Question

Finance; Please answer all. Thank you very much Question 1. FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take

Finance; Please answer all. Thank you very much

Question 1.

FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $207,500 per year. Once in production, the bike is expected to make $292,500 per year for 10 years. The cash inflows begin at the end of year 7. Assume the cost of capital is 9.4% for parts (a), (b), and (c) below.

a. Calculate the NPV of this investment opportunity. Should the company make the investment?

b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged.

c. With costs remaining at $207,500 per year, how long must development last to change the decision?

Assume the cost of capital is 14.2% for parts (d), (e), and (f) below.

d. Calculate the NPV of this investment opportunity. Should the company make the investment?

e. How much must this cost of capital estimate deviate to change the decision?

f. With costs remaining at $207,500 per year, how long must development last to change the decision?

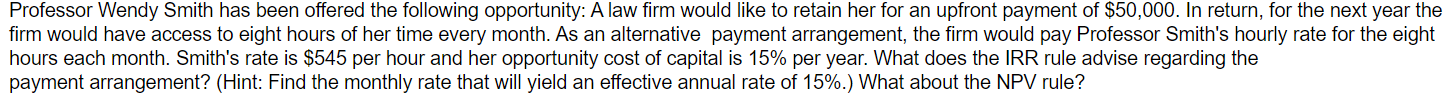

Question 2:

What is The annual IRR?

Please also answer other sub questions in this question 2

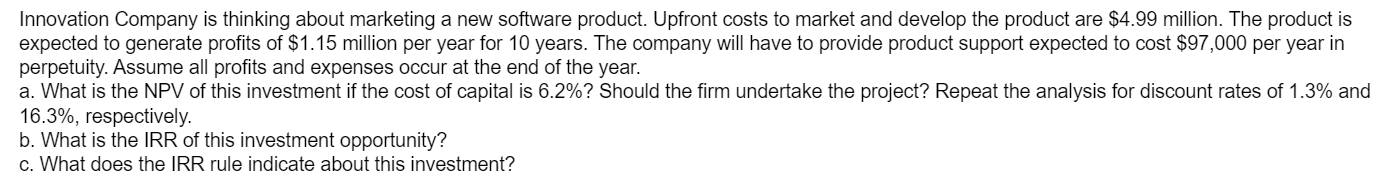

Question 3:

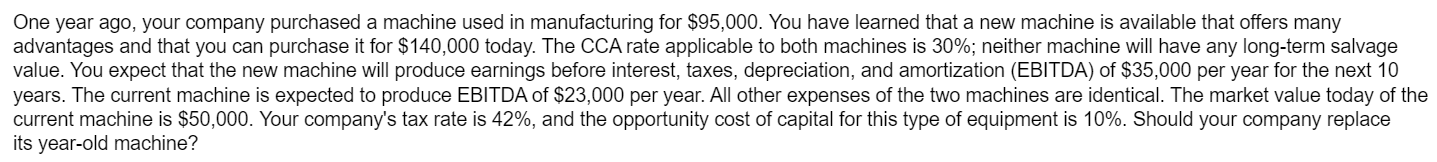

Question 4:

Question 5:

What is the NPV of replacement?

Please also answer other sub questions of this question 5

Question 6:

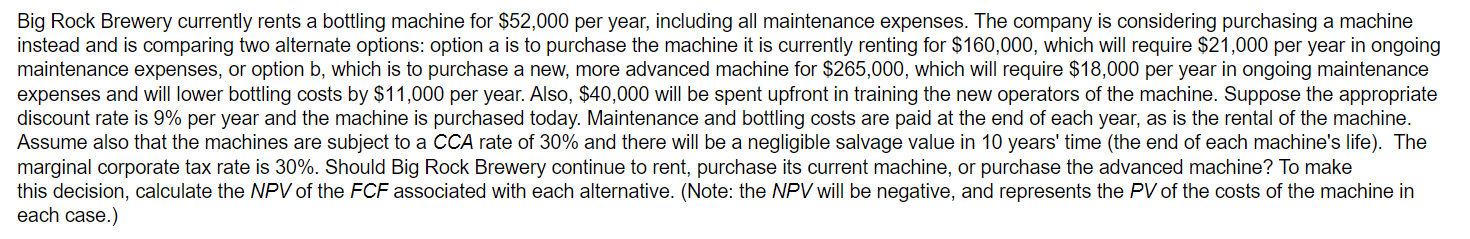

What is The NPV (rent the machine)?

