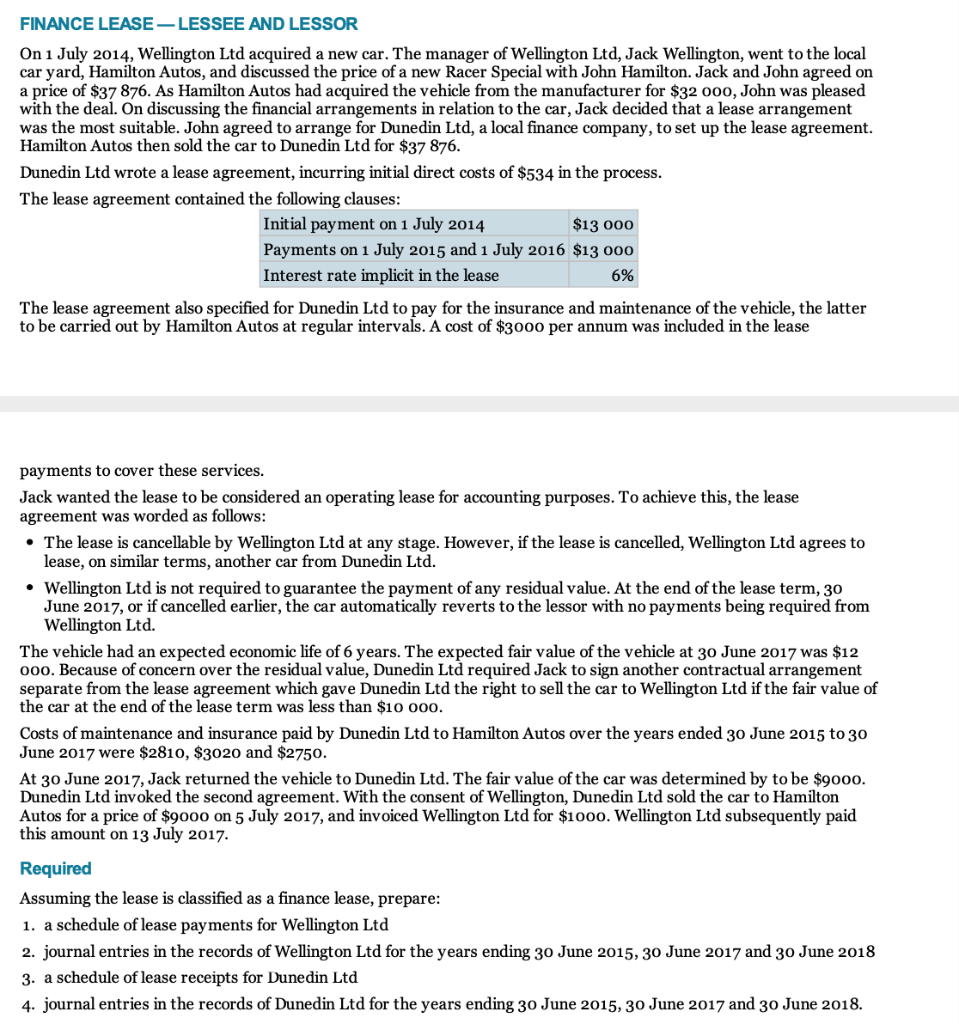

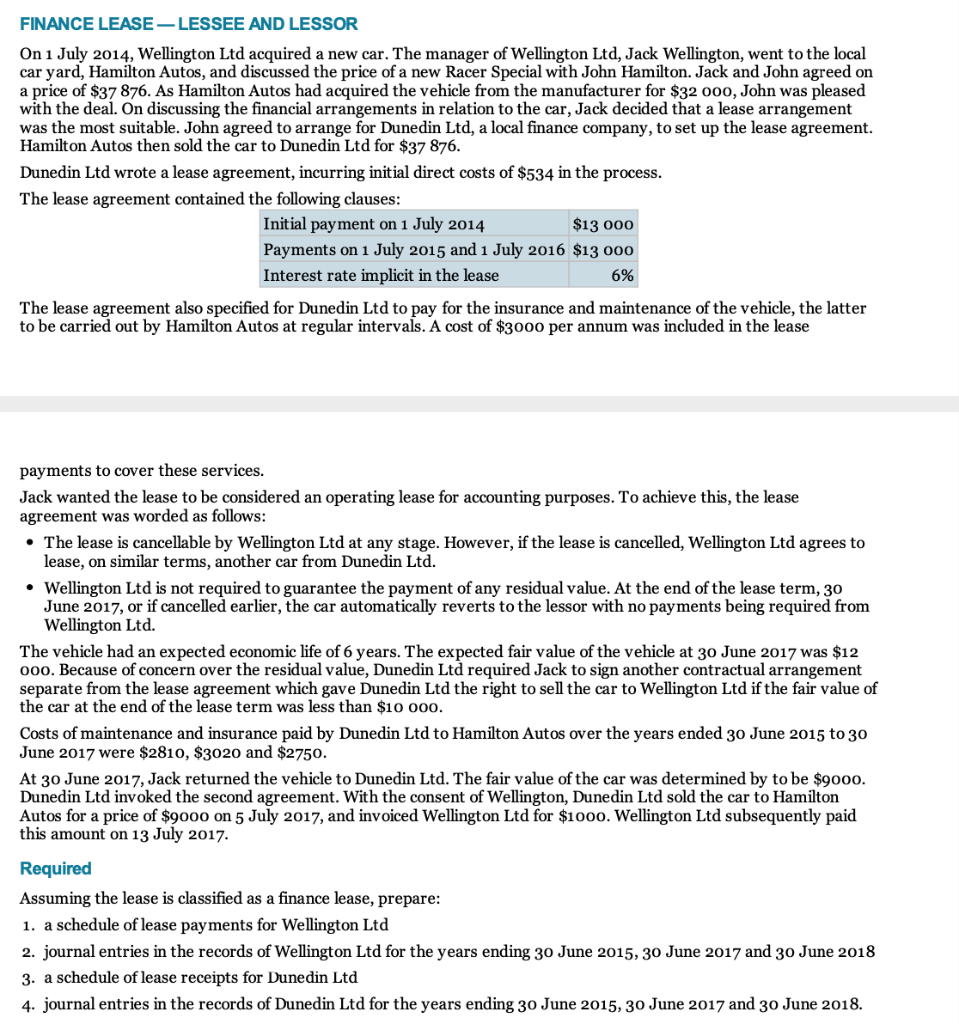

FINANCE LEASE - LESSEE AND LESSOR On 1 July 2014, Wellington Ltd acquired a new car. The manager of Wellington Ltd, Jack Wellington, went to the local car yard, Hamilton Autos, and discussed the price of a new Racer Special with John Hamilton. Jack and John agreed on a price of $37 876. As Hamilton Autos had acquired the vehicle from the manufacturer for $32 000, John was pleased with the deal. On discussing the financial arrangements in relation to the car, Jack decided that a lease arrangement was the most suitable. John agreed to arrange for Dunedin Ltd, a local finance company, to set up the lease agreement. Hamilton Autos then sold the car to Dunedin Ltd for $37 876. Dunedin Ltd wrote a lease agreement, incurring initial direct costs of $534 in the process. The lease agreement contained the following clauses: Initial payment on 1 July 2014 $13 000 Payments on 1 July 2015 and 1 July 2016 $13 000 Interest rate implicit in the lease 6% The lease agreement also specified for Dunedin Ltd to pay for the insurance and maintenance of the vehicle, the latter to be carried out by Hamilton Autos at regular intervals. A cost of $3000 per annum was included in the lease payments to cover these services. Jack wanted the lease to be considered an operating lease for accounting purposes. To achieve this, the lease agreement was worded as follows: The lease is cancellable by Wellington Ltd at any stage. However, if the lease is cancelled, Wellington Ltd agrees to lease, on similar terms, another car from Dunedin Ltd. Wellington Ltd is not required to guarantee the payment of any residual value. At the end of the lease term, 30 June 2017, or if cancelled earlier, the car automatically reverts to the lessor with no payments being required from Wellington Ltd. The vehicle had an expected economic life of 6 years. The expected fair value of the vehicle at 30 June 2017 was $12 000. Because of concern over the residual value, Dunedin Ltd required Jack to sign another contractual arrangement separate from