finance

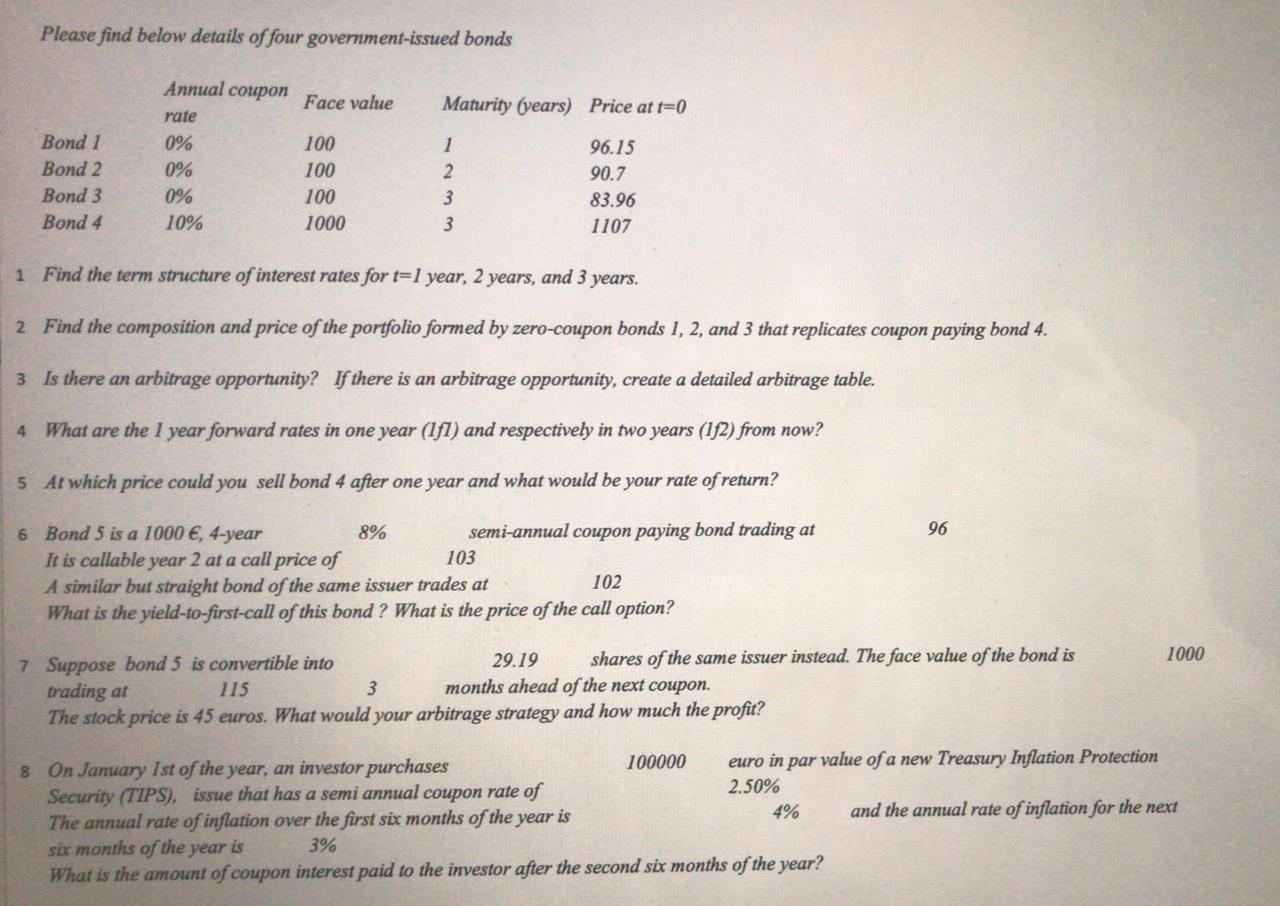

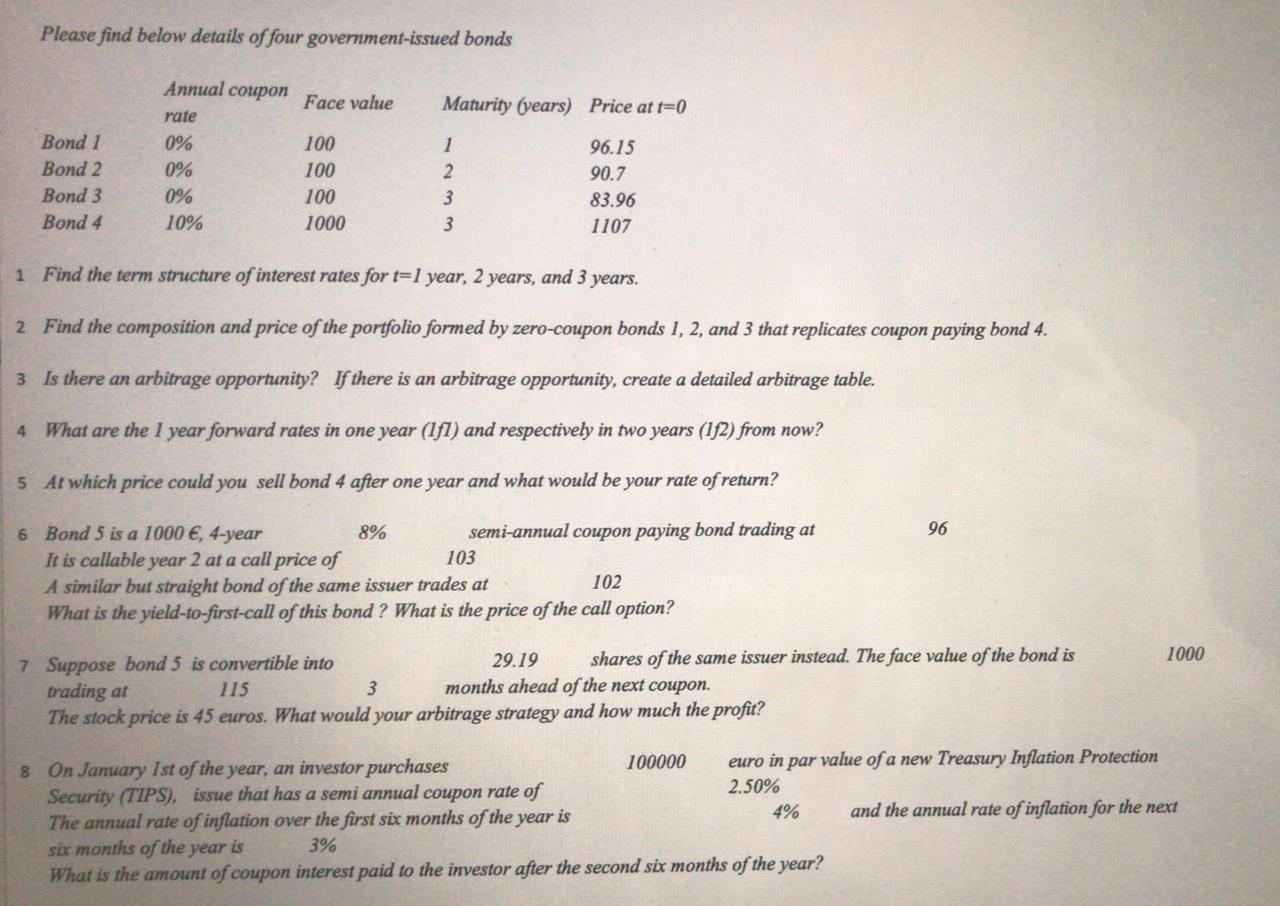

Please find below details of four government-issued bonds Face value Annual coupon rate 0% Maturity (years) Price at t=0 0% Bond 1 Bond 2 Bond 3 Bond 4 100 100 100 1000 1 2 3 3 96.15 90.7 83.96 1107 0% 10% 1 Find the term structure of interest rates for t=1 year, 2 years, and 3 years. 2 Find the composition and price of the portfolio formed by zero-coupon bonds 1, 2, and 3 that replicates coupon paying bond 4. 3 Is there an arbitrage opportunity? If there is an arbitrage opportunity, create a detailed arbitrage table. 4 What are the 1 year forward rates in one year (Ifl) and respectively in two years (182) from now? 5 At which price could you sell bond 4 after one year and what would be your rate of return? 96 6 Bond 5 is a 1000 , 4-year 8% semi-annual coupon paying bond trading at It is callable year 2 at a call price of 103 A similar but straight bond of the same issuer trades at 102 What is the yield-to-first-call of this bond ? What is the price of the call option? 1000 7 Suppose bond 3 is convertible into 29.19 shares of the same issuer instead. The face value of the bond is trading at 115 3 months ahead of the next coupon. The stock price is 45 euros. What would your arbitrage strategy and how much the profit? 8 On January Ist of the year, an investor purchases 100000 euro in par value of a new Treasury Inflation Protection Security (TIPS), issue that has a semi annual coupon rate of 2.50% The annual rate of inflation over the first six months of the year is 4% and the annual rate of inflation for the next six months of the year is What is the amount of coupon interest paid to the investor