finance question from a financial perspective

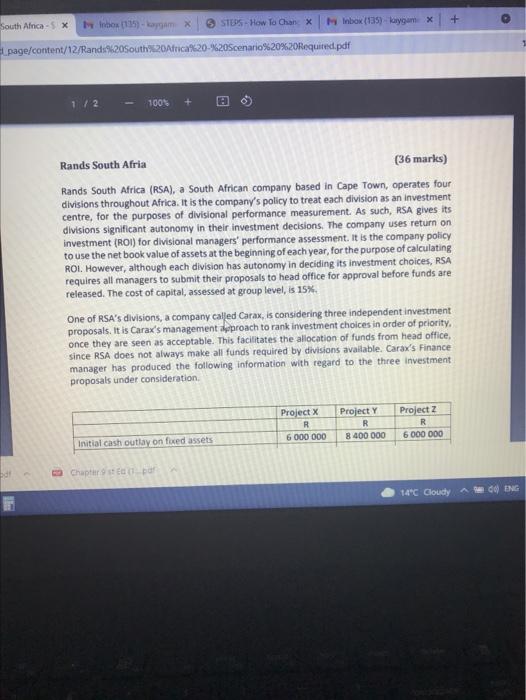

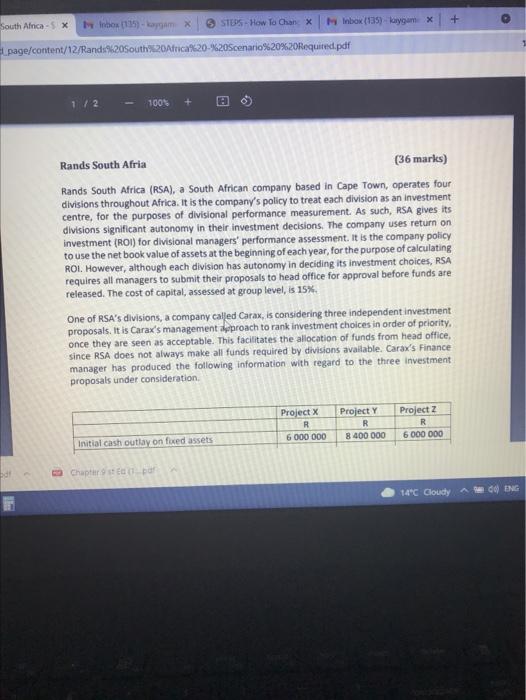

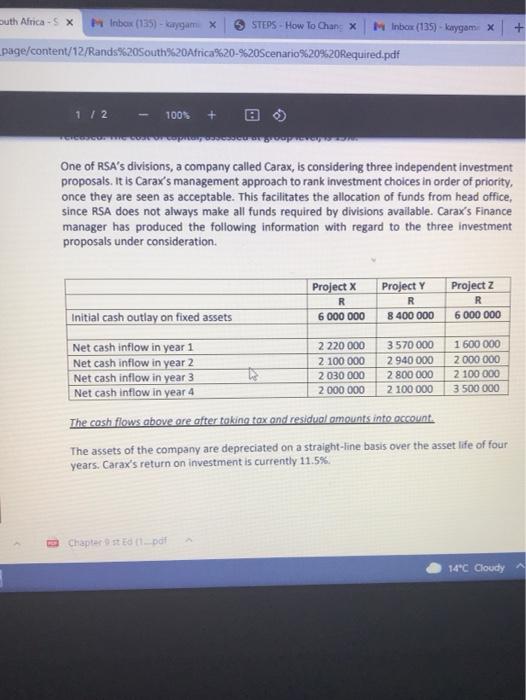

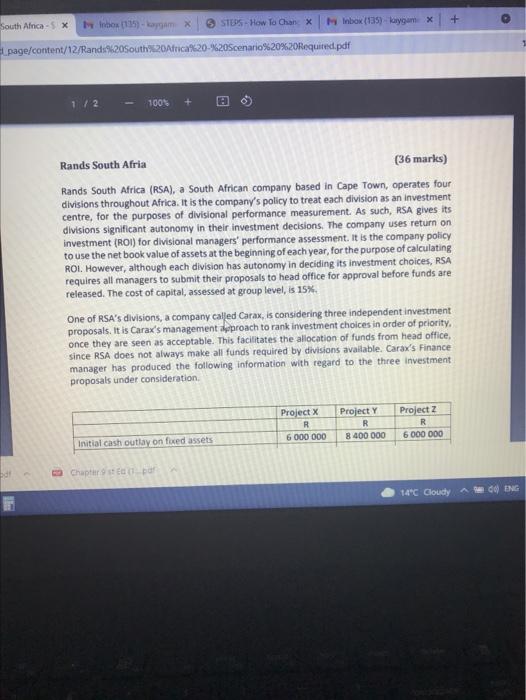

South Africa - X Index (115) -kapam * 3 STES- How To ChanX Inbox (135) lygam X page/content/12/Randi%20South%20Africa%20-%20Scenario%20%20Requited.pdf 1 / 2 100% + Rands South Afria (36 marks) Rands South Africa (RSA), a South African company based in Cape Town, operates four divisions throughout Africa. It is the company's policy to treat each division as an investment centre, for the purposes of divisional performance measurement. As such, RSA gives its divisions significant autonomy in their investment decisions. The company uses return on investment (ROI) for divisional managers' performance assessment. It is the company policy to use the net book value of assets at the beginning of each year, for the purpose of calculating ROI. However, although each division has autonomy in deciding its investment choices, RSA requires all managers to submit their proposals to head office for approval before funds are released. The cost of capital, assessed at group level, is 15% One of RSA's divisions, a company called Carax, is considering three independent investment proposals. It is Carax's management approach to rank investment choices in order of priority, once they are seen as acceptable. This facilitates the allocation of funds from head office, since RSA does not always make all funds required by divisions available. Carax's Finance manager has produced the following information with regard to the three investment proposals under consideration Project x R 000 000 Project Y R 8 400 000 Project 2 R 6 000 000 Initial cash outlay on fixed assets Chapter 14C Cloudy C ENG uth Africa S x Inbox (135) - aygamX STEPS - How To Chanc X Inbox (135) - kiygam* + _page/content/12/Rands%20South%20Africa%20-%20Scenario%20%20Required.pdf 112 100% + One of RSA's divisions, a company called Carax, is considering three independent investment proposals. It is Carax's management approach to rank investment choices in order of priority, once they are seen as acceptable. This facilitates the allocation of funds from head office, Since RSA does not always make all funds required by divisions available. Carax's Finance manager has produced the following information with regard to the three investment proposals under consideration Project X R 6 000 000 Project Y R 8 400 000 Project 2 R 6 000 000 Initial cash outlay on fixed assets 2 000 000 Net cash inflow in year 1 2 220 000 3570 000 1600 000 Net cash inflow in year 2 2 100 000 2 940 000 Net cash inflow in year 3 2030 000 2 800 000 2 100 000 Net cash inflow in year 4 2000.000 2 100 000 3 500 000 The cash flows above ore after taking tox and residualomounts into account. The assets of the company are depreciated on a straight-line basis over the asset life of four years. Carax's return on investment is currently 11.5% Chapter of 14C Cloudy South Africa SX + Mobo (139) kavga X > STEPS How To CharX Inbox (135) ayam X dpage/content/12/Rands%20South%20An%20-%20Scenario20%20Required.pl 2 / 2 1001 Rands South Africa - require pR 2 REQUIRED 1. Evaluate the three investment proposals from the points of view of: (a) Carax (12 Marks) (6) RSA (6 Marks) 2. Discuss any problems that could arise between the divisional (Carax) and group (RSA) points of view as a result of the current performance measurement system, and with regard to these investment proposals. 