Answered step by step

Verified Expert Solution

Question

1 Approved Answer

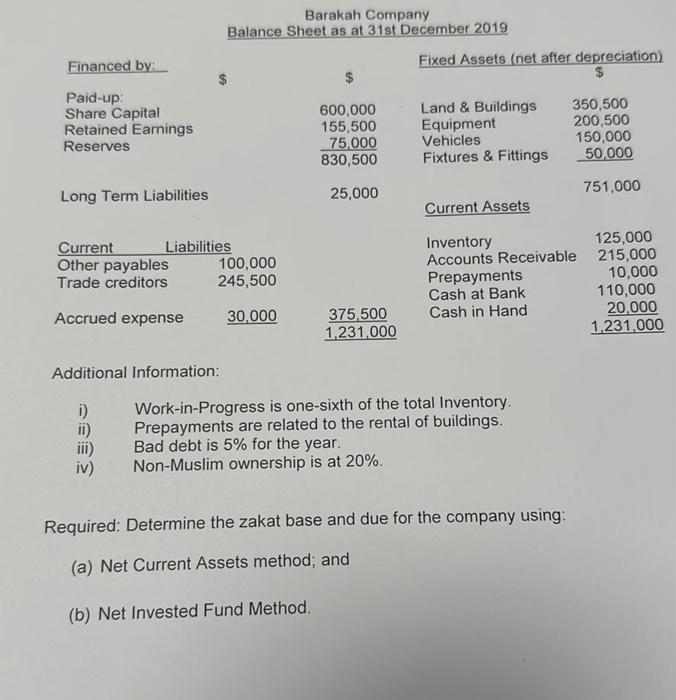

Financed by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense i) ii) iii) iv) Barakah Company

Financed by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense i) ii) iii) iv) Barakah Company Balance Sheet as at 31st December 2019 Additional Information: 100,000 245,500 30,000 600,000 155,500 75,000 830,500 25,000 375,500 1,231,000 Fixed Assets (net after depreciation) Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Prepayments Cash at Bank Cash in Hand Work-in-Progress is one-sixth of the total Inventory. Prepayments are related to the rental of buildings. Bad debt is 5% for the year. Non-Muslim ownership is at 20%. 350,500 200,500 150,000 50,000 751,000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method. 125,000 215,000 10,000 110,000 20,000 1,231,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started