the lease agreement which gave Dunedin Ltd the right to sell the car to Wellington Ltd if the fair value of the car at the end of the lease term was less than $10 000. Costs of maintenance and insurance paid by Dunedin Ltd to Hamilton Autos over the years ended 30 June 2015 to 30 June 2017 were $2810, $3020 and $2750. At 30 June 2017, Jack returned the vehicle to Dunedin Ltd. The fair value of the car was determined by to be $9000. Dunedin Ltd invoked the second agreement. With the consent of Wellington, Dunedin Ltd sold the car to Hamilton Autos for a price of $9000 on 5 July 2017, and invoiced Wellington Ltd for $1000. Wellington Ltd subsequently paid this amount on 13 July 2017. Required Assuming the lease is classified as a finance lease, prepare: 1. a schedule of lease payments for Wellington Ltd 2. journal entries in the records of Wellington Ltd for the years ending 30 June 2015, 30 June 2017 and 30 June 2018 3. a schedule of lease receipts for Dunedin Ltd 4. journal entries in the records of Dunedin Ltd for the years ending 30 June 2015, 30 June 2017 and 30 June 2018. FINANCE LEASE - LESSEE AND LESSOR On 1 July 2014, Wellington Ltd acquired a new car. The manager of Wellington Ltd, Jack Wellington, went to the local car yard, Hamilton Autos, and discussed the price of a new Racer Special with John Hamilton. Jack and John agreed on a price of $37 876. As Hamilton Autos had acquired the vehicle from the manufacturer for $32 000, John was pleased with the deal. On discussing the financial arrangements in relation to the car, Jack decided that a lease arrangement was the most suitable. John agreed to arrange for Dunedin Ltd, a local finance company, to set up the lease agreement. Hamilton Autos then sold the car to Dunedin Ltd for $37 876. Dunedin Ltd wrote a lease agreement, incurring initial direct costs of $534 in the process. The lease agreement contained the following clauses: Initial payment on 1 July 2014 $13 000 Payments on 1 July 2015 and 1 July 2016 $13 000 Interest rate implicit in the lease 6% The lease agreement also specified for Dunedin Ltd to pay