19 Marks) 3. Suggest techniques/approaches that could be used to improve goal congruence between Carax and RSA 14 de EN 140 Cloudy South Africa - X Index (115) -kapam * 3 STES- How To ChanX Inbox (135) lygam X page/content/12/Randi%20South%20Africa%20-%20Scenario%20%20Requited.pdf 1 / 2 100% + Rands South Afria (36 marks) Rands South Africa (RSA), a South African company based in Cape Town, operates four divisions throughout Africa. It is the company's policy to treat each division as an investment centre, for the purposes of divisional performance measurement. As such, RSA gives its divisions significant autonomy in their investment decisions. The company uses return on investment (ROI) for divisional managers' performance assessment. It is the company policy to use the net book value of assets at the beginning of each year, for the purpose of calculating ROI. However, although each division has autonomy in deciding its investment choices, RSA requires all managers to submit their proposals to head office for approval before funds are released. The cost of capital, assessed at group level, is 15% One of RSA's divisions, a company called Carax, is considering three independent investment proposals. It is Carax's management approach to rank investment choices in order of priority, once they are seen as acceptable. This facilitates the allocation of funds from head office, since RSA does not always make all funds required by divisions available. Carax's Finance manager has produced the following information with regard to the three investment proposals under consideration Project x R 000 000 Project Y R 8 400 000 Project 2 R 6 000 000 Initial cash outlay on fixed assets Chapter 14C Cloudy C ENG uth Africa S x Inbox (135) - aygamX STEPS - How To Chanc X Inbox (135) - kiygam* + _page/content/12/Rands%20South%20Africa%20-%20Scenario%20%20Required.pdf 112 100% + One of RSA's divisions, a company called Carax, is considering three independent investment proposals. It is Carax's management approach to rank investment choices in order of priority, once they are seen as acceptable. This facilitates the allocation of funds from head office, Since RSA does not always make all funds required by divisions available. Carax's Finance manager has produced the following information with regard to the three investment proposals under consideration Project X R 6 000 000 Project Y R 8 400 000 Project 2 R 6 000 000 Initial cash outlay on fixed assets 2 000 000 Net cash inflow in year 1 2 220 000 3570 000 1600 000 Net cash inflow in year 2 2 100 000 2 940 000 Net cash inflow in year 3 2030 000 2 800 000 2 100 000 Net cash inflow in year 4 2000.000 2 100 000 3 500 000 The cash flows above ore after taking tox and residualomounts into account. The assets of the company are depreciated on a straight-line basis over the asset life of four years. Carax's return on investment is currently 11.5% Chapter of 14C Cloudy South Africa SX + Mobo (139) kavga X > STEPS How To CharX Inbox (135) ayam X dpage/content/12/Rands%20South%20An%20-%20Scenario20%20Required.pl 2 / 2 1001 Rands South Africa - require pR 2 REQUIRED 1. Evaluate the three investment proposals from the points of view of: (a) Carax (12 Marks) (6) RSA (6 Marks) 2. Discuss any problems that could arise between the divisional (Carax) and group (RSA) points of view as a result of the current performance measurement system, and with regard to these investment proposals. 19 Marks) 3. Suggest techniques/approaches that could be used to improve goal congruence between Carax and RSA 14 de EN 140 Cloudy