Finance problem

Finance problem

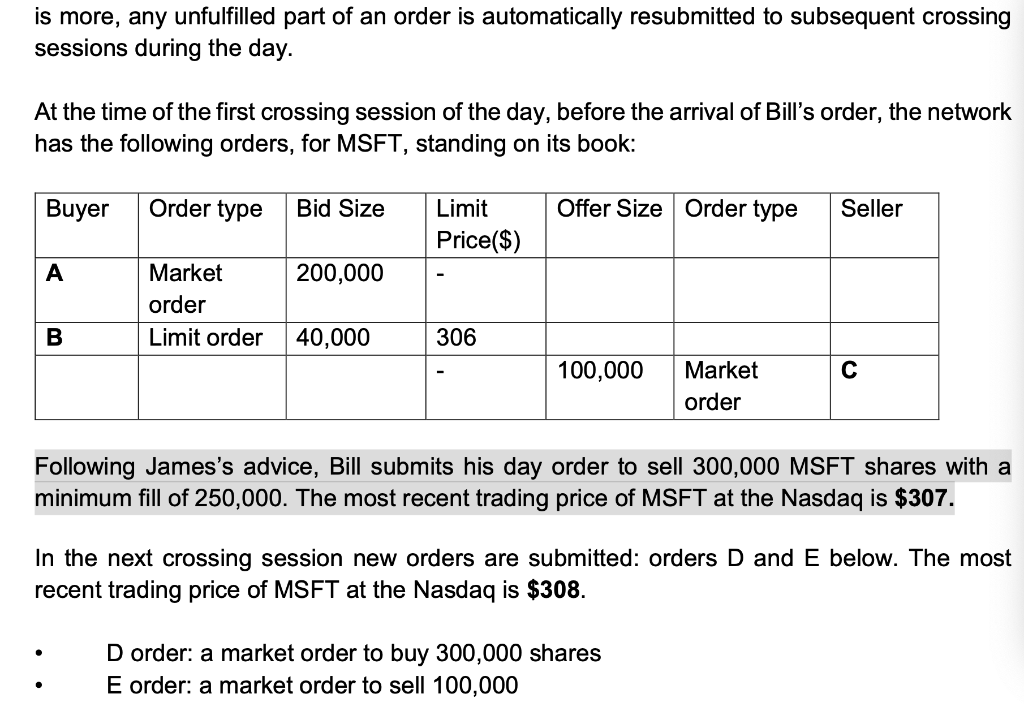

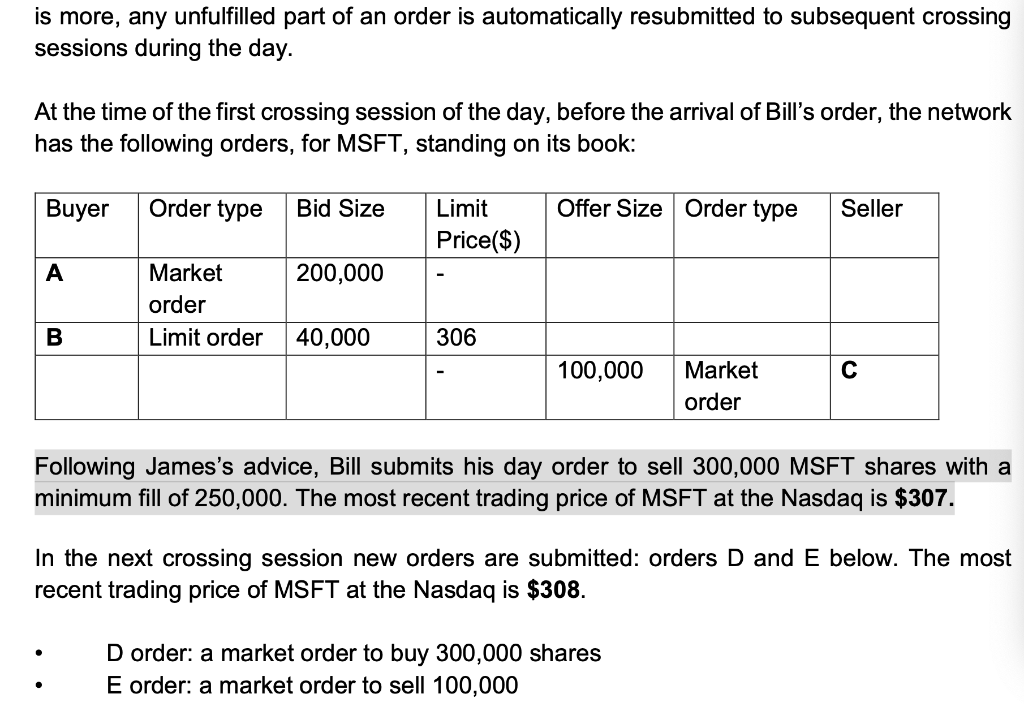

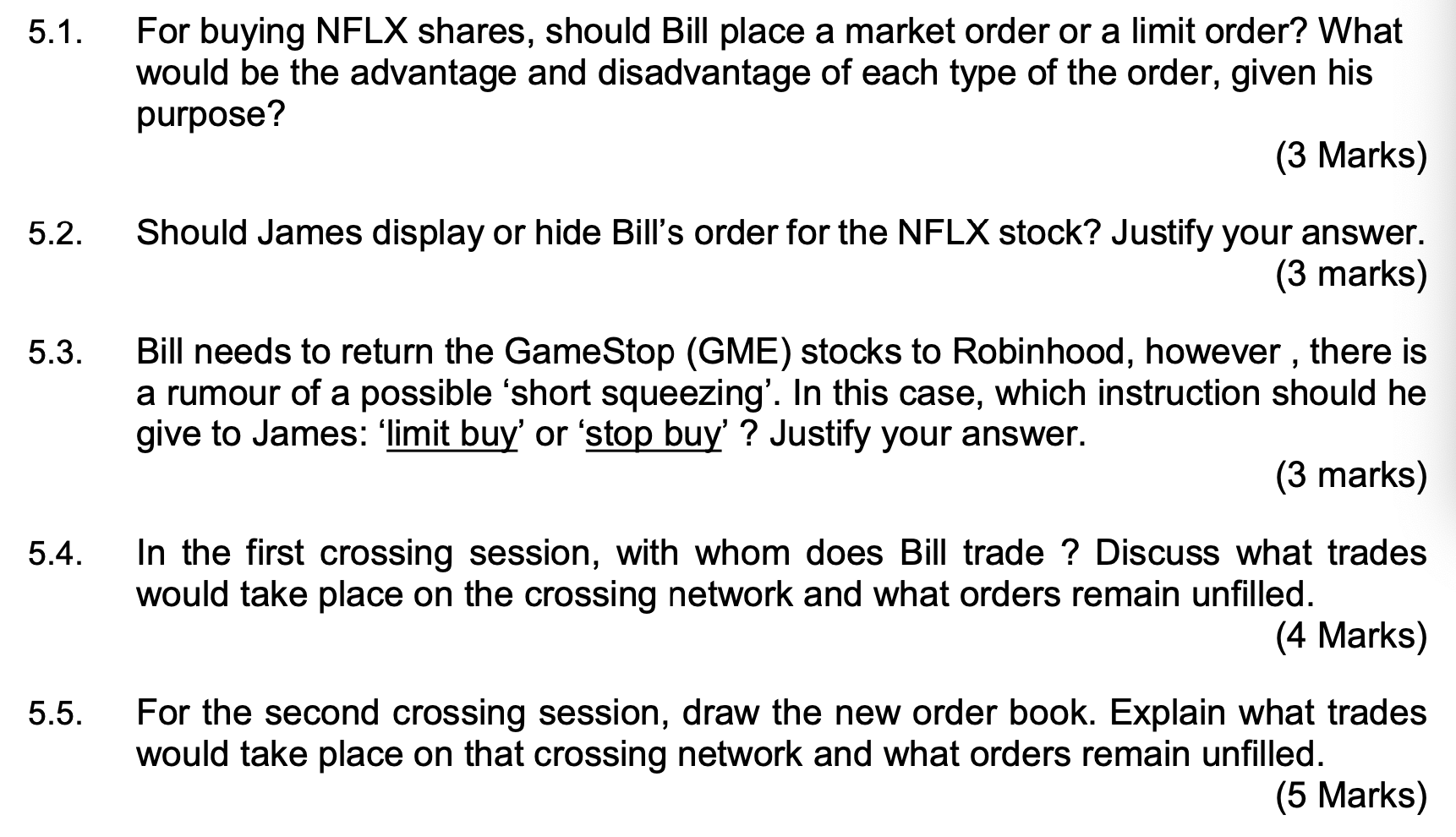

Bill Ackman, the CEO of Pershing Square Capital Management (an American hedge fund), a successful information - motivated investor, plans to buy 100,000 shares of NFLX. The current price is $390. Netflix faces slowing growth in the US and Canadian market, therefore, it has recently been trading at its 52-week low. The stock is very volatile. Bill thinks that the market offers an opportunity to buy NFLX at an attractive valuation. He has done extensive analysis on the company and believes that the stock will jump to $400, as there will be a positive surprise after the earnings announcement, at the end of the week. James Marsh works for Charles Schwab, which provides execution services for Pershing. In his conversation with Bill, James has suggested to take opportunity of the current stock's volatility, and to place a limit order. Bill, however, considers a market order. He agrees that the stock has been more volatile in the last couple of days. This, according to Bill, is because the market is fast moving in the face of the expected earnings release. In addition, Bill believes that other investors would have done similar analysis, thus will start buying any time soon. Bill also looked at GameStop, a brick-and-mortar, second-hand video game store that was already in decline due to competition from digital distribution services, as well as the economic effects of the COVID-19 pandemic, which reduced the number of people who shopped in-person. Some analysts also suspect that GameStop will go bust. The market seems to be of a similar view, as in January, 140 per cent of GME shares were shorted. Bill, therefore, enters the short at $30, and then immediately sells the stock in the market, with the view that it will drop to $17.25 - this was the valuation at the beginning of the month. He is due to return the borrowed shares, plus interest, to Robinhood (his broker) and profit off the difference. Finally, Bill would like to reduce the transaction cost from selling his Microsoft