Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Investments Need full answers Thanks. Question 3 (10 Marks) You work for a hedge fund and have created a portfolio worth $3,750,000 which you

Finance Investments Need full answers Thanks.

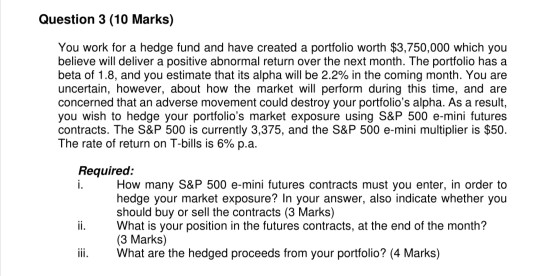

Question 3 (10 Marks) You work for a hedge fund and have created a portfolio worth $3,750,000 which you believe will deliver a positive abnormal return over the next month. The portfolio has a beta of 1.8, and you estimate that its alpha will be 2.2% in the coming month. You are uncertain, however, about how the market will perform during this time, and are concerned that an adverse movement could destroy your portfolio's alpha. As a result, you wish to hedge your portfolio's market exposure using S&P 500 e-mini futures contracts. The S&P 500 is currently 3,375, and the S&P 500 e-mini multiplier is $50. The rate of return on T-bills is 6% p.a. Required: i. How many S&P 500 e-mini futures contracts must you enter, in order to hedge your market exposure? In your answer, also indicate whether you should buy or sell the contracts (3 Marks) What is your position in the futures contracts, at the end of the month? (3 Marks) iii. What are the hedged proceeds from your portfolio? (4 Marks) ii. Question 3 (10 Marks) You work for a hedge fund and have created a portfolio worth $3,750,000 which you believe will deliver a positive abnormal return over the next month. The portfolio has a beta of 1.8, and you estimate that its alpha will be 2.2% in the coming month. You are uncertain, however, about how the market will perform during this time, and are concerned that an adverse movement could destroy your portfolio's alpha. As a result, you wish to hedge your portfolio's market exposure using S&P 500 e-mini futures contracts. The S&P 500 is currently 3,375, and the S&P 500 e-mini multiplier is $50. The rate of return on T-bills is 6% p.a. Required: i. How many S&P 500 e-mini futures contracts must you enter, in order to hedge your market exposure? In your answer, also indicate whether you should buy or sell the contracts (3 Marks) What is your position in the futures contracts, at the end of the month? (3 Marks) iii. What are the hedged proceeds from your portfolio? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started