Answered step by step

Verified Expert Solution

Question

1 Approved Answer

finance question Tom, Inc, is planning to issue bonds with a coupon rate of 10% pald semi-annually and maturing in 20 years with a face

finance question

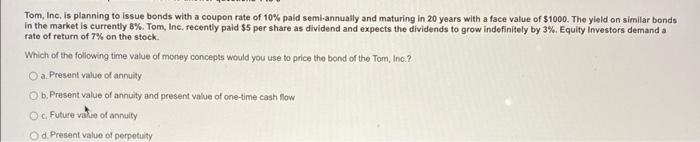

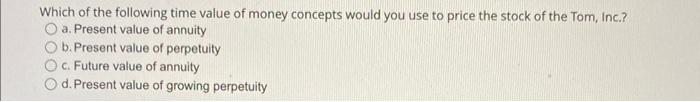

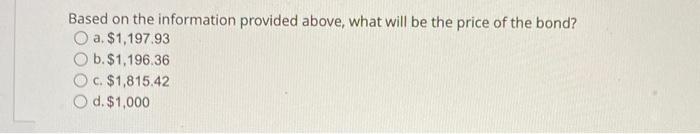

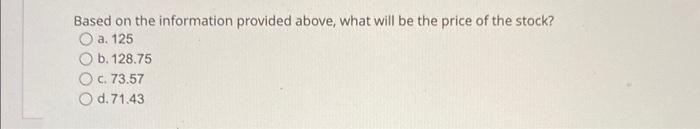

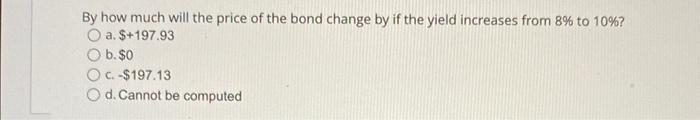

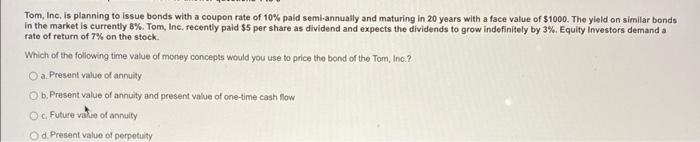

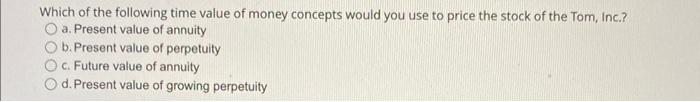

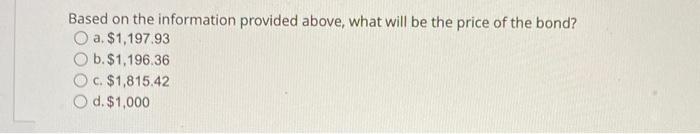

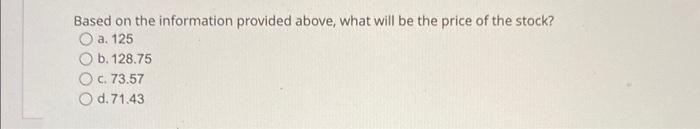

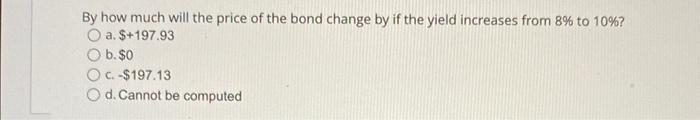

Tom, Inc, is planning to issue bonds with a coupon rate of 10% pald semi-annually and maturing in 20 years with a face value of $1000. The yield on similar bonds in the market is currently 8%. Tom, Inc, recently paid $5 per share as dividend and expects the dividends to grow indefinitely by 3%. Equity Investors demand a rate of return of 7% on the stock. Which of the following time value of money concepts would you use to price the bond of the Tom, inc? a. Present value of annuity b. Present value of annuity and present value of one-time cash flow Future vishie of annuity d. Present value of perpetuity Which of the following time value of money concepts would you use to price the stock of the Tom, Inc? a. Present value of annuity b. Present value of perpetuity c. Future value of annuity d. Present value of growing perpetuity Based on the information provided above, what will be the price of the bond? a. \$1,197.93 b. $1,196.36 c. $1,815.42 d. $1,000 Based on the information provided above, what will be the price of the stock? a. 125 b. 128.75 c. 73.57 d. 71.43 By how much will the price of the bond change by if the yield increases from 8% to 10% ? a. $+197.93 b. \$0 c. $197.13 d. Cannot be computed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started