shares. James advises to use Liquidnet, an Electronic Crossing network, which is an alternative trading system (ATS). James pointed out that trading via these networks can be cheaper, moreover, they offer anonymity for buyers and sellers. Large block orders can be executed without impacting the public quote, in addition, they allow participants to place restrictions on orders, such as price and minimum fill. Those networks, also allow for multiple crossing opportunities of trades per day. This means that all orders submitted to the network are good for day, what is more, any unfulfilled part of an order is automatically resubmitted to subsequent crossing sessions during the day. At the time of the first crossing session of the day, before the arrival of Bill's order, the network has the following orders, for MSFT, standing on its book: Buyer Order type Bid Size Limit Offer Size Order type Seller Price($) A Market 200,000 order B Limit order 40,000 306 100,000 C Market order Following James's advice, Bill submits his day order to sell 300,000 MSFT shares with a minimum fill of 250,000. The most recent trading price of MSFT at the Nasdaq is $307. In the next crossing session new orders are submitted: orders D and E below. The most recent trading price of MSFT at the Nasdaq is $308. D order: a market order to buy 300,000 shares E order: a market order to sell 100,000 5.1. For buying NFLX shares, should Bill place a market order or a limit order? What would be the advantage and disadvantage of each type of the order, given his purpose? (3 Marks) 5.2. Should James display or hide Bill's order for the NFLX stock? Justify your answer. (3 marks) 5.3. Bill needs to return the GameStop (GME) stocks to Robinhood, however, there is a rumour of a possible 'short squeezing'. In this case, which instruction should he give to James: 'limit buy' or 'stop buy' ? Justify your answer. (3 marks) 5.4. In the first crossing session, with whom does Bill trade ? Discuss what trades would take place on the crossing network and what orders remain unfilled. (4 Marks) 5.5. For the second crossing session, draw the new order book. Explain what trades would take place