Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finance Question .. Please answer both question otherwise ignore my question if you can't answer both . I will Upvote of answer is good written

Finance Question ..

Finance Question ..

Please answer both question otherwise ignore my question if you can't answer both . I will Upvote of answer is good written and right and thanks in advance for both answers

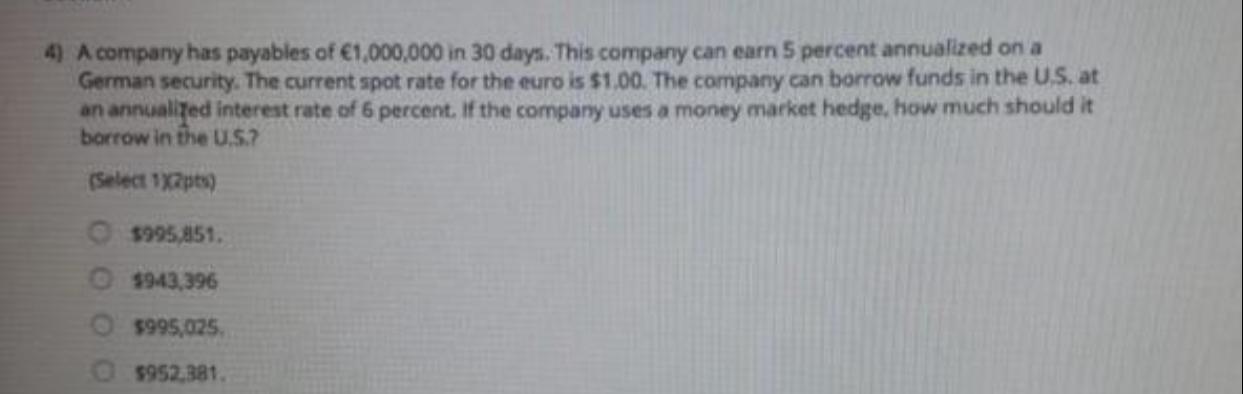

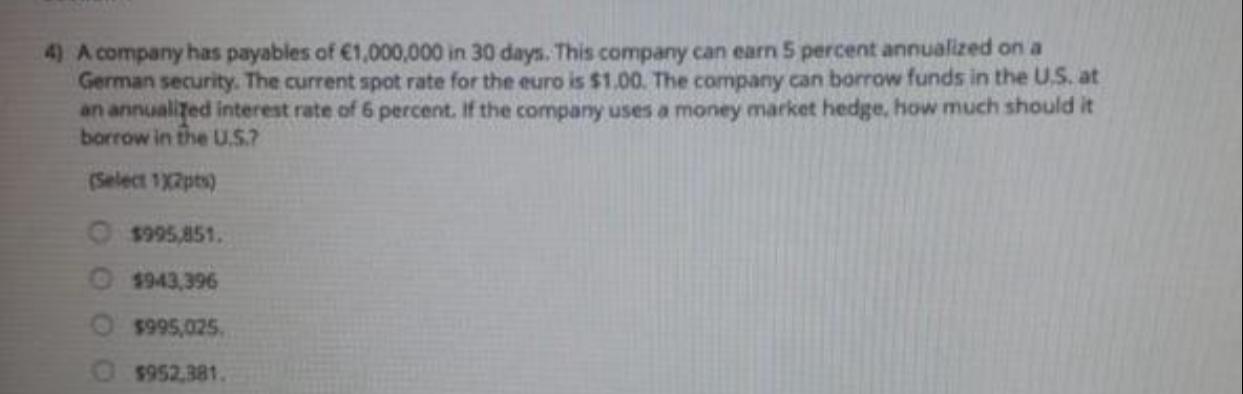

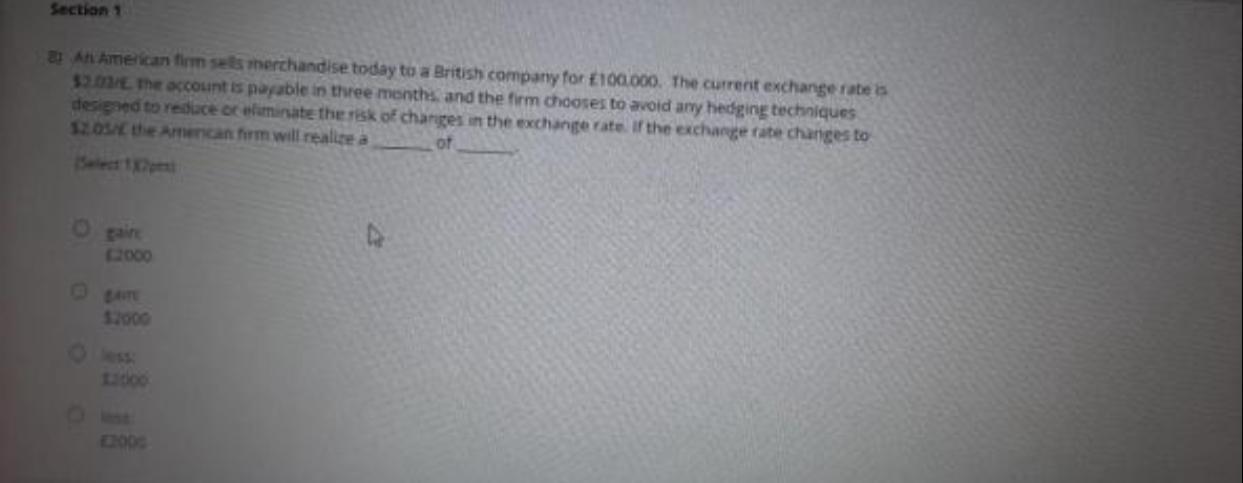

4) A company has payables of 1,000,000 in 30 days. This company can earn 5 percent annualized on a German security. The current spot rate for the euro is $1.00. The company can borrow funds in the U.S. at an annualized interest rate of 6 percent. If the company uses a money market hedge, how much should it borrow in the U.5.7 Select 1X7pts) 5995,851. 5943,396 5995,025 5952.381 4) A company has payables of 1,000,000 in 30 days. This company can earn 5 percent annualized on a German security. The current spot rate for the euro is $1.00. The company can borrow funds in the U.S. at an annualized interest rate of 6 percent. If the company uses a money market hedge, how much should it borrow in the U.5.7 Select 1X7pts) 5995,851. 5943,396 5995,025 5952.381 Section 1 An American fimm sels merchandise today to a British company for 100.000. The current exchange rates 33. The account is payable in three months, and the firm chooses to avoid any hedging techniques designed to reduce o fiminate the risk of changes in the exchange rate. If the exchange rate changes to 12 the Amencantorm will realize a of 2000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started