Please also answer other sub questions of this question 6

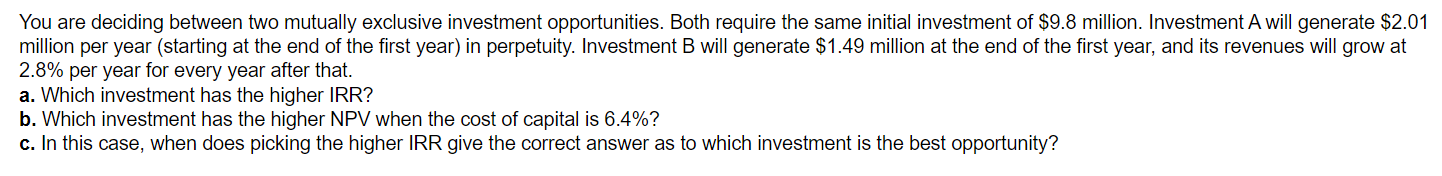

Question 7:

Question 8:

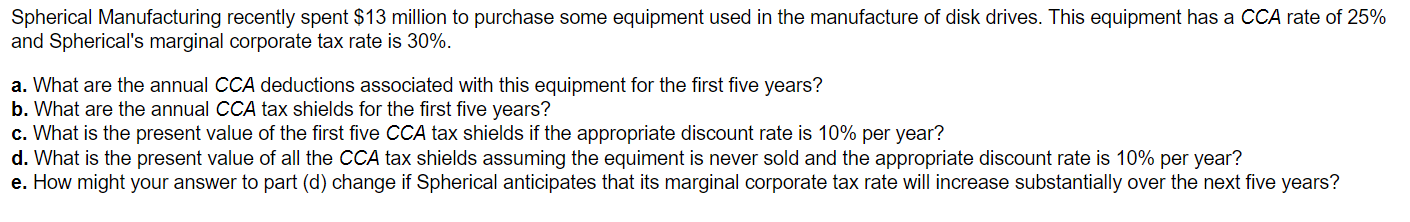

Using the indirect method requires a separate calculation of the CCA tax shield. What is the present value of the CCA tax shield?

