Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Investments Need full answers Thanks. Question 1 (22 Marks) a) Consider the following statement: International Systems Ltd released its annual earnings figure five days

Finance Investments Need full answers Thanks.

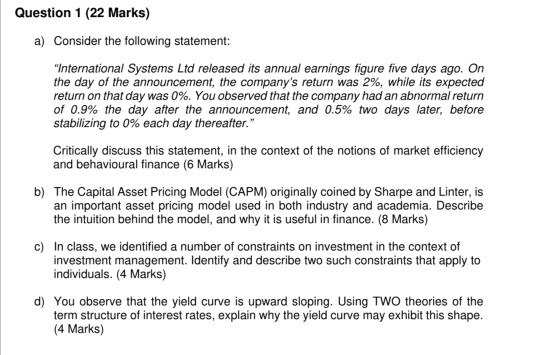

Question 1 (22 Marks) a) Consider the following statement: "International Systems Ltd released its annual earnings figure five days ago. On the day of the announcement, the company's return was 2%, while its expected return on that day was 0%. You observed that the company had an abnormal return of 0.9% the day after the announcement, and 0.5% two days later, before stabilizing to 0% each day thereafter." Critically discuss this statement, in the context of the notions of market efficiency and behavioural finance 6 Marks) b) The Capital Asset Pricing Model (CAPM) originally coined by Sharpe and Linter, is an important asset pricing model used in both industry and academia. Describe the intuition behind the model, and why it is useful in finance. (8 Marks) c) In class, we identified a number of constraints on investment in the context of investment management. Identify and describe two such constraints that apply to individuals. (4 Marks) d) You observe that the yield curve is upward sloping. Using TWO theories of the term structure of interest rates, explain why the yield curve may exhibit this shape. (4 Marks) Question 1 (22 Marks) a) Consider the following statement: "International Systems Ltd released its annual earnings figure five days ago. On the day of the announcement, the company's return was 2%, while its expected return on that day was 0%. You observed that the company had an abnormal return of 0.9% the day after the announcement, and 0.5% two days later, before stabilizing to 0% each day thereafter." Critically discuss this statement, in the context of the notions of market efficiency and behavioural finance 6 Marks) b) The Capital Asset Pricing Model (CAPM) originally coined by Sharpe and Linter, is an important asset pricing model used in both industry and academia. Describe the intuition behind the model, and why it is useful in finance. (8 Marks) c) In class, we identified a number of constraints on investment in the context of investment management. Identify and describe two such constraints that apply to individuals. (4 Marks) d) You observe that the yield curve is upward sloping. Using TWO theories of the term structure of interest rates, explain why the yield curve may exhibit this shape. (4 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started