for the insurance and maintenance of the vehicle, the latter to be carried out by Hamilton Autos at regular intervals. A cost of $3000 per annum was included in the lease payments to cover these services. Jack wanted the lease to be considered an operating lease for accounting purposes. To achieve this, the lease agreement was worded as follows: The lease is cancellable by Wellington Ltd at any stage. However, if the lease is cancelled, Wellington Ltd agrees to lease, on similar terms, another car from Dunedin Ltd. Wellington Ltd is not required to guarantee the payment of any residual value. At the end of the lease term, 30 June 2017, or if cancelled earlier, the car automatically reverts to the lessor with no payments being required from Wellington Ltd. The vehicle had an expected economic life of 6 years. The expected fair value of the vehicle at 30 June 2017 was $12 000. Because of concern over the residual value, Dunedin Ltd required Jack to sign another contractual arrangement separate from the lease agreement which gave Dunedin Ltd the right to sell the car to Wellington Ltd if the fair value of the car at the end of the lease term was less than $10 000. Costs of maintenance and insurance paid by Dunedin Ltd to Hamilton Autos over the years ended 30 June 2015 to 30 June 2017 were $2810, $3020 and $2750. At 30 June 2017, Jack returned the vehicle to Dunedin Ltd. The fair value of the car was determined by to be $9000. Dunedin Ltd invoked the second agreement. With the consent of Wellington, Dunedin Ltd sold the car to Hamilton Autos for a price of $9000 on 5 July 2017, and invoiced Wellington Ltd for $1000. Wellington Ltd subsequently paid this amount on 13 July 2017. Required Assuming the lease is classified as a finance lease, prepare: 1. a schedule of lease payments for Wellington Ltd 2. journal entries in the records of Wellington Ltd for the years ending 30 June 2015, 30 June 2017 and 30 June 2018 3. a schedule of lease receipts for Dunedin Ltd 4. journal entries in the records of Dunedin Ltd for the years ending 30 June 2015, 30 June 2017 and 30 June 2018