Please also answer other sub questions of this question 8

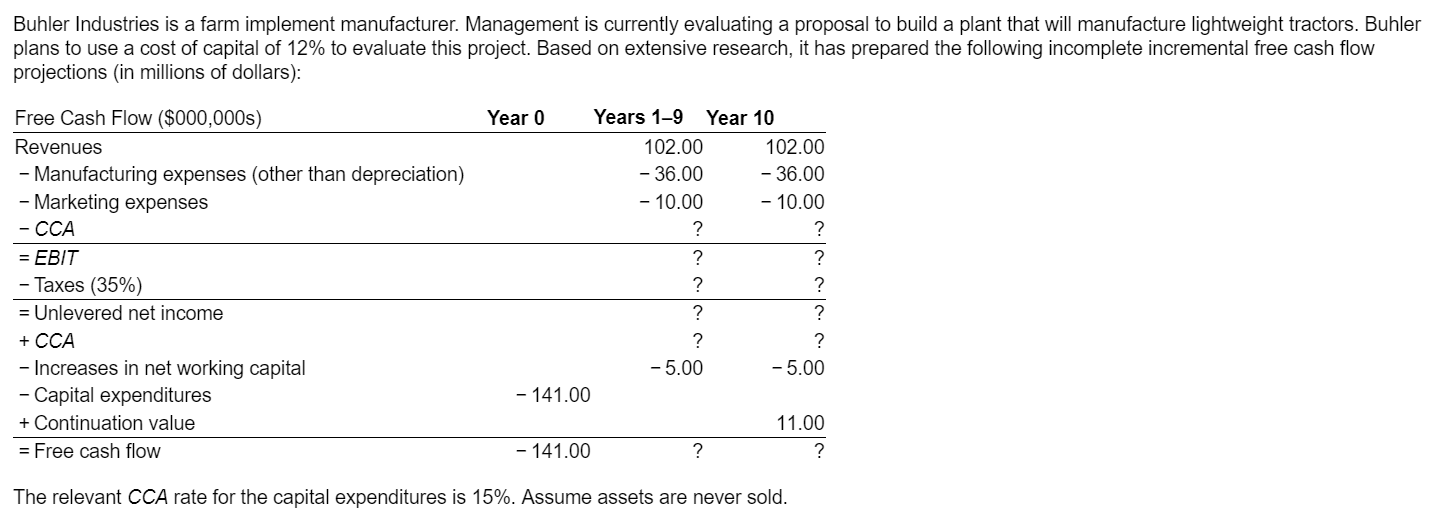

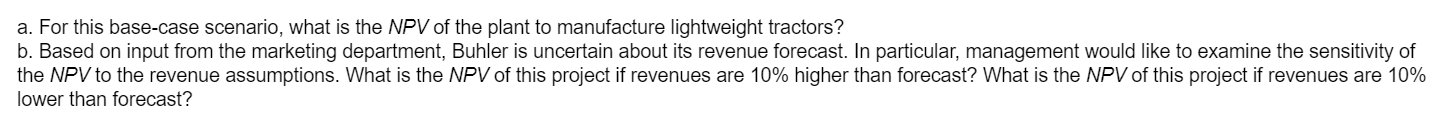

Professor Wendy Smith has been offered the following opportunity: A law firm would like to retain her for an upfront payment of $50,000. In return, for the next year the irm would have access to eight hours of her time every month. As an alternative payment arrangement, the firm would pay Professor Smith's hourly rate for the eight nours each month. Smith's rate is $545 per hour and her opportunity cost of capital is 15% per year. What does the IRR rule advise regarding the Dayment arrangement? (Hint: Find the monthly rate that will yield an effective annual rate of 15%.) What about the NPV rule? Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.99 million. The product is expected to generate profits of $1.15 million per year for 10 years. The company will have to provide product support expected to cost $97,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 6.2% ? Should the firm undertake the project? Repeat the analysis for discount rates of 1.3% and 16.3%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.8 million. Investment A will generate $2.01 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.49 million at the end of the first year, and its revenues will grow at 2.8% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 6.4% ? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? One year ago, your company purchased a machine used in manufacturing for $95,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $140,000 today. The CCA rate applicable to both machines is 30%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $35,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $23,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 42%, and the opportunity cost of capital for this type of equipment is 10%. Should your company replace its year-old machine? Big Rock Brewery currently rents a bottling machine for $52,000 per year, including all maintenance expenses. The company is considering purchasing a machine instead and is comparing two alternate options: option a is to purchase the machine it is currently renting for $160,000, which will require $21,000 per year in ongoing maintenance expenses, or option b, which is to purchase a new, more advanced machine for $265,000, which will require $18,000 per year in ongoing maintenance expenses and will lower bottling costs by $11,000 per year. Also, $40,000 will be spent upfront in training the new operators of the machine. Suppose the appropriate discount rate is 9% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines are subject to a CCA rate of 30% and there will be a negligible salvage value in 10 years' time (the end of each machine's life). The marginal corporate tax rate is 30%. Should Big Rock Brewery continue to rent, purchase its current machine, or purchase the advanced machine? To make this decision, calculate the NPV of the FCF associated with each alternative. (Note: the NPV will be negative, and represents the PV of the costs of the machine in each case.) Spherical Manufacturing recently spent $13 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 25% and Spherical's marginal corporate tax rate is 30%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 10% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 10% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to use a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incomplete incremental free cash flow projections (in millions of dollars): The relevant CCA rate for the capital expenditures is 15%. Assume assets are never sold. a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b. Based on input from the marketing department, Buhler is uncertain about its revenue forecast. In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecastStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started