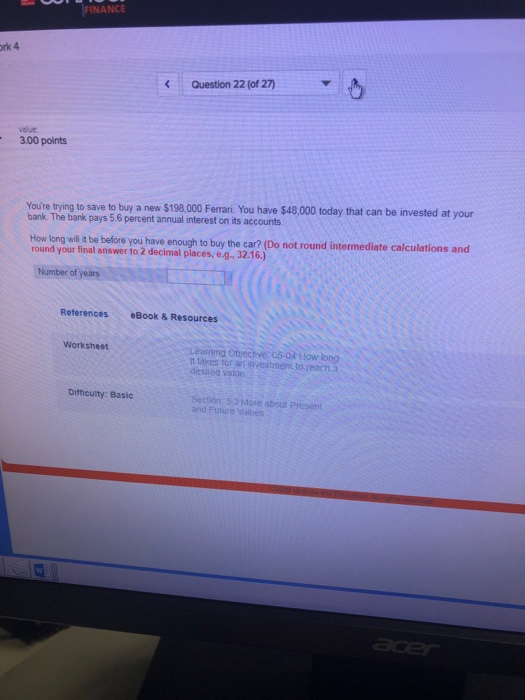

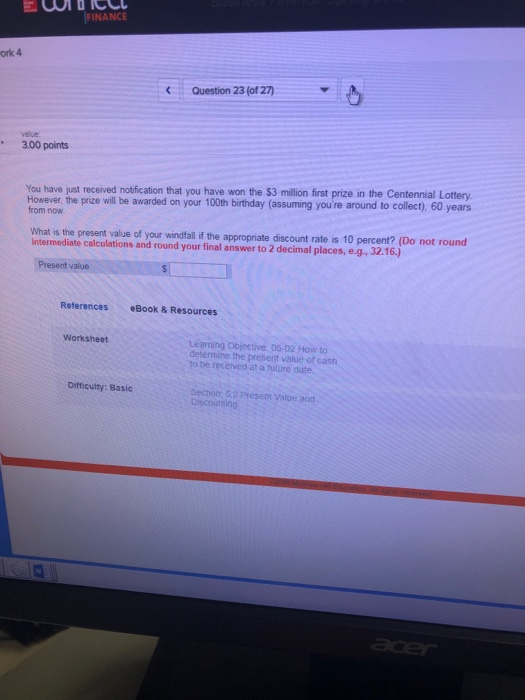

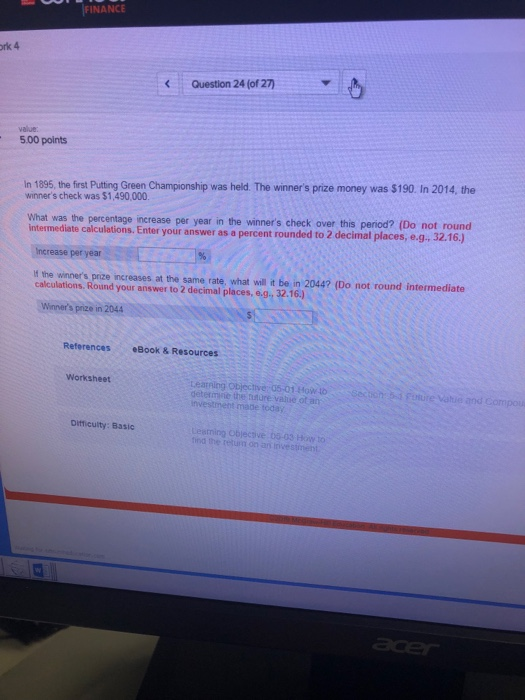

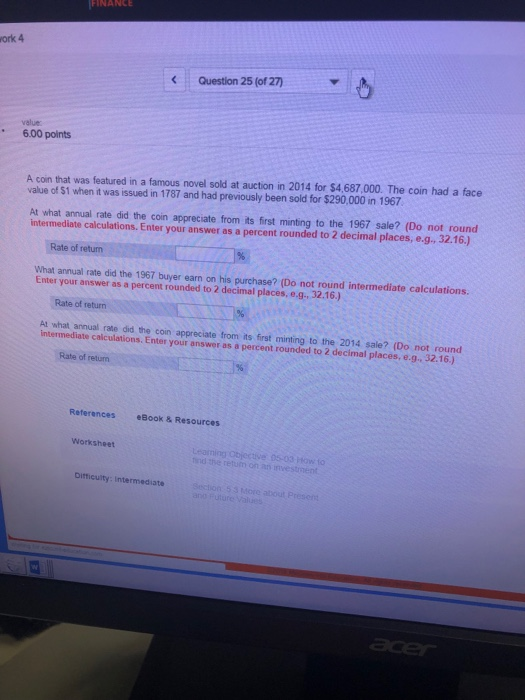

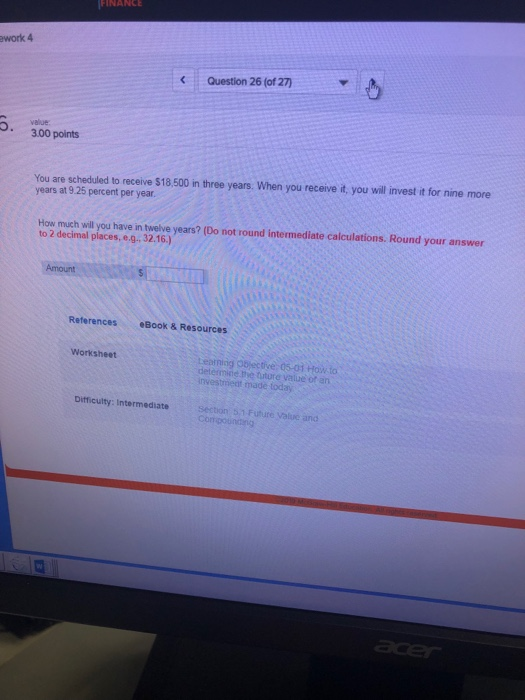

FINANCE ork 4 Question 22 (of 27) value 3.00 points You're trying to save to buy a new $198,000 Ferrari. You have $48,000 today that can be invested at your bank. The bank pays 5.6 percent annual interest on its accounts round your final answer to 2 decimal places, e.g., 32.16) Number of yearss (a net cund inermediate calculations and References eBook & Resources Worksheet Learning Objectve: 05-04 How long it takes tor ar nvestment to reacha desired vatue Difficulty: Basic Sectin 53 More about Present and Fture Values FINANCE ork 4 Question 23 (of 27) value 3.00 points You have just received notification that you have won the $3 million first prize in the Centennial Lottery years However, the prize will be awarded on your 100th birthday (assuming you're around to collect), 60 from now What is the present value of your windfall if the appropriate discount rate is 10 percent? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g, 32.16.) Present value References eBook & Resources Worksheet Learning Objective: 05-02 How to determine the present value of cash to be received at a future date. Difficuity: Basic Sechion: 52 Prsent Value and Discounting FINANCE ork 4 Question 24 (of 27) value 500 points In 1895, the frst Putting Green Championship was held. The winner's prize money was $190. In 2014, the winner's check was $1,490,000 What was the percentage increase per year in the winners check over this period? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g. Increase per year If the winner's prize increases at the same rate, what will it be in 2044? