finance questions that i need help with

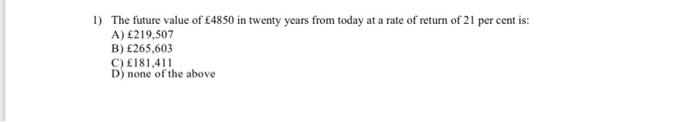

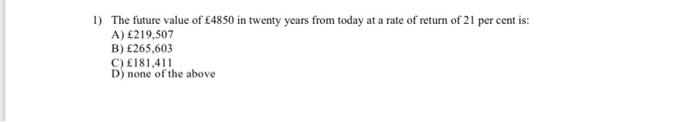

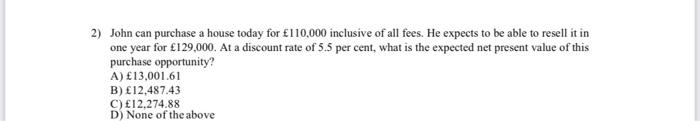

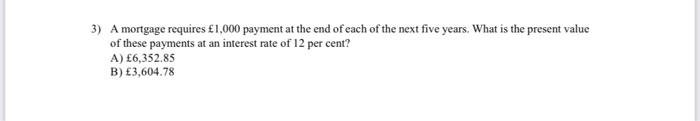

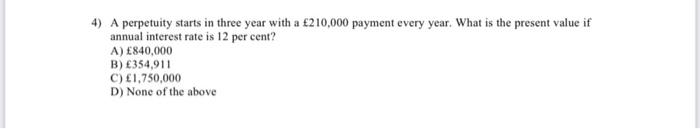

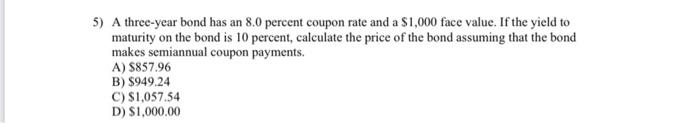

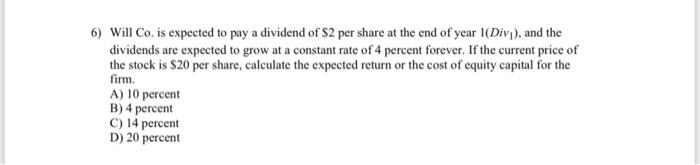

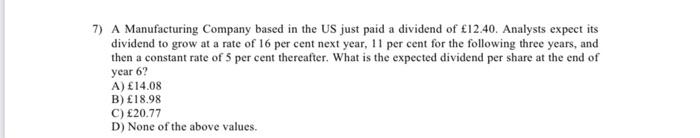

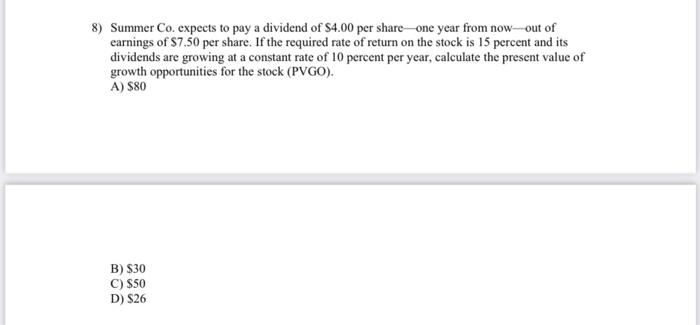

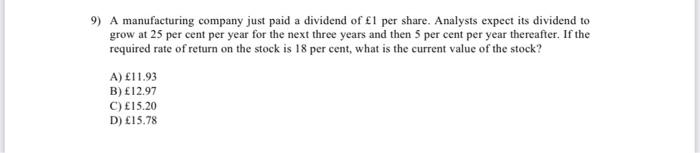

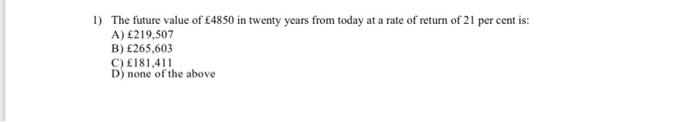

1) The future value of 4850 in twenty years from today at a rate of return of 21 per cent is: A) 219,507 B) 265,603 C) 181,411 D) none of the above 2) John can purchase a house today for 110,000 inclusive of all fees. He expects to be able to resell it in one year for 129,000. At a discount rate of 5.5 per cent, what is the expected net present value of this purchase opportunity? A) 13,00161 B) 12,487.43 C) 12,274.88 D) None of the above 3) A mortgage requires 1,000 payment at the end of each of the next five years. What is the present value of these payments at an interest rate of 12 per cent? A) 6,352.85 B) 3,604.78 4) A perpetuity starts in three year with a 210,000 payment every year. What is the present value if annual interest rate is 12 per cent? A) 840,000 B) 354,911 C) 1,750,000 D) None of the above 5) A three-year bond has an 8.0 percent coupon rate and a $1,000 face value. If the yield to maturity on the bond is 10 percent, calculate the price of the bond assuming that the bond makes semiannual coupon payments. A) S857.96 B) $949.24 C) $1,057.54 D) $1,000.00 6) Will Co. is expected to pay a dividend of $2 per share at the end of year (Divi), and the dividends are expected to grow at a constant rate of 4 percent forever. If the current price of the stock is $20 per share, calculate the expected return or the cost of equity capital for the A) 10 percent B) 4 percent C) 14 percent D) 20 percent firm 7) A Manufacturing Company based in the US just paid a dividend of 12.40. Analysts expect its dividend to grow at a rate of 16 per cent next year, 11 per cent for the following three years, and then a constant rate of 5 per cent thereafter. What is the expected dividend per share at the end of year 6? A) 14.08 B) 18.98 C) 20.77 D) None of the above values. 8) Summer Co. expects to pay a dividend of S4.00 per share one year from now-out of earnings of $7.50 per share. If the required rate of return on the stock is 15 percent and its dividends are growing at a constant rate of 10 percent per year, calculate the present value of growth opportunities for the stock (PVGO). A) $80 B) $30 C) $50 D) S26 9) A manufacturing company just paid a dividend of 1 per share. Analysts expect its dividend to grow at 25 per cent per year for the next three years and then 5 per cent per year thereafter. If the required rate of return on the stock is 18 per cent, what is the current value of the stock? A) 11.93 B) 12.97 C) 15.20 D) 15.78