on that crossing network and what orders remain unfilled. (5 Marks) Bill Ackman, the CEO of Pershing Square Capital Management (an American hedge fund), a successful information - motivated investor, plans to buy 100,000 shares of NFLX. The current price is $390. Netflix faces slowing growth in the US and Canadian market, therefore, it has recently been trading at its 52-week low. The stock is very volatile. Bill thinks that the market offers an opportunity to buy NFLX at an attractive valuation. He has done extensive analysis on the company and believes that the stock will jump to $400, as there will be a positive surprise after the earnings announcement, at the end of the week. James Marsh works for Charles Schwab, which provides execution services for Pershing. In his conversation with Bill, James has suggested to take opportunity of the current stock's volatility, and to place a limit order. Bill, however, considers a market order. He agrees that the stock has been more volatile in the last couple of days. This, according to Bill, is because the market is fast moving in the face of the expected earnings release. In addition, Bill believes that other investors would have done similar analysis, thus will start buying any time soon. Bill also looked at GameStop, a brick-and-mortar, second-hand video game store that was already in decline due to competition from digital distribution services, as well as the economic effects of the COVID-19 pandemic, which reduced the number of people who shopped in-person. Some analysts also suspect that GameStop will go bust. The market seems to be of a similar view, as in January, 140 per cent of GME shares were shorted. Bill, therefore, enters the short at $30, and then immediately sells the stock in the market, with the view that it will drop to $17.25 - this was the valuation at the beginning of the month. He is due to return the borrowed shares, plus interest, to Robinhood (his broker) and profit off the difference. Finally, Bill would like to reduce the transaction cost from selling his Microsoft shares. James advises to use Liquidnet, an Electronic Crossing network, which is an alternative