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g, 32.16.) Winners prize in 2044 References Book & Resources Worksheet Learring Objective 05-01 HoW t0ssSecion5 ure Valtie and Compou determne the naure vatie ot an investment made today Difficulty: Basic Leatning Objective 05-03 How to tind the retun on an inive stment FINANCE ork 4 Question 25(of 27) value 6.00 points A coin that was featured in a famous novel sold at auction in 2014 for $4,687,000. The coin had a face value of $1 when it was issued in 1787 and had previously been sold for $290,000 in 1967 At what annual rate did the coin appreciate from its first minting to the 1967 sale? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g, 32.16.) Rate of retum What annual rate did the 1967 buyer earn on his purchase? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Rate of return Al what annual rate did the coin appreciate from its first minting to the 2014 sale? (Do not round intermediate calculations. Enter your an swer as a percent rounded to 2 decimal places, e.9 32.16,) Rate of return Referances Book & Resources Worksheet d ine retum on an investment Oifficuity: Intermediate Section 5 3 More about Presom ework 4 Question 26 (of 27) value .3.00 points You are scheduled to receive $18,.500 in three years. When you receive it, you will invest it for nine more years at 9.25 percent per year. How much will you have in twelve years? (Do not round intermediate calculations. Round your answer to 2 decimal places, e.g.32.16.) Amount References Book & Resources Worksheet Learniig Objective 05-01 How to determinie.the future value of an investment made today Difficulty: Intermediate section 5 1 Future Valuc and