after the second six months of the year? 3% Please find below details of four government-issued bonds Face value Annual coupon rate 0% Maturity (years) Price at t=0 0% Bond 1 Bond 2 Bond 3 Bond 4 100 100 100 1000 1 2 3 3 96.15 90.7 83.96 1107 0% 10% 1 Find the term structure of interest rates for t=1 year, 2 years, and 3 years. 2 Find the composition and price of the portfolio formed by zero-coupon bonds 1, 2, and 3 that replicates coupon paying bond 4. 3 Is there an arbitrage opportunity? If there is an arbitrage opportunity, create a detailed arbitrage table. 4 What are the 1 year forward rates in one year (Ifl) and respectively in two years (182) from now? 5 At which price could you sell bond 4 after one year and what would be your rate of return? 96 6 Bond 5 is a 1000 , 4-year 8% semi-annual coupon paying bond trading at It is callable year 2 at a call price of 103 A similar but straight bond of the same issuer trades at 102 What is the yield-to-first-call of this bond ? What is the price of the call option? 1000 7 Suppose bond 3 is convertible into 29.19 shares of the same issuer instead. The face value of the bond is trading at 115 3 months ahead of the next coupon. The stock price is 45 euros. What would your arbitrage strategy and how much the profit? 8 On January Ist of the year, an investor purchases 100000 euro in par value of a new Treasury Inflation Protection Security (TIPS), issue that has a semi annual coupon rate of 2.50% The annual rate of inflation over the first six months of the year is 4% and the annual rate of inflation for the next six months of the year is What is the amount of coupon interest paid to the investor after the second six months of the year? 3%