trading system (ATS). James pointed out that trading via these networks can be cheaper, moreover, they offer anonymity for buyers and sellers. Large block orders can be executed without impacting the public quote, in addition, they allow participants to place restrictions on orders, such as price and minimum fill. Those networks, also allow for multiple crossing opportunities of trades per day. This means that all orders submitted to the network are good for day, what is more, any unfulfilled part of an order is automatically resubmitted to subsequent crossing sessions during the day. At the time of the first crossing session of the day, before the arrival of Bill's order, the network has the following orders, for MSFT, standing on its book: Buyer Order type Bid Size Limit Offer Size Order type Seller Price($) A Market 200,000 order B Limit order 40,000 306 100,000 C Market order Following James's advice, Bill submits his day order to sell 300,000 MSFT shares with a minimum fill of 250,000. The most recent trading price of MSFT at the Nasdaq is $307. In the next crossing session new orders are submitted: orders D and E below. The most recent trading price of MSFT at the Nasdaq is $308. D order: a market order to buy 300,000 shares E order: a market order to sell 100,000 5.1. For buying NFLX shares, should Bill place a market order or a limit order? What would be the advantage and disadvantage of each type of the order, given his purpose? (3 Marks) 5.2. Should James display or hide Bill's order for the NFLX stock? Justify your answer. (3 marks) 5.3. Bill needs to return the GameStop (GME) stocks to Robinhood, however, there is a rumour of a possible 'short squeezing'. In this case, which instruction should he give to James: 'limit buy' or 'stop buy' ? Justify your answer. (3 marks) 5.4. In the first crossing session, with whom does Bill trade ? Discuss what trades would take place on the crossing network and what orders remain unfilled. (4 Marks) 5.5. For the second crossing session, draw the new order book. Explain what trades would take place on that crossing network and what orders remain unfilled

Finance problem

Finance problem