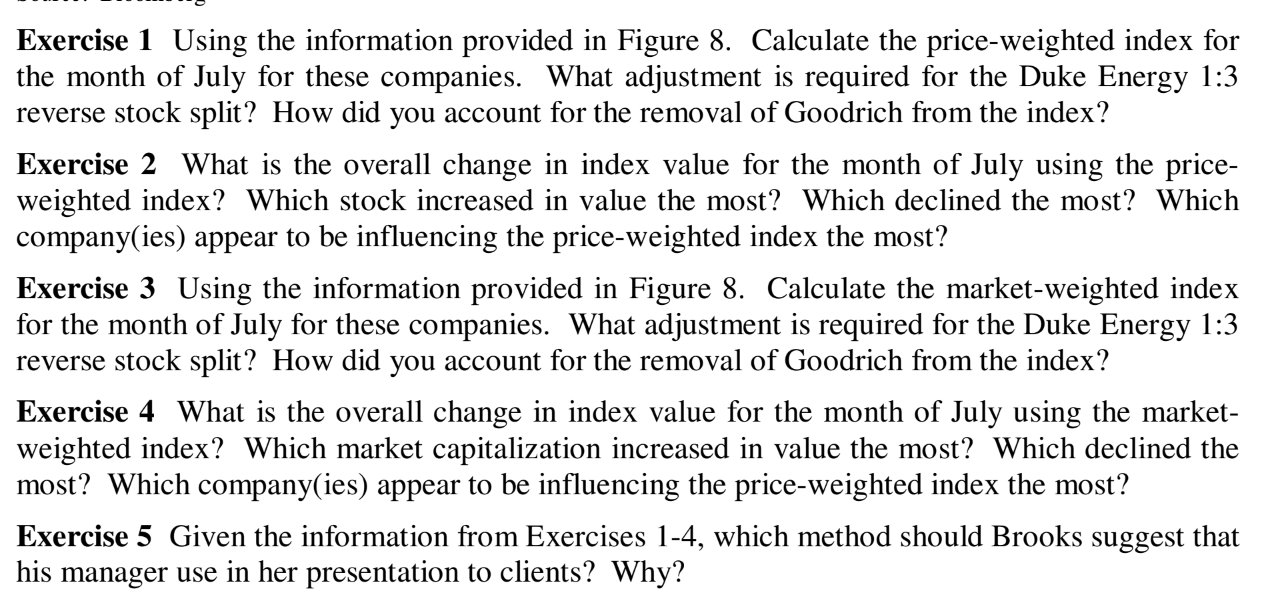

A: Goodrich purchased after market close on July 26 by United Technologies. B : Duke Energy conducts a reverse stock split of 1:3 after market close on July 2. C: Following reverse stock split for Duke Energy there were 446.04 shares outstanding. Exercise 1 Using the information provided in Figure 8. Calculate the price-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 2 What is the overall change in index value for the month of July using the priceweighted index? Which stock increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? Exercise 3 Using the information provided in Figure 8. Calculate the market-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 4 What is the overall change in index value for the month of July using the marketweighted index? Which market capitalization increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? A: Goodrich purchased after market close on July 26 by United Technologies. B : Duke Energy conducts a reverse stock split of 1:3 after market close on July 2. C: Following reverse stock split for Duke Energy there were 446.04 shares outstanding. Exercise 1 Using the information provided in Figure 8. Calculate the price-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 2 What is the overall change in index value for the month of July using the priceweighted index? Which stock increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the most? Exercise 3 Using the information provided in Figure 8. Calculate the market-weighted index for the month of July for these companies. What adjustment is required for the Duke Energy 1:3 reverse stock split? How did you account for the removal of Goodrich from the index? Exercise 4 What is the overall change in index value for the month of July using the marketweighted index? Which market capitalization increased in value the most? Which declined the most? Which company(ies) appear to be influencing the price-weighted index the mostStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started