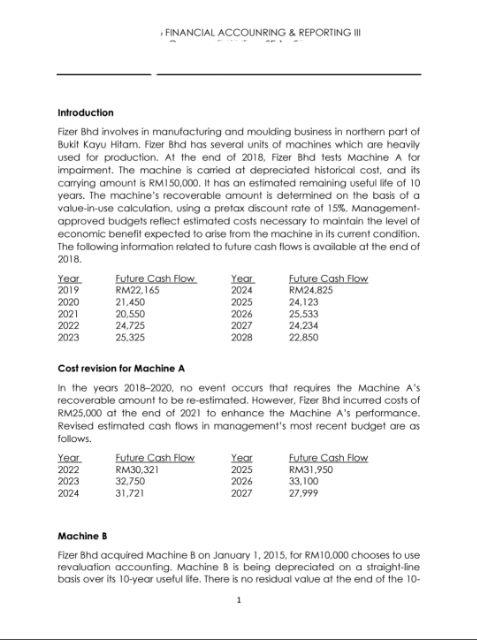

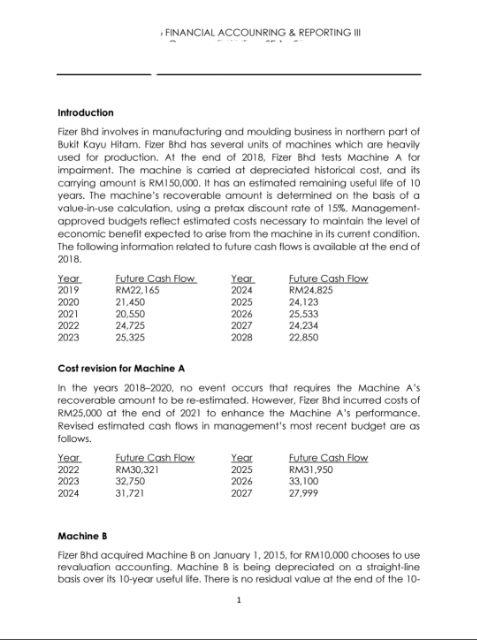

FINANCIAL ACCOUNRING & REPORTING II Introduction Fizer Bhd involves in manufacturing and moulding business in northern part of Bukit Kayu Hitam. Fizer Bhd has several units of machines which are heavily used for production. At the end of 2018, Fizer Bhd tests Machine A for impaiment. The machine is carried at depreciated historical cost, and its carrying amount is RM150,000. It has an estimated remaining useful life of 10 years. The machine's recoverable amount is determined on the basis of a value-in-use calculation using a pretax discount rate of 15%. Management- approved budgets reflect estimated costs necessary to maintain the level of economic benefit expected to arise from the machine in its current condition. The following information related to future cash flows is available at the end of 2018. Year Future Cash Flow Year Future Cash Flow 2019 RM22.165 RM24,825 2020 21.450 2025 24.123 2021 20.550 2026 25,533 2022 24.725 2027 24,234 2023 25.325 2028 22.850 2024 Cost revision for Machine A In the years 2018-2020, no event occurs that requires the Machine A's recoverable amount to be re-estimated. However, Fizer Bhd incurred costs of RM25,000 at the end of 2021 to enhance the Machine A's performance. Revised estimated cash flows in management's most recent budget are as follows. Year. Future Cash Flow Year Future Cash Flow 2022 RM30,321 2025 RM31.950 2023 32.750 2026 33,100 2024 31.721 2027 27.999 Machine B Fizer Bhd acquired Machine B on January 1, 2015, for RM10.000 chooses to use revaluation accounting Machine B is being depreciated on a straight line basis over its 10-year useful life. There is no residual value at the end of the 10- year period. The appraised value of Machine B approximates the carrying value at December 31, 2015 and 2017. On December 31, 2016, the fair value was determined to be RM8,800; on December 31, 2018, the fair value was determined to be RM5,000 REQUIRED e) Show all journal entries required for each year for Machine B from 2015 through 2018 ) Fizer Bhd also owns some property and buildings for which revaluation accounting is not used. Briefly discuss why Fizer Bhd might not use revaluation accounting for these assets